Budget 2024: Hunt blasted for abandoning pensioners as he gives families child benefit boost and slashes NI by 2p

Refresh this page for all the latest updates on today's Spring Budget

- National Insurance contributions cut by 2p

- Inflation will fall to the 2 per cent target in just a few months time - almost a year earlier than forecast in the Autumn Statement

- Fuel duty and Alcohol duty to be frozen until 2025

- Hunt has announced the introduction of the 'British ISA' which will allow an additional £5,000 annual investment in UK equity

- Sir Keir Starmer accused the Tories of giving with one hand but taking 'even more with the other'

Don't Miss

Most Read

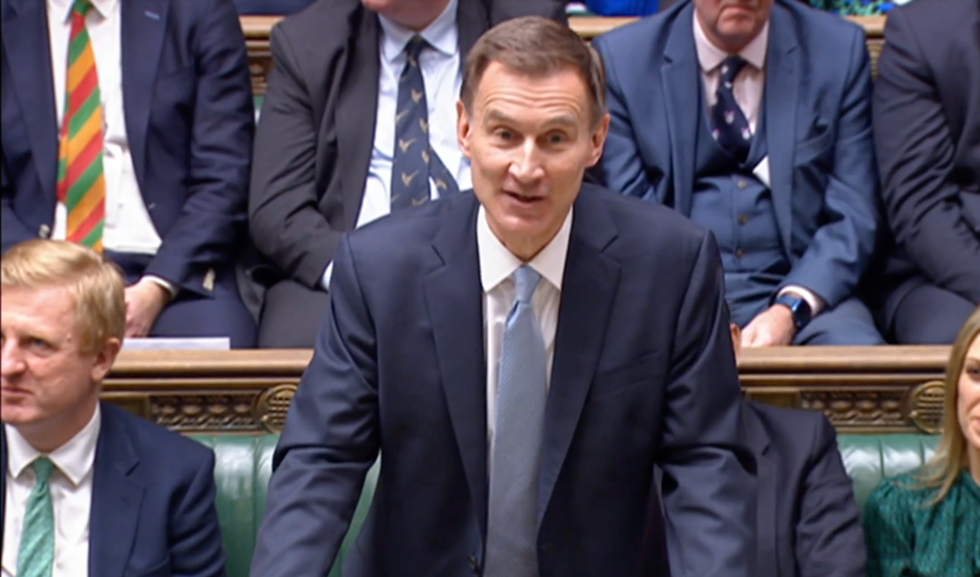

Jeremy Hunt has slashed National Insurance (NI) contributions by 2p at the Spring Budget - but has left income tax untouched.

The Chancellor said the Treasury was able to introduce the changes "because of the progress we have made in bringing down inflation, because of the additional investment that is flowing into the economy, because we have a plan for better and more efficient public services and because we have asked those with the broadest shoulders to pay a bit more."

The NI cut will save an extra £450 for the average employee. But Age UK has accused him of not doing enough for pensioners, describing today's budget as a "non-event for older people". Hitting back, Tory MP Robert Buckland told GB News his party is "proud" of their record.

Delivering his Spring Budget, he told MPs that inflation will drop to just two per cent in a matter of months.

Jeremy Hunt has begun unveiling the Spring Budget in the House of Commons, telling MPs that inflation will drop to just two per cent in a matter of months

|GB NEWS

Pointing to the Office for Budget Responsibility's report, Hunt said: "When the Prime Minister and I came to office, inflation was 11 per cent.

"The latest figures show it is now 4 per cent more than meeting our pledge to halve it last year and today's forecasts from the OBR show it falling below the 2 per cent target in just a few months time, nearly a whole year earlier than forecast in the autumn statement."

The Chancellor said the Government is now in a position to deliver “permanent tax cuts”, and billed his financial statement as a “Budget for long-term growth”.

Hunt said: “Because of the progress we’ve made, because we are delivering the Prime Minister’s economic priorities, we can now help families not just with temporary cost-of-living support, but with permanent cuts in taxation.”

He claimed Conservatives know “lower tax means higher growth. And higher growth means more opportunity, more prosperity and more funding for our precious public services”.

The Chancellor said the UK has faced "the most challenging economic headwinds in modern history

|PA

Jeremy Hunt's key announcements

Hunt announced he will cut 2p off national insurance contributions from April, slashing it from 10 per cent to eight per cent. Self-employed national insurance will be cut from 8 per cent to 6 per cent. The changes will bring £450 for the average employee, or £350 for the self-employed.

He said the Treasury was able to introduce the changes "because of the progress we have made in bringing down inflation, because of the additional investment that is flowing into the economy, because we have a plan for better and more efficient public services and because we have asked those with the broadest shoulders to pay a bit more."

VAT thresholds

The VAT registration threshold will be increased from £85,000 to £90,000 from the start of April, Hunt confirmed.

He said the move will help “tens of thousands of businesses.”

Hunt has announced that he will extend the alcohol duty freeze until February 2025, a move that the Chancellor said will benefit 38,000 pubs across the UK with the aim of “backing the great British pub”.

The Chancellor told the Commons: “In the autumn statement I froze alcohol duty until August of this year. Without any action today, it would have been due to rise by 3 per cent".

He said he had listened to representations from MPs about the tax, adding: “So today I have decided to extend the alcohol duty freeze until February 2025. This benefits 38,000 pubs all across the UK – and on top of the £13,000 saving a typical pub will get from the 75% business rates discount I announced in the autumn.

“We value our hospitality industry and we are backing the great British pub.”

Hunt said he will maintain the 5p cut and freeze fuel duty for a further 12 months, a move he said would save the average driver £50 next year and bring total savings since the 5p cut was introduced to around £250.

The Chancellor said: “The shadow chancellor complained about the freeze on fuel duty and Labour has opposed it at every opportunity. The Labour Mayor of London wants to punish motorists even more with his Ulez plans."

He added: “Taken together with the alcohol duty freeze, this decision also reduces headline inflation by 0.2 percentage points in 2024-25 allowing us to make faster progress towards the Bank of England’s 2% target.”

Hunt has announced that he will extend the alcohol duty freeze until February 2025

|PA

Hunt leaving Number 11 Downing Street ahead of the budget

Debt relief

The Treasury has announced it will abolish the £90 debt relief order to help people who take out loans. Hunt said he wanted to focus on people falling into debt, saying: “Nearly one million households on Universal Credit take out budgeting advance loans to pay for more expensive emergencies like boiler repairs or help getting a job.

“To help make such loans more affordable, I have today decided to increase the repayment period for new loans from 12 months to 24 months.”

The Chancellor said a debt relief order can cost £90 and deter people seeking one, adding: “Having listened carefully to representations from Citizens Advice, I today relieve pressure on around 40,000 families every year by abolishing that £90 charge completely.”

Growth forecast

Hunt told MPs that the economy is expected to grow 0.8 per cent this year and 1.9 per cent next year, 0.5 per cent higher than the OBR’s autumn forecast.

He added: “Because we have turned the corner on inflation, we will soon turn the corner on growth.”

The Chancellor urged Labour MPs to listen to him as “they don’t have a growth plan”, adding: “Our plan is for economic growth not sustained through migration but one that raises wages and living standards for families.”

Hunt has announced the introduction of the "British ISA", which will allow an additional £5,000 annually for investments in UK equity.

The policy, Hunt said, is aimed at ensuring "British savers can benefit from the growth of the most promising UK businesses".

Vaping

The Chancellor has announced a tax on vapes from October 2026 in order to discourage non-smokers from taking up vaping. He also announced a one-off incresae in tobacco duty, in order to maintain the financial incentive of switching to vaping from smoking.

Creative industries

The Chancellor announced that tax reliefs for orchestras, museums, galleries and theatres - introduced during the pandemic - will be made permanent.

He told MPs: “In the pandemic we introduced higher 45% and 50% level of tax relief which were due to end in March 2025. It has been a lifeline for performing arts across the country.,

“Today in recognition of their vital importance to our national life I can announce I am making those tax reliefs permanent at 45% for touring and orchestral productions and 40% for non-touring productions. Lord Lloyd-Webber says this will be a once-in-a-generation transformational change that will ensure Britain remains the global capital of creativity.

“I suspect the theatre reliefs may be of particular interest to the shadow chancellor who fancies her thespian skills when it comes to acting like a Tory. The trouble is we all know how her show ends: higher taxes like every Labour government in history.”

National Savings and Investments (NS&I) is set to launch a new “British Savings Bond” with a three-year fixed interest rate.

Jeremy Hunt announced the new savings product will have a guaranteed rate for three years. He said the new NS&I bond’s introduction will make it “easier for people to save for the long term” with it expected to be launched in April 2024.

LATEST DEVELOPMENTS:

NHS

Hunt said he will invest £3.4 billion in improving NHS productivity, something he said will "unlock £35 billion of savings".

The Chancellor said systems that support its staff are “often antiquated”, adding: “I wanted better care for patients, better value for taxpayers and more rewarding work for its staff. Making changes on the scale we need is not cheap. The investment needed to modernise NHS IT systems so they are as good as the best in the world costs £3.4 billion.

“But it helps unlock £35 billion of savings, 10 times that amount. So in today’s Budget for long-term growth, I have decided to fund the NHS productivity plan in full.”

Chancellor Jeremy Hunt said improvements will be made to the NHS so it can be used to confirm and modify all appointments, telling MPs: “On top of funding this longer-term transformation, we will also help the NHS meet pressures in the coming year with an additional £2.5 billion."

Hunt announced he would abolish the current tax system for non-doms and "get rid of the outdated status of non-domicile". He said the Government will replace the non-dom regime with a "modern, simpler and fairer residency-based system" from April 2025.

People who move to the UK will be exempt from paying tax on income they earn abroad for the first four years.

Labour had already promised to scrap it, so the move may cause problems for the opposition as it was expected to be a key attack line in the lead up to the election.

Jeremy Hunt extended child benefit to hundreds of thousands of middle-income families, increasing the threshold high-income child benefit charge threshold from £50,000 to £60,000. The taper will extend up to £80,000.

Starmer hits back

Responding to the budget Sir Keir Starmer accused the Tories of giving with one hand but taking “even more with the other”.

He said today's Spring Budget was the final act of a “party that has failed”.

The Labour leader told the Commons: “Britain in recession, the national credit card maxed out, and despite the measures today, the highest tax burden for 70 years.

“The first parliament since records began to see living standards fall, confirmed by this Budget today.

“That is their record. It is still their record. Give with one hand and take even more with the other and nothing they do between now and the election will change that.”

Starmer accused Jeremy Hunt of "smiling as the ship goes down", dubbing him and Rishi Sunak "the chuckle brothers of decline".

He accused the Conservative Party of "torching..any notion that they can serve the country not themselves", claiming they "lost control of the economy".

Starmer hit out at the Government for their decision to axe non-dom status, something Labour had previously pledged to do themselves.

Starmer said today's Spring Budget was the final act of a “party that has failed”

|PA

He asked: "Has there ever been a more obvious example of a Government that is totally bereft of ideas? The question they must answer today is, why did they not do it earlier?"

While the Labour leader confirmed the party will support today's National Insurance cut, he criticised Sunak for abandoning his pledge to cut Income Tax from 20p to 19p. He said the promise now "lies in tatters".

He accused the Tory party of "breathtaking complacency", saying: "Britain deserves better than this".

Starmer claimed "chaos" is the "worldview" of the current Conservative Government, adding: "Chaos feeding off decline, decline feeding off chaos, while working people pay the price."

He continued: "The British people know this will not stop, five more years and it will only get worse.

"There'll be no change of direction without a change of Government and that leaves Britain as a nation in limbo, unable to shake off the Tory chaos that dragged us into recession and loaded the tax burden onto the backs of working people and maxed out the nation's credit card."

He demanded the Government confirm May 2 as the date of a general election, saying "Britain deserves better".

Industry response

Beer and pub industry welcomes alcohol duty freeze but warns of 'cliff edge of spiralling wage costs'

Reacting to Jeremy Hunt’s announcement that beer duty will be frozen until February 2025 at today’s Budget, Emma McClarkin, Chief Executive of the British Beer and Pub Association said: “It is good news that the Chancellor was able to extend the freeze to beer duty at this Budget and will be welcomed by brewers, pubs and consumers alike and will go some way to keep the price of a pint affordable.

“However, this April brewers and pubs still face a £450 million cliff edge of spiralling wage costs and business rates increases, particularly those pubs that are larger or food-led. It is disappointing that the Chancellor did not choose to go further with a cut duty, reduce VAT or cap the increase to the business rates multiplier which would have helped mitigate the huge cost of doing business.

"Pressures on our sector remain acute with margins being squeezed to the point where we fear it is likely that a further 500-600 pubs are likely to close this year on top of the 530 that closed in 2023. No government should turn a blind eye to the erosion of such an integral economic, social and cultural asset and it is vital that at the election the political parties commit to putting in place a fiscal and policy framework that will see our sector thrive for the long term and not continue to deteriorate.

“We very much hope that the decision to cut National Insurance contributions for all workers by 2p in the pound will boost consumer spending power and encourage people to enjoy an extra pint in their local, but I urge the Government to look again at the urgent measures needed to make the cost to doing business more affordable at the next fiscal event and through policy commitments made in the run up to the election to truly back the British Pub.”

A Heineken spokesperson added: “We welcome the freezing of alcohol duties until February 2025. This freeze will help bring out the best in the great British Pub. Licensees across the UK now need further help to thrive, in the form of long-term, fundamental reform to the business rates system which despite recent support still sees UK pubs overpaying by £400m.”

Nationwide criticises Treasury for failing to announce 'substantial measures' to support first-time buyers

Building Society Nationwide called for the Government to produce a "sustainable long-term strategy" to support buyers.

Henry Jordan, Nationwide’s Director of Home, said: “As an organisation whose purpose it is to support people into a home of their own, we are disappointed that the Chancellor hasn’t announced any substantial measures to support first-time buyers in today’s Spring Budget.

"Nationwide continues to call for a government-commissioned, independently-chaired review of the first-time buyer market – this is needed to help government produce a sustainable long-term strategy to support people hoping to purchase a property.”

Scrapping the non-dom regime is a 'major step-change' in the UK's tax system

In response to Jeremy Hunt’s announcement on scrapping the non-domiciled tax regime, Adam Craggs, Partner, Tax Disputes, RPC comments: "Scrapping the non-dom tax status is a major step-change in the UK's tax regime and will be likely to lead to an outflow from the UK of much needed investment as those affected relocate to other more attractive locations.

"While there are reasonable arguments on both sides of the non-dom debate, there can be no denying that such a change will have significant consequences for a large number of taxpayers. Statistics provided by HMRC in 2023 indicated that there were around 68,000 individuals claiming non-dom status in the UK in the tax year ending 2022 with tax liabilities of around £8.5b – not an insignificant sum.

"Taxpayers affected by the Chancellor's announcement will want to carefully consider what the changes mean for them, and will no doubt take appropriate steps to protect their position."

'A non-event for older people'

Hunt has been accused of abandoning pensions, with Caroline Abrahams, Charity Director at Age UK, describing today's budget as a "non-event for older people".

She said: "'Was that it?' This Budget was something of a non-event for older people, with very few announcements of much interest or relevance to them.

"The reductions in National Insurance (NI) will be welcomed by people in their fifties and early sixties who are in employment but do nothing for anyone working beyond their State Pension Age because they do not pay NI. They can be forgiven for feeling hard done by as a result, especially since many of them are working in their late sixties and beyond not because they want to, but because they simply cannot afford to retire. Nor will it help retired people with modest pensions that take them over the tax threshold who will face an increase in income tax rise because personal allowances remain frozen.'

"Age UK had called for the Household Support Fund to be continued beyond April, to help people of all ages struggling on low incomes, and we are pleased the Chancellor announced a six-month extension. However, six months is not long enough and, crucially, this leaves older people on low fixed incomes without recourse to this extra help through the winter months, when high energy bills provoke so much hardship and fear."