Inheritance tax is unfair, economically harmful and trivial, says Jacob Rees-Mogg

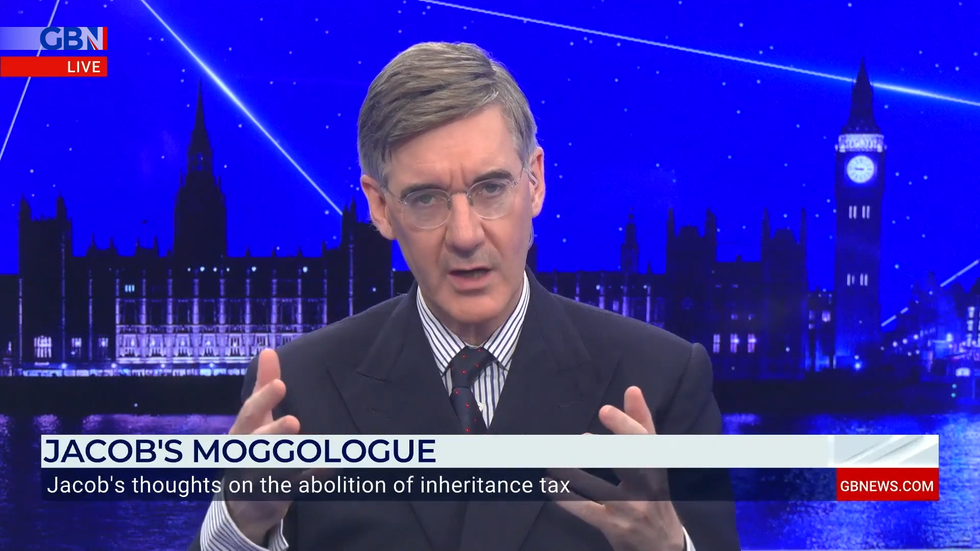

Jacob Rees-Mogg says inheritance tax is 'unfair'

|GB News

Don't Miss

Most Read

Latest

A number of sources close to the Prime Minister have confirmed reports that he is drawing up plans to cut and ultimately abolish inheritance tax.

Perhaps after last week's pruning of the greenery, the government is going to adopt sensible election winning policies. According to polling, death duties are the most unpopular taxes in Britain. An opinion poll for 2021 found 24% of the public feel that it's their least favourite tax, the income tax, coming in at 2nd place.

Despite what might seem counterintuitive, inheritance tax does not raise much money. Receipts reached a record of £7billion this year, but that's less than 1% of total tax revenue. And this £7billion comes at a remarkably high economic cost.

Now why is this? Well, economic activity depends on good and successful capital allocation. You want to invest in things that will grow and take money out of things that are not going to grow. But death duties are very distortive. They discourage active investment. They encourage people changing from a bad investment to a good investment.

WATCH NOW: Jacob Rees-Mogg calls for inheritance tax scrap

Let me explain why. If you're elderly and you think you may only have a few years to live, and you have a capital gain, the combination of capital gains tax and inheritance tax means that on a property investment, £100 of gain becomes £43.20. So that is a tax rate of 28% on the gain, followed by inheritance tax of 40%, meaning you've got less than half of your money at the end of it of your gain.

But that means the elderly allow their assets to stagnate. They don't sell and buy something new because they've got to be so successful with their investments to get back to zero.

And then there are the exemptions on death duties, which are highly distorting. Take one example. Farmland is broadly exempt if you own it in the right way. And anyone who's tax planning can ensure that their farmland is exempt. Therefore, if you buy farmland which pays no inheritance tax, that's much better for you than having cash, or an investment in equities, in shares, in businesses that are creating growth other than very small businesses because you keep 100% of it or your heirs do.

But what this does is it puts up the price of farmland. But if you put up the price of farmland, the capital costs to the farmer of buying or renting land is higher. And what that means is that the cost of food for you and for me is higher. Why? Because of inheritance tax, and this is why asset allocation matters.

You want people to allocate the most economically successful area that will give the best return, and don't distort it so that people put money in things purely for tax reasons.

But it's also an unfair tax. This is why it sound popular, even with people who aren't likely to pay it. Because they see that those who have worked hard and saved for being good citizens, but not being able to make use of tax planning, will get whacked and that children will get whacked. It's in that sense a double tax, that you're taxed on money where you're already likely to have paid tax during your lifetime.

Rees-Mogg claimed that 'getting rid of it could be an election winner'

|GB News

And it's also an unnatural tax. It goes against the grain of society. Why? Because what do most parents want to do? They want to help their children have a good start in life. But if your money gets pinched from you, then that's harder to do. It's unfair, it's economically harmful and it's trivial.

Getting rid of it could be an election winner. Not a manifesto pledge. No one will believe a manifesto pledge. We've had those before. We had one from George Osborne in 2010. This is abolition. So the Lib Dems and Labour would clown for its reintroduction and the Blue Wall would be secure.