Universal Credit claimants could claim £646 boost via DWP freebie benefits in July 2025 - list of discounts

Sir Keir Starmer responds to a question about benefits reform from Chris Hope |

GB NEWS

Analysts are urging Universal Credit recipients to check what other DWP support they are eligible for this summer

Don't Miss

Most Read

Universal Credit recipients could be eligible for as much as £646.10 in freebie benefits and reductions this July, according to recent reports.

This amounts to potential savings of £4,128 throughout the year from the benefit, which is administered by the Department for Work and Pensions (DWP).

These supplementary benefits and discounts represent significant financial relief for thousands of households across Britain who depend on Universal Credit to supplement their income or provide essential support during unemployment.

Universal Credit functions as more than just unemployment support, extending to full-time workers earning low salaries who require income supplementation. The benefit also assists individuals with certain health-related circumstances.

Families could get hundreds of pounds worth in DWP freebie benefits if they claim Universal Credit

| GETTYHere is a full list of the freebie benefits Britons could be entitled to if they claim Universal Credit, as well as the potential savings:

- Council tax discount - up to £1,710 a year, or £171 per month

- Household Support Fund - £300 single payment

- Energy bill discounts - £2,000, or £166 per month

- Free prescriptions - £118 per year, £9.90 per month.

Universal Credit claimants are able to apply for up to 75 per cent off their council tax bill, however the concession's exact amount depends on their individual circumstances.

Factors are taken into account include income, someone's living situation, whether they have dependents or have a disability.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Taxpayers are struggling with the unsustainable burden of council tax | PA

Taxpayers are struggling with the unsustainable burden of council tax | PAAn average Band D council tax bill for properties in England in the 2025-26 tax year which began on April 6, 2025, is £2,280, The Times reports.

As such, a 75 per cent discount on that would be worth £1,710 which would come to around £171 per month.

Tom Barrett, Debt and Benefits Expert at caba, has offered guidance for those navigating welfare changes. He emphasised the importance of verifying benefit eligibility during this period.

"During this time, it's important to check what benefits you may be entitled to and benefits advisers can help you with this," Barrett stated. "It may also be worth seeking independent financial advice to help you make the most of your money."

LATEST DEVELOPMENTS:

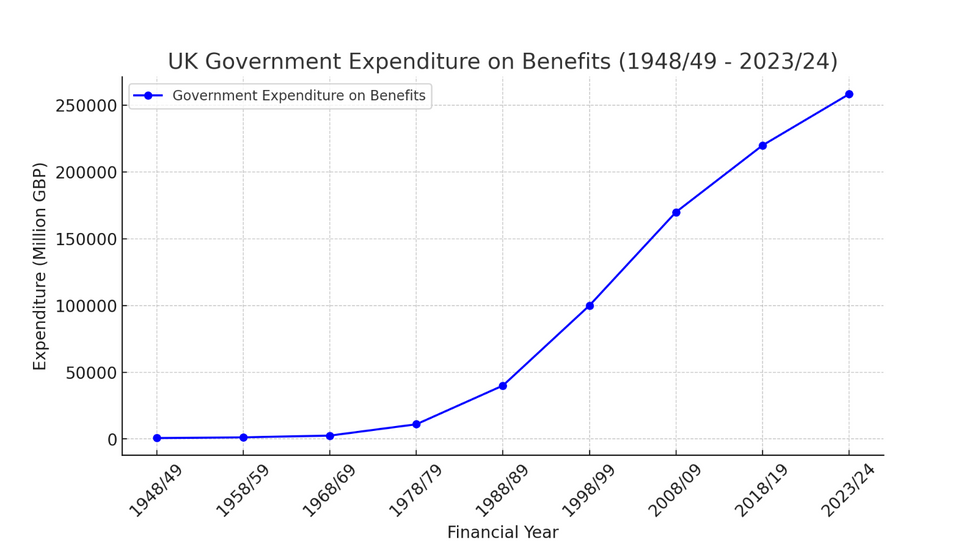

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT His recommendations come as revised Labour welfare measures are reportedly pushing 150,000 people into poverty, making it crucial for claimants to understand their full entitlements and seek professional guidance where needed.

Barrett also advised those affected by welfare changes to review their financial management strategies. He suggested prioritising high-interest debt repayments and conducting thorough assessments of all income sources, including savings and state benefits.

"Consider taking a review of your income sources, whether from savings or state benefits, and track what you're spending each month," Barrett explained. "Even small changes to your budget can make a difference over time, and using a budget planner can help you get started."

He urged claimants not to struggle alone, adding: "Often, taking that first step to speak to a trusted support service like caba can help regain financial control and protect your wellbeing."

More From GB News