Martin Lewis reveals how you can turn £800 into £5,500 before you retire

The money saving guru explains how plugging your NI gaps can boost your pension

Don't Miss

Most Read

Latest

Consumer finance guru Martin Lewis has broken down how workers between the ages of approximately 45 and 70 can flip £800 into £5.5k for their retirement.

Mr Lewis, founder of MoneySavingExpert, says the process involves purchasing additional National Insurance (NI) years to bump your state pension.

The current full state pension is worth £185.15 per week.

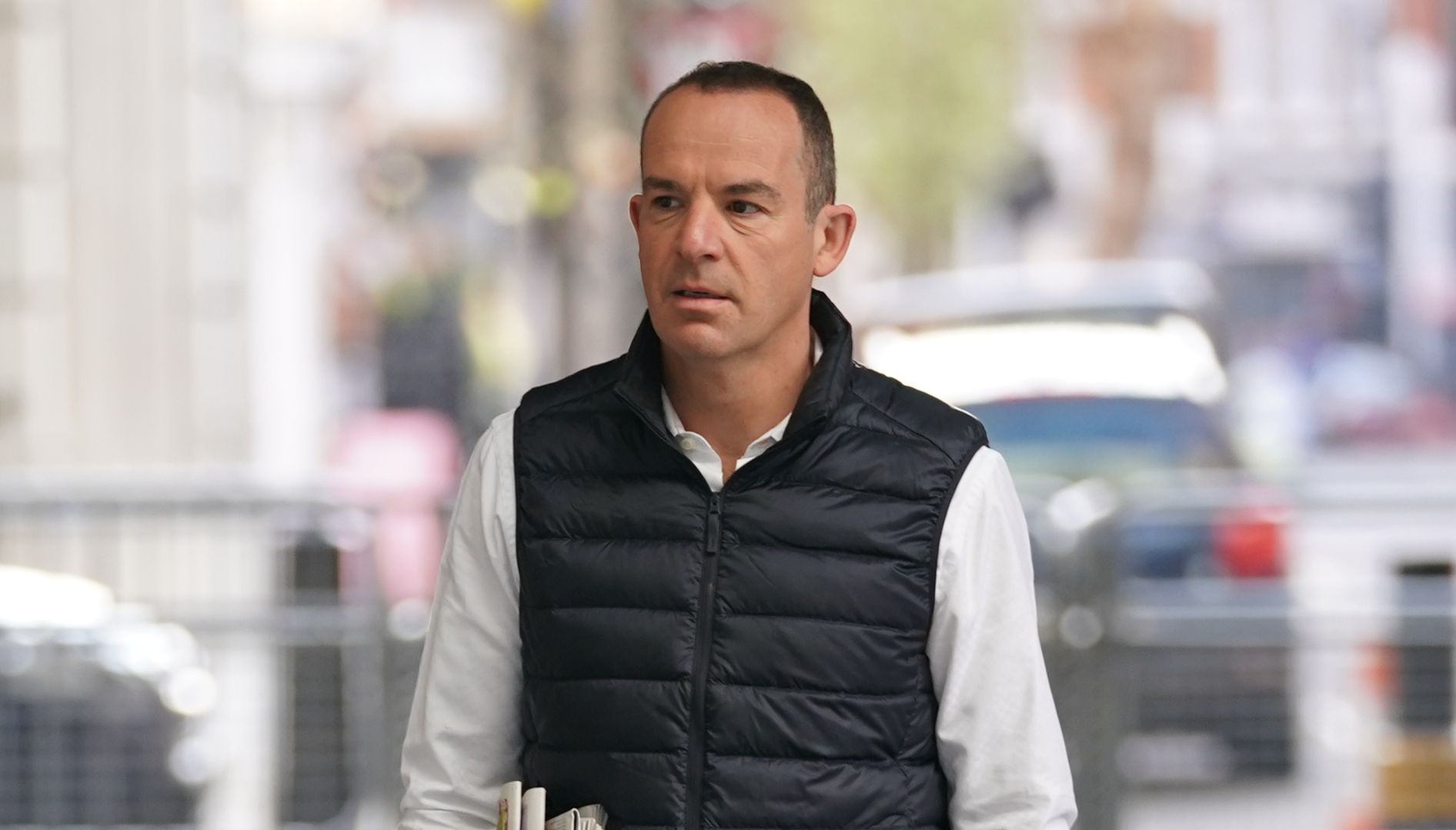

Martin Lewis.

Kirsty O'Connor

Mr Lewis confirms that in order to receive the full amount, you'd need 35 years' worth of NI contributions. Less than this and you wouldn't receive as much.

NI gaps going back to 2006 can be plugged by buy years back. However, these rules are to be changed next year.

You'll only be eligible to buy six years' worth of NI contributions, once April 5th has passed.

"When the transitional arrangements end, the number of extra years purchasable drops, so checking now is key", Mr Lewis said in the MoneySavingExpert newsletter.

"Those at or near state pension age will find it relatively easy to see if topping up may help."

"If a man who's reached age 66 lives the typical 19 more years, a woman 21 more years, then for each £800 spent, a man can expect to get £5,300 extra pension, a woman £5,800," he went on.

"Plus the state pension currently (usually) has a triple lock, meaning it rises with the highest of inflation, 2.5% or average earnings (though the average earnings figure is suspended this year).

"Therefore for many, unless you've a chronic condition likely to substantially impact life expectancy, if this works for you it's virtually unbeatable."

These figures are a rough calculation according to Mr Lewis. Individual circumstances will dictate exactly how the calculation will work out.

As noted in the Mirror, It is worth checking whether or not NI gaps can be plugged without the need to purchase NI credits.