Universal Credit rules slammed as DWP urged to reform savings loophole 'locking out 1m low-income families'

Analysts are calling on the DWP to change the existing savings rules linked to Universal Credit claimants

Don't Miss

Most Read

Universal Credit's means-testing rules are undermining Government efforts to encourage saving among low-income households, according to research published by the Resolution Foundation.

Last month, a report by the think tank revealed that around two million families have had their benefits reduced due to savings rules that haven't changed since 2006.

These long-neglected rules mean that Universal Credit entitlement is tapered away if claimants have savings above £6,000, and eliminated entirely if savings exceed £16,000.

The research, part of a partnership with abrdn Financial Fairness Trust, found that of the affected families, 830,000 faced partial reductions while 1.2 million lost their entitlement completely.

The DWP is being urged to reform savings rules linked to Universal Credit

| GETTYFamilies had an average household income of just £15,700, highlighting how the rules are impacting some of the most financially vulnerable households.

The capital thresholds that determine Universal Credit entitlement have remained frozen at £6,000 and £16,000 since 2006, despite significant inflation over nearly two decades.

This means claimants with savings between these amounts see their benefits gradually reduced, while those with just a penny over £16,000 receive nothing at all.

Had these thresholds kept pace with inflation, they would currently stand at £10,000 and £27,000 respectively. The proportion of UK families with savings above £6,000 has increased significantly, from 35 per cent in 2006-08 to 45 per cent in 2020-22.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Analysts have cited more low-income households are being caught by rules originally designed to ensure claimants use their own resources before seeking state support.

According to the Resolution Foundation, the rules undermine flagship Government savings initiatives like Help to Save and Lifetime ISAs, which are designed to boost financial resilience among Universal Credit recipients.

These schemes are weakened when savings accrued through them count towards capital thresholds, effectively penalising families trying to build meaningful savings.

Secondly, the long-term freeze in thresholds means more low-income families are affected each year as inflation erodes the real value of the limits.

Thirdly, the rules create the kind of cliff-edges that Universal Credit was originally designed to eliminate.

For example, a family entitled to £750 monthly in Universal Credit would see this reduced to £576 with £16,000 in savings, but nothing at all with just a penny more.

LATEST DEVELOPMENTS:

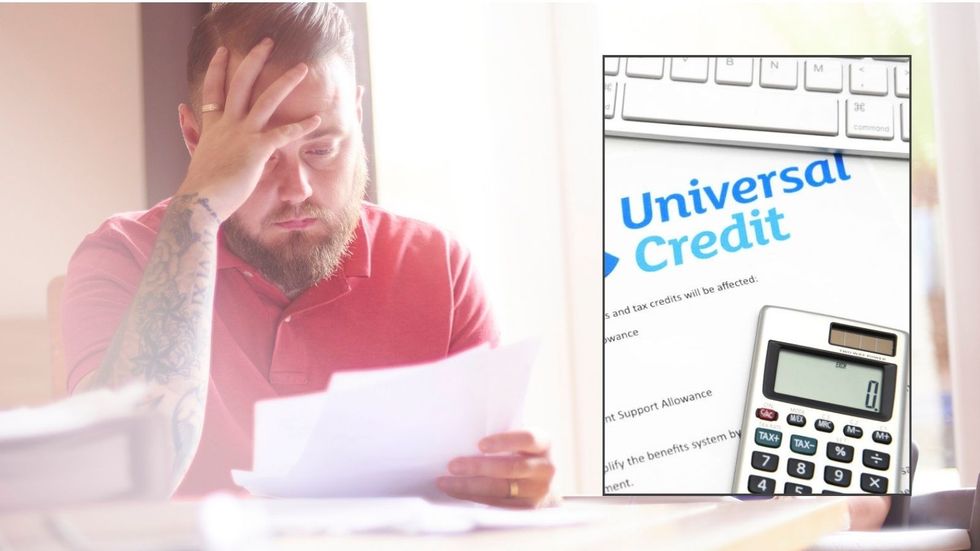

Universal Credit payments are changing | GETTY

Universal Credit payments are changing | GETTYMolly Broome, a senior economist at the Resolution Foundation, said: "Benefits are means-tested on both income and capital. But the long-term neglect of the capital rules in Universal Credit means they are now undermining wider Government efforts to encourage low-income families to save.

"Important schemes such as Help to Save and Lifetime ISAs should be exempted from these capital rules so that families doing the right thing by saving into them aren't penalised for doing so."

Mubin Haq, CEO at abrdn Financial Fairness Trust, added: "Given limited Government resources, it is right that those claiming means-tested benefits who have significant savings use these first before claiming support from the state.

"However, the capital limits for savings have failed to keep pace with inflation for nearly twenty years and this is leading to over a million low-income families being locked out of Universal Credit support."