State pension: Jeremy Hunt's reforms to cost Britons £250 a year

Hunt has scrapped plans to bring forward the retirement age increase to the end of the 2030s

|PA

The Chancellor’s decision to scrap the state pension age will cost taxpayers more than £60billion, warns the Institute for Fiscal Studies (IFS)

Don't Miss

Most Read

Latest

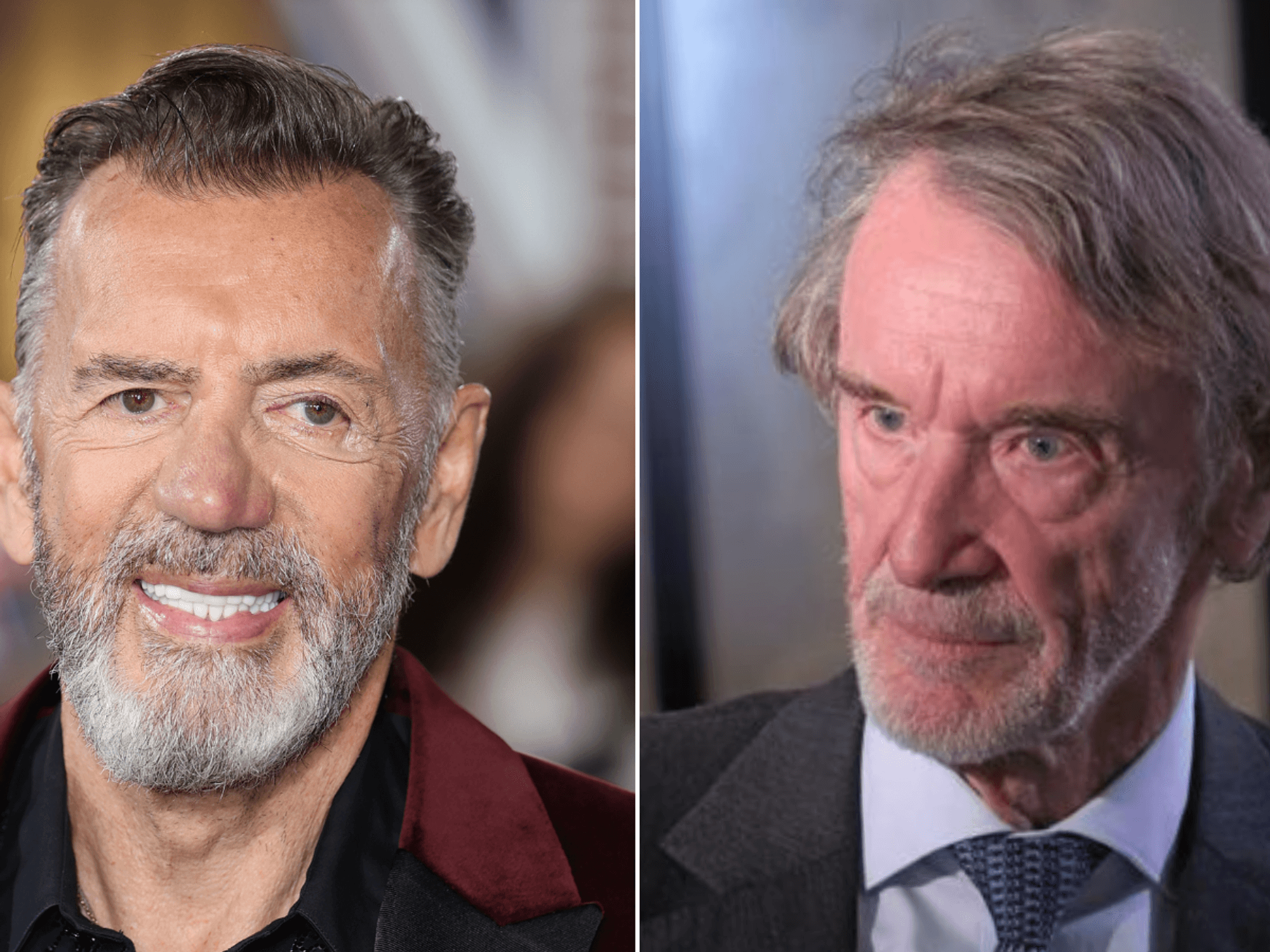

Jeremy Hunt’s abandoned plan to increase the retirement age earlier will cost taxpayers the equivalent of £250 each per year, new analysis shows.

The state pension age is currently 66 and is set to rise to 68 by 2046, but Hunt had been hoping to bring forward the increase to the end of the 2030s.

His decision to abandon the plan comes after an unexpected decline in life expectancy caused by the pandemic.

According to the Office for Health Improvement and Disparities, life expectancy was lower in 2021 than in 2011.

The next pension age review will be published by May 7

|PA

But the move could cost taxpayers more than £60billion.

Jonathan Cribb, associate director at the IFS, said the reversal in longevity trends provided a reason to put off the increase but it would come with significant costs.

Cribb said: “Higher mortality rates in recent years mean that any given generation is expected to live less long now than was expected at the time of the last pension age review in 2016. This provides a justification for delaying the rise in the state pension age.

“But to do so would cost money. There are significant long-term fiscal challenges coming from the ageing population and delaying the rise in the state pension age will cost the Exchequer around £8-9 billion for each year of delay.”

The Department for Work and Pensions spokesman said: “The Government is required by law to regularly review the state pension age and the next review will be published by May 7.”

The UK government spends far less on the state pension, as a proportion of GDP, than many other European countries.

Levels of pensioner poverty are also higher than other countries in Europe, suggesting many pensioners are struggling to supplement the flat-rate UK state pension.

During his Spring Budget, Hunt abolished the tax-free limit on pensions savings.

It had originally stood at £1.07million, with the tax break set to cost £2.75billion over the next five years.

The Chancellor’s abandoned plan to increase the retirement age earlier will cost taxpayers more than £60bn

|Reuters

Also, income poverty rates among 65-year-olds more than doubled, rising from 10 per cent to 24 per cent, when the state pension age was raised from 65 to 66.

In France, workers have been protesting against President Emmanuel Macron's move to raise the retirement age from 62 to 64.

Thousands have flooded the streets in recent weeks against the move, while public transport workers, teachers and garbage collectors have walked out to show their disapproval.