Interest rates cut: Recession warning as top economist says Bank of England move falls short - ‘I would have welcomed more’

GBNEWS

Iran-Israel tensions and US airstrikes have sent oil prices swinging, fuelling UK inflation risk

Don't Miss

Most Read

Latest

Bank of England Governor Andrew Bailey has cautioned that volatile developments in the Middle East are creating significant complications for interest rate decisions as oil prices swing dramatically.

Speaking to the House of Lords economic affairs committee, Bailey highlighted how rapidly changing events between Israel and Iran have made monetary policy particularly challenging.

"It is so unpredictable at the moment that as we saw in the last 24 hours it can easily change overnight," Bailey told peers.

Oil prices surged above $80 per barrel earlier this week following US strikes on Iranian nuclear facilities, before dropping sharply below $70 after Donald Trump announced a ceasefire.

The governor emphasised that oil price volatility poses difficulties for the Bank as higher energy costs can fuel inflation, making interest rate cuts more problematic.

Bailey acknowledged the extreme uncertainty surrounding global developments, noting: "We've seen so far rather a big turnaround overnight in terms of the situation with the oil price."

'Stagflation' fears grow as UK inflation could hit 3.7% by summer

GETTYThe governor stressed that predicting the trajectory of these events has become nearly impossible. "It is very unpredictable where this is all going to end up," he said.

He explained that the impact of trade conflicts on UK inflation remains difficult to forecast, potentially resulting in either cheaper Chinese goods flooding the UK market or supply chain disruptions pushing prices higher.

Bailey revealed he was not "putting that high a weight" on the latest global developments when considering interest rate decisions, given the volatility. However, he cautioned that this uncertainty made signalling future rate paths even more challenging.

Megan Greene, a member of the Bank's Monetary Policy Committee, said at a separate event: "I continue to think the risks remain two-sided but skewed to the downside on growth and to the upside on inflation."

"This is an uncomfortable place to be for a central banker," she added.

Greene, who voted alongside Bailey to keep interest rates unchanged at 4.25 per cent last week, warned that the Bank faces the prospect of stagflation - a scenario where the economy stagnates whilst inflation remains elevated.

This situation proves particularly challenging for policymakers because raising rates to combat inflation could further dampen economic growth.

She emphasised that a "careful and gradual approach" to monetary policy would be necessary given the persistent uncertainties facing the UK economy.

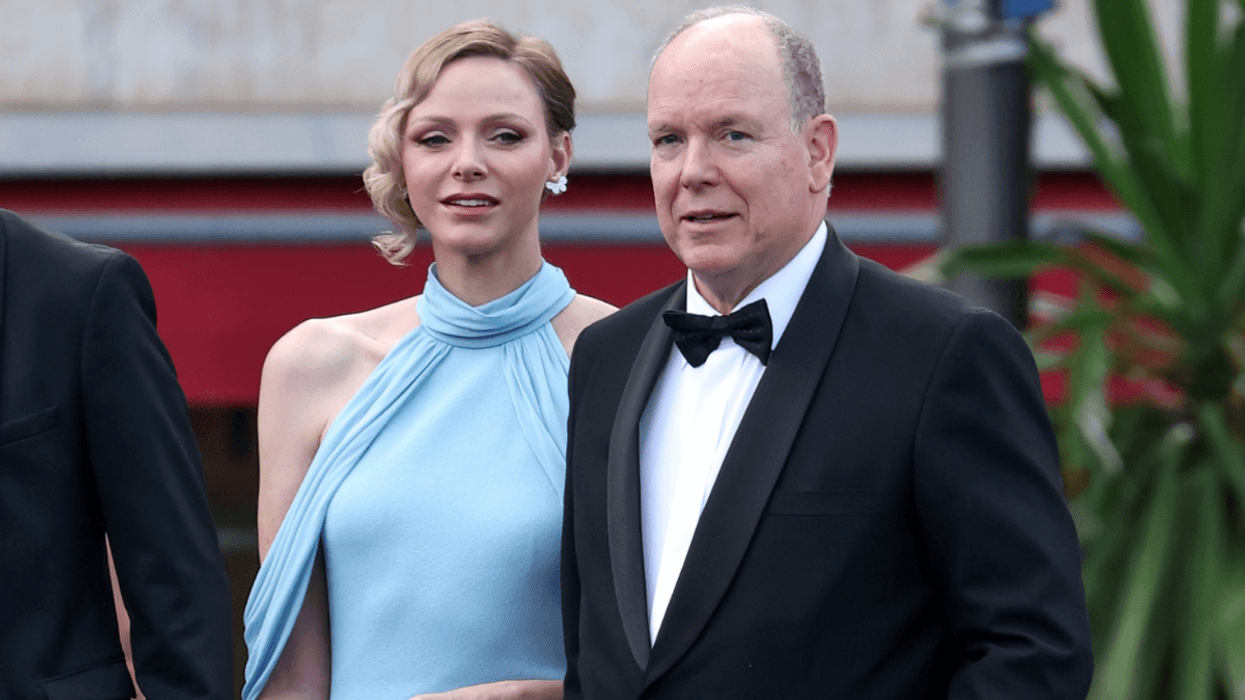

Andrew Bailey voted to keep interest rates unchanged at 4.25 per cent at the last meeting

PAMorgan Stanley strategists have warned that Middle East tensions could trigger the bank's worst-case scenario for equity markets if oil prices spike significantly late in the business cycle.

The investment bank noted that oil price increases of at least 75 per cent year-on-year, implying Brent crude trading around $120 per barrel, would "materially" raise market risks.

Such a scenario would likely require "sustained" disruption to oil supply in the Strait of Hormuz, a crucial passage for Middle Eastern oil exporters, according to the bank's analysis.

Morgan Stanley's research indicates that oil price spikes occurring late in business cycles have historically led to recessions.

JPMorgan analysts separately projected oil could reach $130 per barrel if conflict between Israel and Iran disrupts energy production in the Persian Gulf.

British households and businesses might respond to higher utility and food bills by adjusting their inflation expectations

GETTYBailey warned that Britain's employment market was "softening" with pay rise agreements "coming down", noting this weakness comes as firms respond to Labour's National Insurance raid by scaling back pay and jobs.

His comments follow recent figures showing more than 100,000 jobs were lost in May.

Greene expressed particular concern about the risk of inflation expectations becoming entrenched. "I think the risk that our near-term plateau in inflation feeds through into second round effects is skewed to the upside," she said.

"This is even more a concern in light of the escalating conflict in the Middle East, which poses upside risks to oil prices."

She warned that British households and businesses might respond to higher utility and food bills by adjusting their inflation expectations, potentially demanding bigger pay rises or increasing prices, keeping inflation above the Bank's two per cent target longer than forecast.