REVEALED: Britain forecast to lose more millionaires than any other nation after Rachel Reeves's tax overhaul

Labour's inheritance tax raid on non-doms is being blamed for the projected 'millionaire exodus' expected to hit the UK

Don't Miss

Most Read

Britain has experienced a dramatic reversal in its appeal to the world's wealthy, transforming from a millionaire magnet to a net exporter of high-net-worth individuals over the last decade.

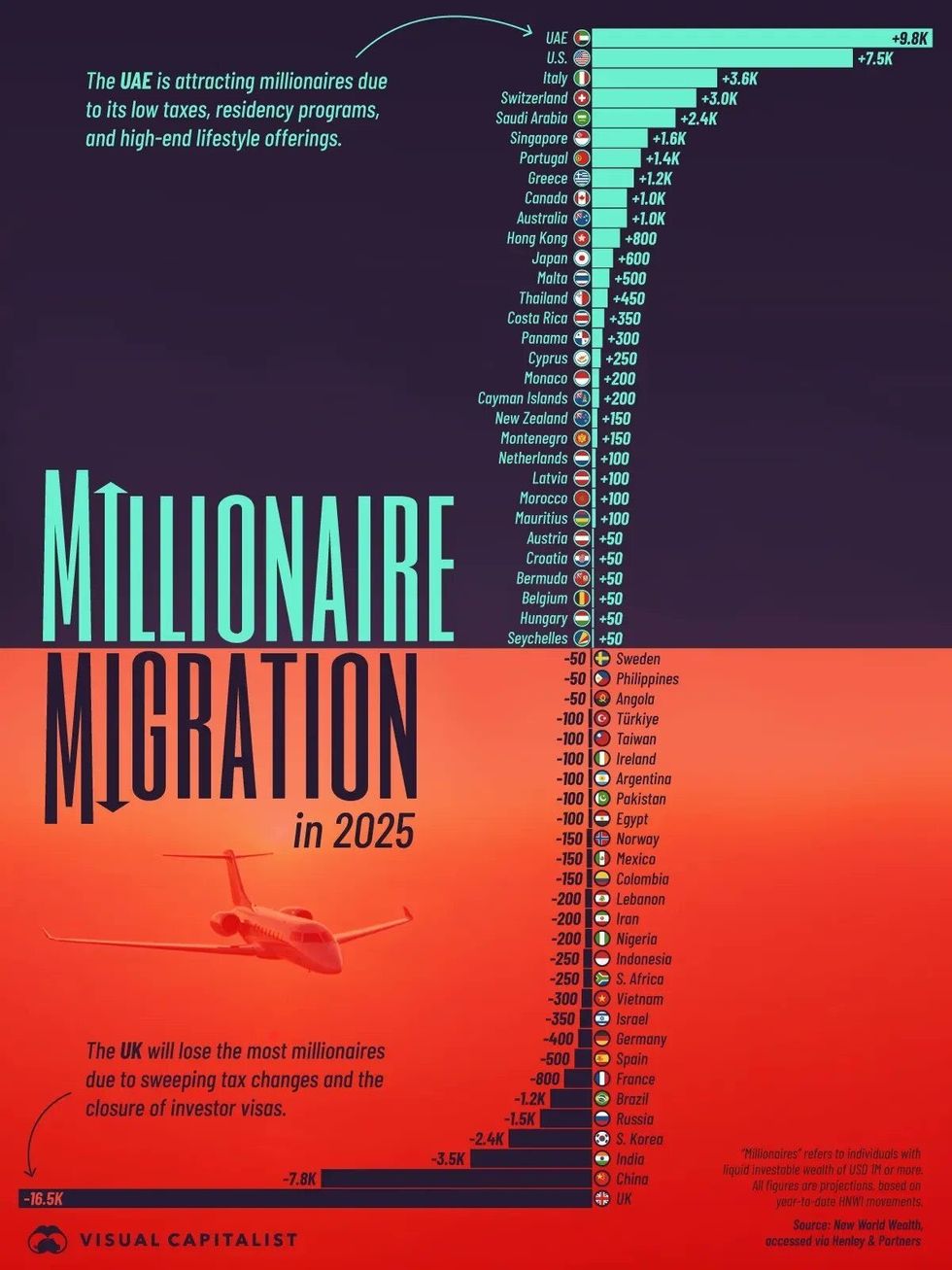

A record 16,500 millionaires are expected to leave the UK in 2025, according to the latest Wealth Migration Report by Henley & Partners and New World Wealth.

The latest surge has been driven by sweeping tax reforms, with last year's Autumn Budget introducing sharp increases to capital gains and inheritance taxes for foreign residents.

Chancellor Rachel Reeves unveiled new rules targeting non-domiciled residents and family wealth structures, which came into effect in April.

Rachel Reeves and the Treasury is under pressure over tax decisions

| GB NewsThis has sparked what some are calling a "WEXIT" - a wealth exit. Affluent individuals are relocating to tax-friendly jurisdictions including the UAE, Monaco and Malta, as well as lifestyle havens such as Italy, Greece, Portugal and Switzerland.

The UK's economic performance has been particularly poor over the past decade, according to Prof. Trevor Williams, Chair and Co-founder at FXGuard and former Chief Economist at Lloyds Bank Commercial Banking.

"Since 2014, the number of resident millionaires in the UK dropped by nine per cent compared with the W10's global average growth of plus 40 per cent," he explained.

A graph created by Visual Capitalist highlighted how the UK's "millionaire exodus" is forecast to be substantially greater than other nations.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Where are millionaires moving to and leaving from?

|VISUAL CAPITALIST / HENLEY & PARTNERS

Britain is the only nation among the world's 10 wealthiest countries to have experienced negative millionaire growth.

"Over the same period, the US saw a 78 per cent increase in millionaires the fastest wealth growth among the W10," Williams adds.

However, the UK is not alone in experiencing this wealth drain. For the first time, EU heavyweights France, Spain and Germany are expected to see net losses of 800, 500 and 400 millionaires respectively in 2025.

Ireland, Norway and Sweden are also beginning to see significant wealth losses. Many affluent Europeans are relocating to more investor-friendly hubs across the continent.

Switzerland is set to attract a net gain of 3,000 migrating millionaires this year. Italy, Portugal and Greece are forecast to see record inflows of 3,600, 1,400 and 1,200 respectively, driven by favourable tax regimes, lifestyle appeal and active investment migration programmes.

Andrew Amoils, Head of Research at New World Wealth, broke down what is at stake for European companies if this trajectory continues.

LATEST DEVELOPMENTS:

Keir Starmer is preparing to block a potential tax taid

| PAHe explained: "If one reviews the fastest growing wealth markets in the world over the past decade, it is noticeable that most of these countries are either popular destinations for migrating millionaires — such as Montenegro, the UAE, Malta, the USA, and Costa Rica — or emerging market tech hubs like China, India, and Taiwan. This demonstrates the importance of millionaire migration in driving new wealth formation in a country."

Last week, reports circulated that Prime Minister Keir Starmer is posed to block any potential wealth taxes from being implemented at the next Budget to encourage investment.

In March, Starmer told MPs: "We have raised money – the energy profits levy, taxing non-doms and air passenger duty on private jets.

"But this isn't a bottomless pit and we must kick-start growth to get the economic stability that we need."