State pension 'fiscal crisis' looms as 'grossly unsustainable' DWP benefit faces insolvency by 2036

GB NEWS

New analysis from the Adam Smith Institute is raising questions about the long-term viability of the state pension triple lock

Don't Miss

Most Read

State pension payments could become financially unsustainable by 2036, with the Treasury set to spend more on welfare than it collects in National Insurance contributions, according to new modelling from the Adam Smith Institute (ASI)

The free-market think tank warned that recent increases to National Insurance have extended the system's viability by just one year, pushing the insolvency threshold from 2035 to 2036.

The ASI described this tipping point as a "fiscal crisis moment" when the system becomes structurally dependent on reserves from the National Insurance investment fund rather than current tax income.

This warning comes despite employer National Insurance contributions rising to 15 per cent in April as part of Chancellor Rachel Reeves' £40billionn tax package announced in last year's Autumn Budget.

The state pension has been declared "grossly unsustainable"

|GETTY

As part of its fiscal model, ASI examined workforce participation and national pay data from the Office for National Statistics (ONS) and HM Revenue and Customs (HMRC) to project the system's future sustainability.

The analysis reveals that from 2036, the Government will need to draw on reserves from the National Insurance fund to cover welfare deficits, with those reserves beginning to shrink by 2040 as deficits exceed investment income.

In 2018, the total lifetime liability of the welfare system, of which the state pension is the single largest component, stood at £8.9trillion - more than three times the UK's GDP.

This figure is forecast to grow even further as the population ages, with approximately 22.7 million people eligible for state benefits including the pension by 2040, supported by just 34 million of working age.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves and the Treasury is under pressure over the state pension's future

| GB NewsMaxwell Marlow, director of public affairs at the ASI, criticised the minimal impact of the tax increases: "The latest analysis shows we are taxing workers and firms harder, and suppressing growth, just to keep the state pension alive for one more year."

He added: "It should alarm us all that such drastic action produces such a marginal result."

The National Insurance hikes were intended to stabilise the UK's public finances but are now drawing criticism for placing a disproportionate burden on working-age Britons whilst offering little long-term fiscal payoff.

ASI has renewed its call for the Government to suspend the state pension's triple lock mechanism, which increases pensions annually by the highest of inflation, earnings or 2.5 per cent.

Marlow described the policy as unsustainable: "The triple lock is a political luxury that the Treasury simply cannot afford. We are moving towards a system where today's workers are funding yesterday's benefits, and it cannot hold."

ASI researchers highlighted significant intergenerational imbalances, with figures showing that the average person born in 1956 will receive £291,000 more in pension and benefits than they contributed via National Insurance.

LATEST DEVELOPMENTS:

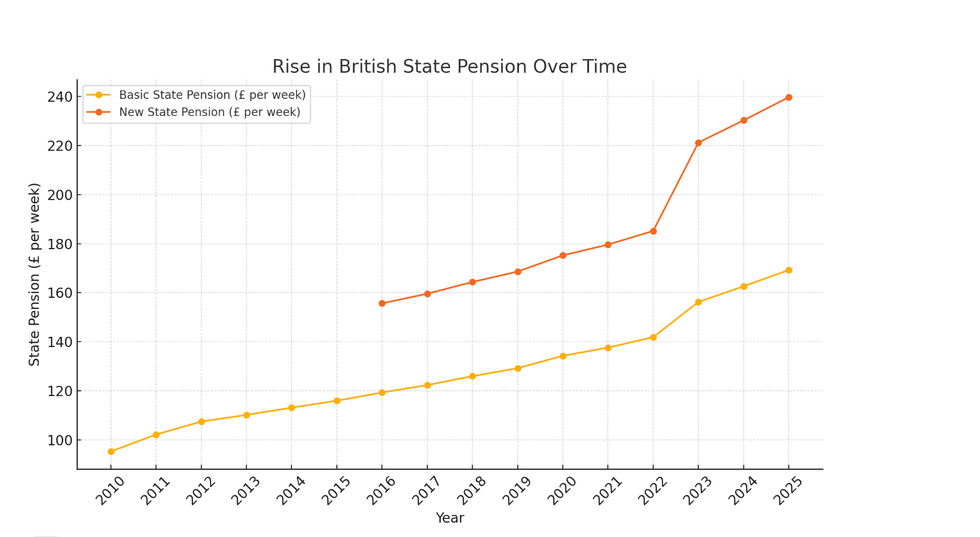

The rise in the British State Pension over time, including the 4.1 per cent increase in 2025 | ChatGPT

The rise in the British State Pension over time, including the 4.1 per cent increase in 2025 | ChatGPTThe think tank's warning adds to growing concerns over the UK's long-term fiscal position, with analysts at Deutsche Bank cautioning that tax revenues may come under further pressure if employment levels fall and growth stagnates.

HSBC has warned the UK risks entering a "doom loop" of high taxes and low growth, particularly if bond yields remain elevated.

The Office for Budget Responsibility (OBR) has indicated that future Governments may need to re-examine long-term liabilities like the state pension if public spending pressures continue to build.

A Government spokesperson said: "The State Pension remains the foundation of support for millions of people. We're committed to ensuring it is sustainable for future generations."