Jeremy Hunt and Rishi Sunak have frozen income tax allowances until 2028

PA

Frozen tax allowances mean people are paying more in tax as wages rise

Don't Miss

Most Read

The UK is set to see its biggest tax rise in at least 50 years due to the freeze on personal thresholds and soaring inflation, according to new analysis.

Taxpayers are set to pay £40billion by 2028, the Resolution Foundation said.

The think-tank said the figure, up from a forecast £30billion at the time of the Chancellor Jeremy Hunt’s Budget in March this year, is due to the recent inflation shock.

Income tax and National Insurance thresholds are currently frozen until 2028, meaning million of people will pay more in tax as incomes rise during the ongoing six-year freeze.

WATCH NOW: Inheritance tax 'should be scrapped!'

Had the Government uprated the personal tax allowance with inflation over this period, people would have started paying income tax at around £16,200.

The current threshold of tax-free income is £12,570, and it’s set to remain at this level until April 2028.

It means an additional £720 in income tax for most basic rate taxpayers, the think-tank said.

The Institute for Fiscal Studies said the freeze will compound challenges for many employees whose earnings growth is not keeping up with inflation.

Adam Corlett, principal economist at the Resolution Foundation, said: “Abandoning the usual uprating of tax thresholds is a tried and tested way for governments of all stripes to raise revenue in a stealthy way.

Do you have a money story you'd like to share? Get in touch by emailing the money team at money@gbnews.uk.

“But it is the far bigger than anticipated scale of the Government’s £40 billion stealth tax rise that stands out.

“The reality of the largest, and ongoing, tax rise on incomes in at least 50 years is why any talk of pre-election tax cuts will inevitably be seen in the wider context of some far bigger tax rises.”

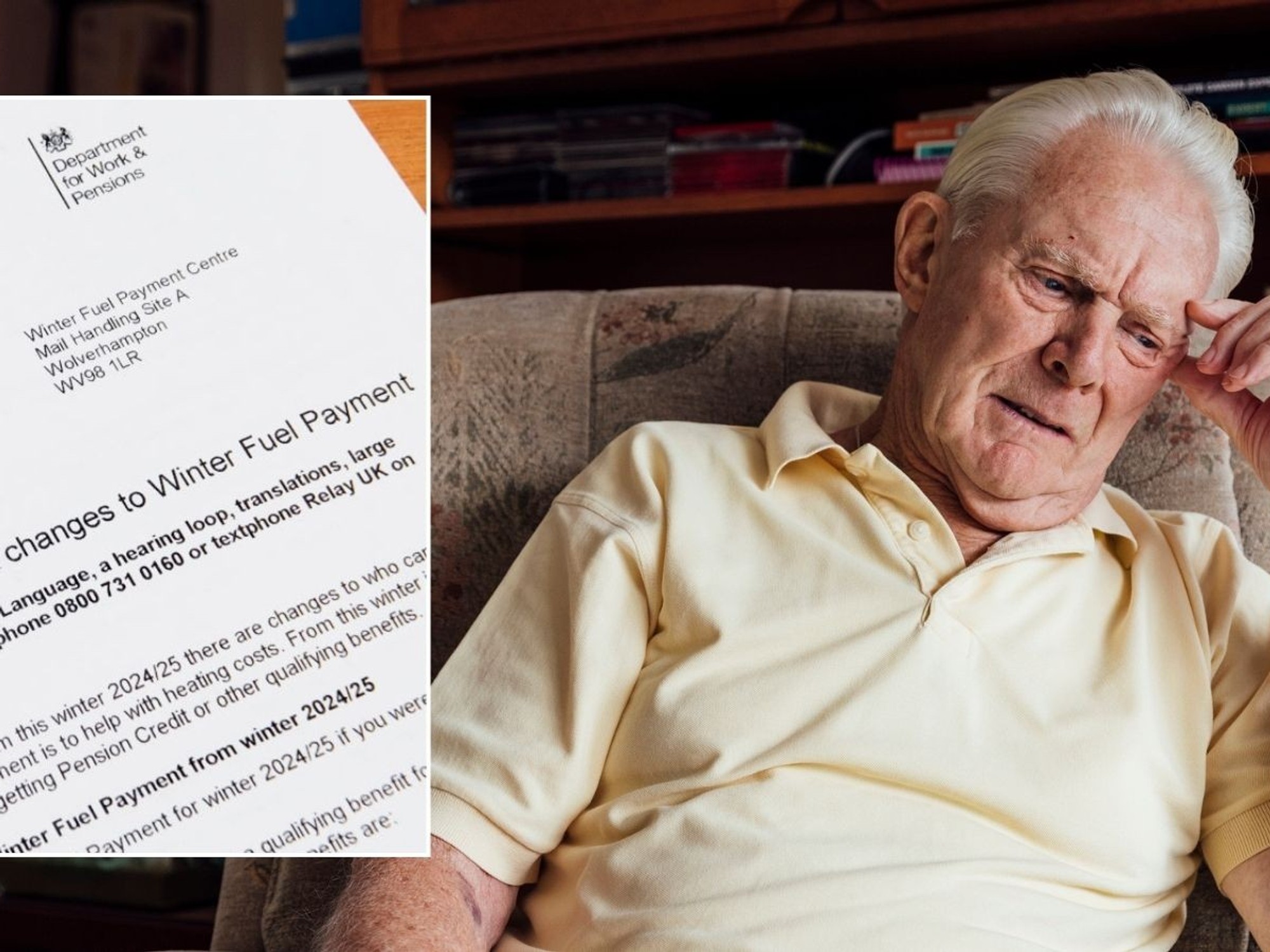

More than half a million pensioners are set to be dragged into the income tax net next year, amid the allowance freeze and a large state pension rise expected.

Sir Steve Webb, partner at LCP and former pensions minister, said: "Alongside a continued freeze of the tax-free personal allowance, this is likely to drag well over half a million more pensioners into the income tax net."

LATEST DEVELOPMENTS:

The current threshold of tax-free income is £12,570, and it’s set to remain at this level until April 2028

PA

"Once again, ‘stealth’ taxation proves a convenient revenue raiser for the Chancellor."

Alice Guy, head of pension and savings at interactive investor, told GB News that freezing tax thresholds is the "ultimate stealth tax" as "not many people take much notice of tax thresholds".

She continued: "In a time of high inflation, it’s an especially effective policy and will have a big impact on people’s spending power over time.

"Sadly it will often be the poorest taxpayers who are affected the most, as they see their income eroded in real terms over time.”

GB News spoke to a pensioner couple who have already found they have been dragged into the income tax net after a 10.1 per cent rise in their state pension in April this year.

An HMT spokesperson said: “Our tax burden remains lower than any major European economy, despite the difficult decisions we’ve had to make to restore public finances after the dual shocks of the pandemic and Putin’s illegal invasion of Ukraine.

“Driving down inflation is the most effective tax cut we can deliver right now, and we are sticking to our plan to halve it, rather than making it worse by borrowing money to fund tax cuts.

“We have also taken three million people out of paying tax altogether since 2010 through raising personal thresholds, and the Chancellor has said he wants to lower the tax burden further – but has been clear that sound money must come first.”