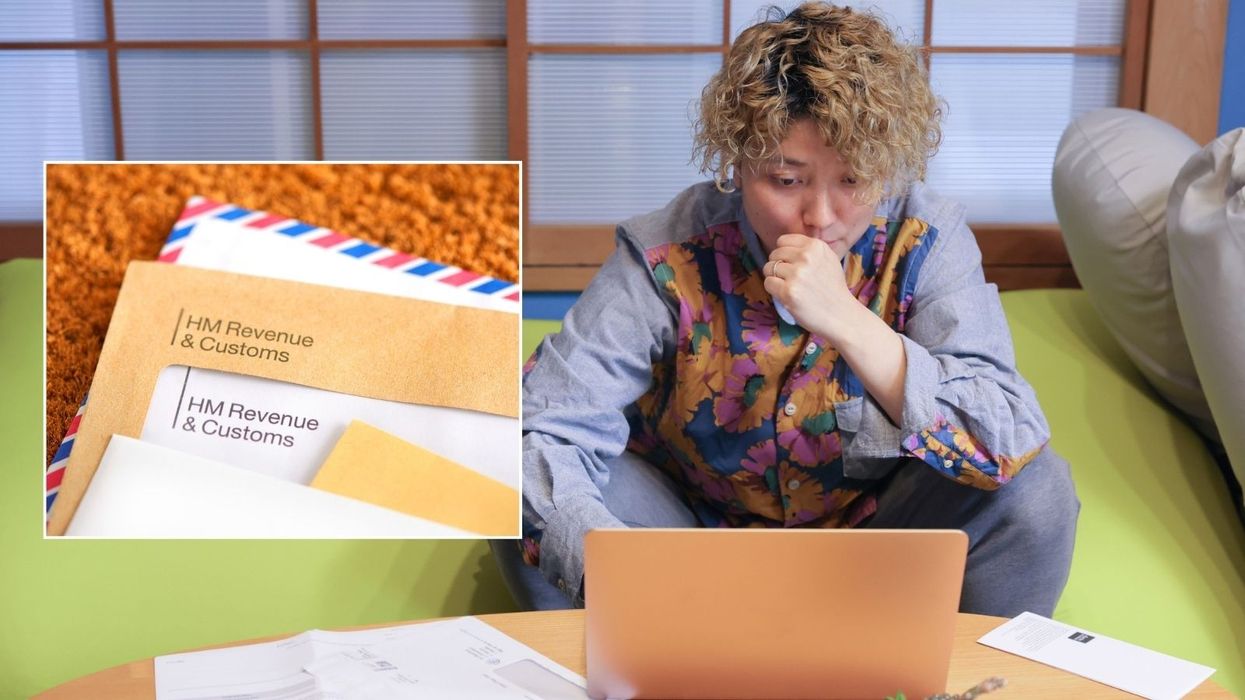

Thousands of families missing out on £4,000 boost with special HMRC code - can you claim?

To claim this extra support, households must act before the deadline

|GETTY

To claim this extra support, households must act before the deadline

Don't Miss

Most Read

A special HMRC code will allow households to claim up to £4,000.

Parents can use the cash to help with the cost of their nursery care, to fund nurseries, nannies, after school clubs and play schemes.

The Tax-Free Childcare scheme sees parents paid between £500 and £1,000 every three months, up to a maximum of £2,000 or £4,000 a year.

Individuals have until Saturday, August 31, to set up a Tax-Free Childcare account.

HMRC will then send them a code, to be given to a childcare provider, such as a nursery to allow them to claim the cash.

The childcare scheme is an online account which parents and guardians pay into, and then they receive top up payments from the Government.

The Tax-Free Childcare scheme sees parents paid between £500 and £1,000 every three months

| PexelsFor every £8 someone pays into the account, the Government will automatically add in £2 which they can put towards their childcare costs.

According to recent data, around 1.3 million families are eligible, but around 800,000 aren't currently using this benefit.

The scheme helps pay for childcare for children up to the age of 11 years, or up to 16 if the child has a disability.

Britons can get Tax-Free Childcare at the same time as 15 or 30 hours free childcare if they are eligible for both.

Eligibility depends on

- whether you’re working (employed, self-employed, or a director)

- your income (and your partner’s income, if you have one)

- your child’s age and circumstances

- your immigration status

Workers must earn at least the minimum wage, for the equivalent of 16 hours a week. If they're in a couple, their partner must also earn this.

Self-employed workers are also eligible if they earn this amount too. Both them and their partner also have to earn less than £100,000 a year to qualify.

This scheme is open to working families so those claiming Tax Credits, Universal Credit or childcare vouchers will not be able to benefit.

However, there are some exceptions for those who are not working. For example, people may still be able to claim if one of them is working and the other gets Incapacity Benefit, Severe Disablement Allowance, Carer’s Allowance or Employment and Support Allowance (ESA).

HMRC says it takes around 20 minutes to apply for the scheme and you can do this through the Gov.uk website.