Energy bills to fall in July as Ofgem confirms price cap drop

GBNEWS

Ofgem has reminded households that they do not have to pay the price cap, saying 'there are better deals out there'

Don't Miss

Most Read

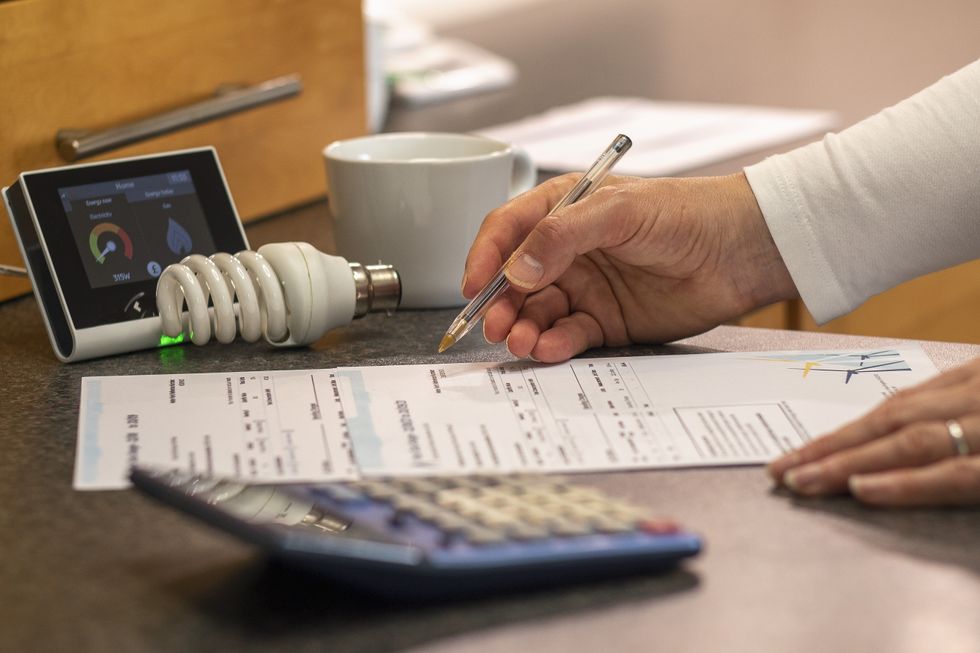

Energy customers across Britain have been urged to submit meter readings by the end of today to avoid overpaying on their bills.

The energy price cap will fall by seven per cent from tomorrow, July 1, reducing typical household bills by £129 to £1,720 per year.

The new cap represents a significant decrease from the peak of the energy crisis in early 2023, when bills reached £2,380 under the Government's energy price guarantee. However, costs remain 10 per cent higher than the same period last year.

Customers of major suppliers including British Gas, Octopus, Eon, EDF and OVO who fail to provide accurate meter readings risk being charged at the higher pre-July rate through estimated billing.

The price cap, set by regulator Ofgem, determines the maximum suppliers can charge per unit of energy but does not limit total bills, which depend on consumption.

Energy experts have warned that failing to submit readings leaves households vulnerable to inaccurate estimated bills. Research from comparison site Uswitch reveals that 20 per cent of households without smart meters have not submitted meter readings in the past three months, whilst six per cent have not done so for an entire year.

Ben Gallizzi, energy spokesman for Uswitch, said: "Customers who don't have a smart meter should submit their readings before or on Tuesday 1 July, so their supplier has an updated and accurate view of their account."

The timing is particularly crucial as energy usage varies significantly between months. Uswitch calculations show that homes on standard price cap tariffs with average usage are expected to spend £63 on energy in July compared with £113 in June, reflecting both cheaper unit rates and reduced summer consumption.

Customers at various energy suppliers could make their own savings to avoid the pending price cap hike PA

Customers at various energy suppliers could make their own savings to avoid the pending price cap hike PA Approximately 22 million households across England, Wales and Scotland remain on the energy price cap, representing around 65 per cent of domestic customers. The remaining 35 per cent have actively sought fixed deals that are not governed by the cap.

The new cap level of £1,720 per year for typical usage is £660 lower than the £2,380 peak during the energy crisis at the start of 2023. Despite this substantial reduction, bills remain elevated compared to pre-crisis levels, sitting £152 higher than July 2024.

The price cap controls the maximum amount suppliers can charge per unit of energy but does not limit total bills, which continue to reflect actual consumption.

The seven per cent reduction applies to unit rates rather than overall bills, meaning households will still pay for the energy they use.

Energy customers are urged to act or risk overpaying bills

GETTYThe comparison site identified 10 fixed deals currently available that are cheaper than the July price cap, with the best offering savings of around £145 for average households.

Ofgem has reminded customers that "there are better deals out there" beyond the price cap.

Gallizzi urged customers to act quickly, stating: "There's a lot of uncertainty about global energy costs at the moment, which has led industry experts to predict a rise in energy bills and in the price cap this autumn."

Ofgem's new energy price cap will come into effect on July 1

GETTYHe added: "If you can switch to a deal cheaper than the July price cap, now is a good time to make the change.

"We urge customers to run an energy comparison as soon as possible."

The fall in energy costs provides some relief after what was described as an "awful April" of bill rises, including Ofgem's previous 6.4 per cent price cap increase.