State pension warning: Labour urged to introduce 'means testing' as pensioner bill set to hit £181billion

Updated figures put state pension spending at nearly half of all welfare costs by 2030, raising questions over sustainability

Don't Miss

Most Read

Latest

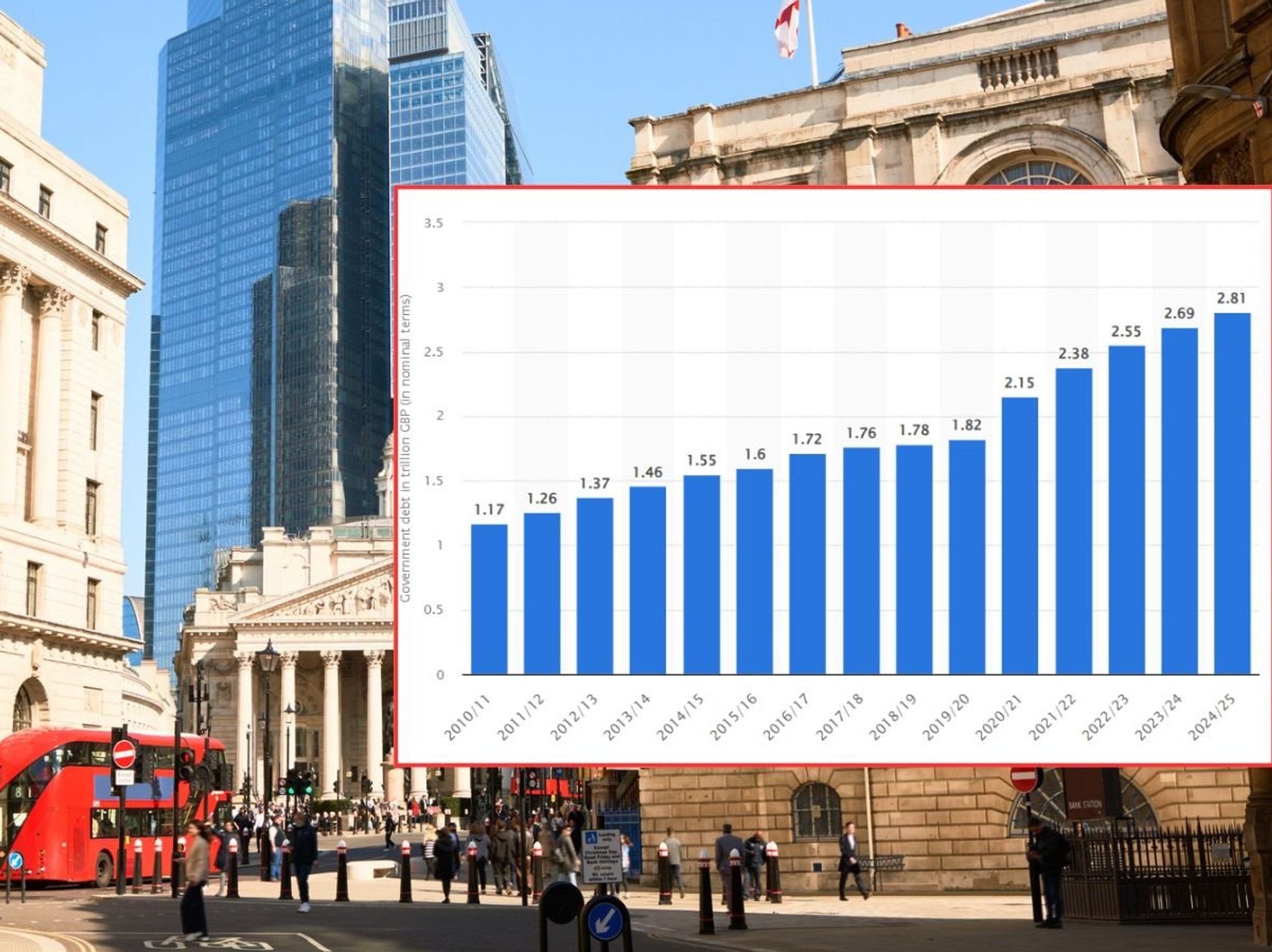

Government spending on pensioners is set to reach £181.8 billion by 2029/30, according to new forecasts from the Office for Budget Responsibility (OBR).

The projections were released shortly after the Intergenerational Foundation called for Labour to introduce means-testing for state pension payments. The think tank argues that rising costs, combined with long-standing disparities in how different age groups are treated by the welfare system, demand urgent reform.

Total welfare spending is expected to reach £373.4 billion by the end of the decade, an increase of £60.4 billion from 2024/25, or nearly a fifth.

Of that, nearly half is already allocated to pensioner-related costs, which currently stand at £150.7 billion a year. This includes spending on the state pension, housing benefit, pension credit and winter fuel payments.

By 2029/30, those costs are forecast to rise to £181.8 billion, continuing to account for just under 49 per cent of the entire welfare budget.

The Intergenerational Foundation has pointed to what it describes as a stark imbalance in public spending growth across generations

| GETTYIt is this scale of spending that has triggered renewed scrutiny from economists and policy experts. The Intergenerational Foundation has pointed to what it describes as a stark imbalance in public spending growth across generations.

According to its research, real per-person spending on pensioners rose by 55 per cent between 2004–05 and 2023–24, compared with just a 20 per cent increase in spending on children over the same period.

The think tank says the growing gap in spending between age groups could lead to long-term unfairness built into the welfare system.

In its latest report, it calls on the Government to consider means-testing the state pension, meaning wealthier pensioners would get less or nothing.

This would be a big shift away from the current system, where everyone who qualifies gets the same amount, regardless of income.

Economists at the think tank are now pressing Chancellor Rachel Reeves to address these disparities through pension reform. Their report specifically recommends: "Reform the state pension by removing the triple lock and introducing modest means-testing."

Currently, all Britons who reach the official retirement age of 66 are entitled to receive the state pension and associated age-related benefits, regardless of their financial circumstances.

The triple lock mechanism guarantees state pension payments rise annually by whichever is highest: inflation, average earnings or 2.5 per cent.

The triple lock mechanism guarantees state pension payments rise annually by whichever is highest: inflation, average earnings or 2.5 per cent

| PAThe Institute for Fiscal Studies estimates this policy costs approximately £11 billion per year compared to increasing pensions solely in line with inflation or earnings.

This substantial cost has raised questions about the triple lock's long-term sustainability. The IFS analysis suggests the mechanism significantly inflates state pension expenditure beyond what standard uprating methods would require.

For the 2025-26 tax year, the full new state pension stands at £230.25 per week, equating to roughly £997.58 monthly or £11,973 annually.

Recipients must have 35 qualifying years of National Insurance contributions to receive the full amount, with a minimum of 10 years required for any state pension entitlement.

Means-testing would end the universal nature of state pension entitlement that has existed for generations

| GETTYThe Intergenerational Foundation's proposals would mark a fundamental shift in UK pension policy. Means-testing would end the universal nature of state pension entitlement that has existed for generations.

Under current rules, pension eligibility depends solely on age and National Insurance contribution history, not personal wealth or income.

Welfare spending as a proportion of GDP is forecast to fall slightly to 10.8 per cent, despite the absolute increase in expenditure. This indicates the economy is expected to grow at a faster rate than welfare costs.

More From GB News