NS&I to launch new ‘British Savings Bond’ with three-year interest rate, Hunt announces in Budget

Jeremy Hunt announced the new savings bond will be accessible to Britons through NS&I

Don't Miss

Most Read

National Savings and Investments (NS&I) is set to launch a new “British Savings Bond” with a three-year fixed interest rate. On its website, NS&I confirmed the bonds will be available to savers from April.

In today’s Spring Budget, Chancellor Jeremy Hunt announced the new savings product will have a guaranteed rate for three years for investments between £500 and £1million.

He said the new NS&I bond’s introduction will make it “easier for people to save for the long term” with it expected to be launched in April 2024.

However, Mr Hunt gave no indication what the interest rate attached to this bond will be during his speech to Parliament.

What did you think of Jeremy Hunt's Spring Budget? Get in touch by emailing money@gbnews.uk.

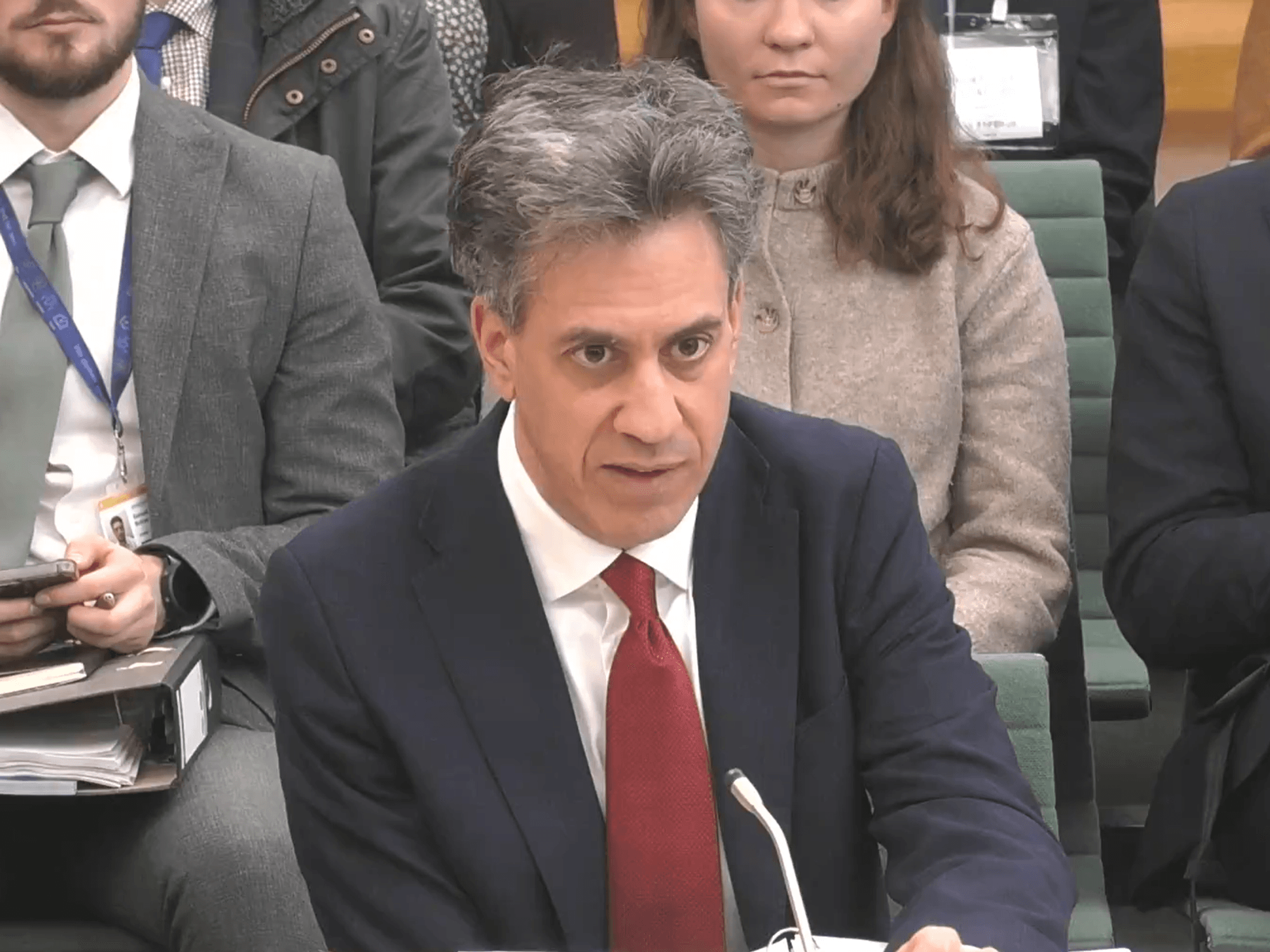

Mr Hunt confirmed the launch of a new "British Savings Bond"

|GB NEWS/NS&I

Many Britons use the government-backed savings provider NS&I to bolster their savings through popular products, such as Premium Bonds and Savings Bonds.

Reacting to new product on X, formerly Twitter, Martin Lewis warned that the interest rate will need to competitive to be “worth” peoples’ time.

The personal finance journalist wrote: “British Saving Bond to come from NS&I with new thee year fix.

“The key is what is the rate - it will need to be over five per cent to be worth it.

“Unless it allows very large savings, over £85,000, which is when NS&I being state owned has an extra safety boon.”

Mark Hicks, the head of active savings at Hargreaves Lansdown, hailed the announcement of the NS&I savings product as a “new British landmark”.

He said: “All eyes will be on the rate available, because even savers who want to buy British with their cash will not want to accept a disappointing rate in return.”

However, the savings expert noted that those considering the British Saving Bond will “need to think carefully whether they want to wait for this bond”.

LATEST DEVELOPMENTS:

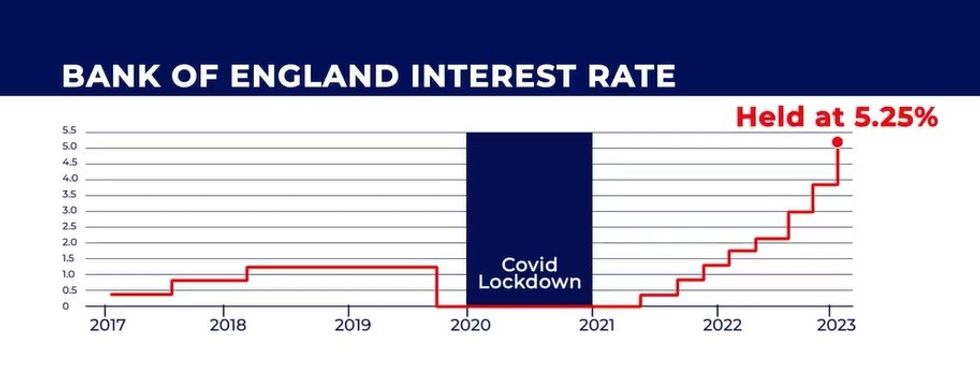

The Bank of England has held the base rate at 5.25 per cent | GB NEWS

The Bank of England has held the base rate at 5.25 per cent | GB NEWSThis is due to the fact the Bank of England is expected to cut interest rates and customers are considering whether they can lock down a better rate now.

Mr Hicks added: “It’s also worth noting that most savers are currently choosing easy access and shorter-term fixed rates.

“Given this is a three-year bond, it will need to be a very attractive rate to inspire much interest from savers.”

Elsewhere in today’s Budget, Mr Hunt announced a new British ISA, providing an extra £5,000 tax-free allowance, on top of the existing £20,000 annual ISA allowance.