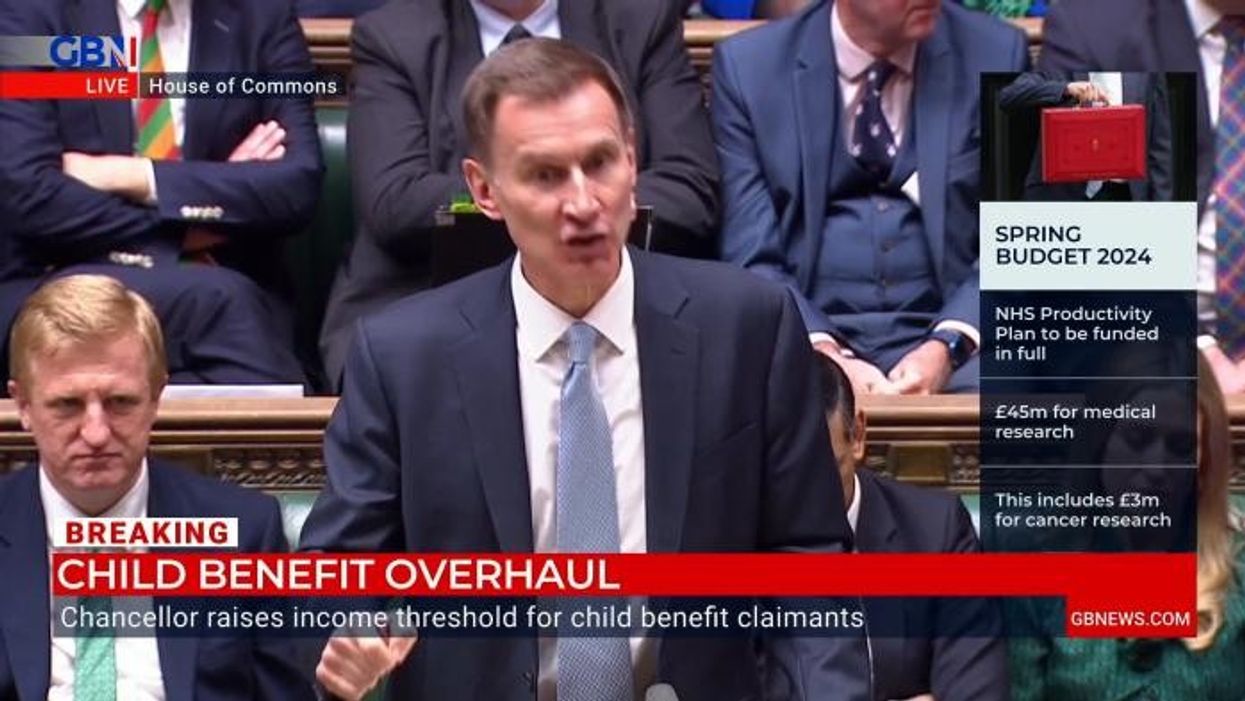

National Insurance rate slashed to eight per cent as Jeremy Hunt confirms tax cut in Budget

Chancellor Jeremy Hunt has confirmed another cut to the National Insurance rate for workers in today’s Spring Budget

Don't Miss

Most Read

National Insurance for workers in the UK will be cut once again, from 10 per cent to eight per cent, with the rate being slashed from eight per cent to six per cent for the self-employed.

Some 27 million workers across the country are expected to benefit from this reduction in the National Insurance rate and save around an extra £450.

In today’s Spring Budget announcement, Chancellor Jeremy Hunt said this latest tax cut will save the average worker around a similar amount to the January cut, which means taxpayers are expected to be £900 better off.

The Chancellor said: “From April 6, employee national insurance will be cut by another 2p, from 10 per cent to eight per cent, and self-employed national insurance will be cut from eight per cent to six per cent. It means an additional £450 a year for the average employee or £350 for someone self-employed. When combined with the autumn reductions, it means 27 million employees will get an average tax cut of £900 a year and two million self-employed a tax cut averaging £650.”

What do you think of the Spring Budget? How will you be impacted by the changes to National Insurance? Get in touch by emailing money@gbnews.uk.

The Government is under fire for the rising tax burden

|GETTY

However, people are still at risk of paying more in income tax over the coming years as the tax thresholds remain frozen until 2028, resulting in working-age adults and pensioners being dragged into higher tax rate bands.

Prior to today’s Budget, the Chancellor told the BBC he wanted to “show a path” to a low tax economy but wanted to be “responsible” in doing so. In January 2024, the Office for Budget Responsibility (OBR) estimated the Treasury would have around £30billion in “headroom” for the Budget.

This forecast came following a fall in borrowing costs and would have given the Chancellor room to introduce tax cuts.

However, borrowing costs have risen since then and the “headroom” figure has reportedly fallen to around £13billion, the BBC reports.

It is believed that the announced cut to National Insurance is considered a cheaper alternative to slashing income tax.

Alastair Douglas, the CEO for TotallyMoney, questioned how beneficial this latest move from the Chancellor will be due to the impact of fiscal drag.

This is the term used to describe when taxpayers end up paying more to HM Revenue and Customs (HMRC) due to tax allowances being frozen while wages rise.

As a result, workers are inadvertently dragged into higher tax bands and end up paying more than initially expected.

LATEST DEVELOPMENTS:

The average British worker is expected to save an extra £450 a year

| GETTYDuring last year’s Autumn Budget, Mr Hunt confirmed that income tax thresholds would remain frozen until at least 2028. Mr Douglas explained: “This means that over the next few years, 4 million people will start paying income tax and 3 million will be subject to higher rates.

“Inflation continues to soar at double the target rate, and the impact of the cost of living crisis will be felt for years to come. £450 may paper over the cracks, but it won’t fill the pockets of the millions of people struggling to make ends meet.”

According to TotallyMoney, here is how much a worker on an average salary for their region is expected to save with the most recent National Insurance cut:

- United Kingdom - £447.86

- England - £450.75

- North East - £372.60

- North West - £409.32

- Yorkshire and The Humber - £387

- East Midlands - £381.28

- West Midlands - £408.66

- East - £445.26

- London - £636

- South East - £479.80

- South West - £417.60

- Wales - £396.02

- Scotland - £458.96

- Northern Ireland - £406.18.

Here is how much taxpayers are expected to save depending on their salary with the National Insurance rate being slashed to eight per cent:

- £20,000 – 148.60

- £25,000 - £248.60

- £30,000 - £348.60

- £34,969 - £447.86

- £40,000 - £548.60

- £50,000 - £748.60

- £75,000 - £754

- £100,000 -£754.