UK needs tax rises not cuts says IMF, branding Jeremy Hunt’s spending plans ‘unrealistic’

Chancellor Jeremy Hunt has been urged to avoid cutting taxes in the upcoming Spring Budget

Don't Miss

Most Read

Latest

The Chancellor Jeremy Hunt has been urged against cutting taxes further, as it could risk the Government’s ability to invest in the National Health Service (NHS) and other vital services.

The International Monetary Fund (IMF) has advised against tax cuts, warning the UK will see extra pressure to spend money on social care, education and healthcare.

IMF chief economist Pierre-Olivier Gourinchas told a press conference today: “There is a need to put in place medium-term fiscal plans that will accommodate a very significant increase in spending pressures.

“In the case of the UK, you might think of spending on healthcare and modernising the NHS; spending on social care; on education; you might think about critical public investment to address the climate transition; but also to boost growth.”

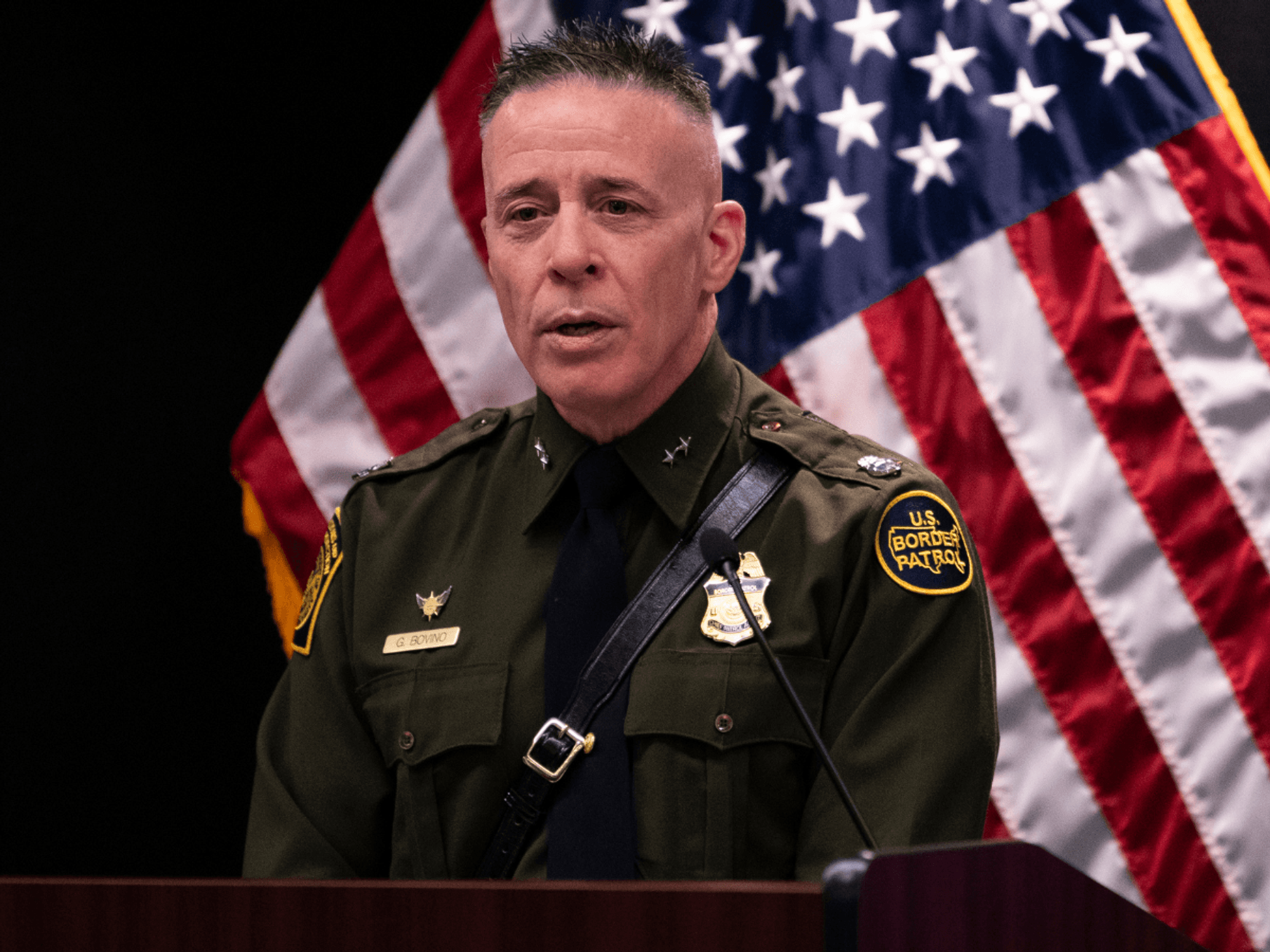

Chancellor Jeremy Hunt has been urged against cutting taxes further

|PA

Mr Gourinchas said the Government must balance its tax gains with its spending to ensure debt doesn’t spiral out of control, if it wants to meet the commitments.

He added: “In that context we would advise against further discretionary tax cuts as envisioned and discussed now.”

The Chancellor announced a cut to the National Insurance rate for millions of workers during his Autumn Statement last year.

The measure will cost the Treasury around £9.76billion in the 2028 tax year, according to the Office for Budget Responsibility.

However, the Government’s ongoing freeze on income tax thresholds is raising income for the Treasury through fiscal drag.

Ahead of the General Election which will likely take place this year, the Chancellor has signalled he’s keen to cut taxes further if possible.

On Tuesday, Mr Hunt said: “It is too early to know whether further reductions in tax will be affordable in the Budget, but we continue to believe that smart tax reductions can make a big difference in boosting growth.”

Jeremy Hunt will deliver his Spring Budget statement in the House of Commons on March 6.

The Chancellor’s Budget headroom could depend on the upcoming interest rate decision from the Bank of England’s Monetary Policy Committee (MPC), due on Thursday, according to Khalaf, head of investment analysis at AJ Bell.

LATEST DEVELOPMENTS:

There’s been speculation interest rates could be hiked, due to a “sticky inflation” reading published earlier this month.

Mr Khalaf said: “If interest rates rise on the back of the meeting, that will push up the cost of government borrowing, and down on the chancellor’s wriggle room.

“The OBR closes its budgetary forecasts to new economic data on February 14, so will encompass any fallout from this week’s interest rate decision.

“It seems unlikely anything apart from a rate hike would move interest rates in a material way, but the market is poised for so many rate cuts this year, it might well be sensitive to lesser challenges to the prevailing narrative.

“Much will likely depend on the Bank of England’s assessment of current monetary conditions. If the Bank wants to send a signal that markets have got ahead of themselves, this week’s interest rate decision provides a golden opportunity to do so.”