State pension shortfall slaps Britons as retirees losing £4,000 a year: 'Indefensible!'

Shadow Secretary of State for Work and Pensions Helen Whately slams Rachel Reeves for economic decline since Labour took office |

GB NEWS

State pension payment rates are guaranteed to rise every year

Don't Miss

Most Read

Latest

British pensioners who have retired to countries such as Australia, South Africa and Canada are losing thousands of pounds annually due to longstanding agreements between Governments.

Expats could see their state pension payments remain frozen at the level they first received when moving abroad.

Unlike retirees in the UK who benefit from triple lock protection guaranteeing annual increases, these expatriates receive no uprating to their pensions.

Analysis reveals that some pensioners are now more than £4,000 per year worse off than a decade ago as inflation erodes their purchasing power.

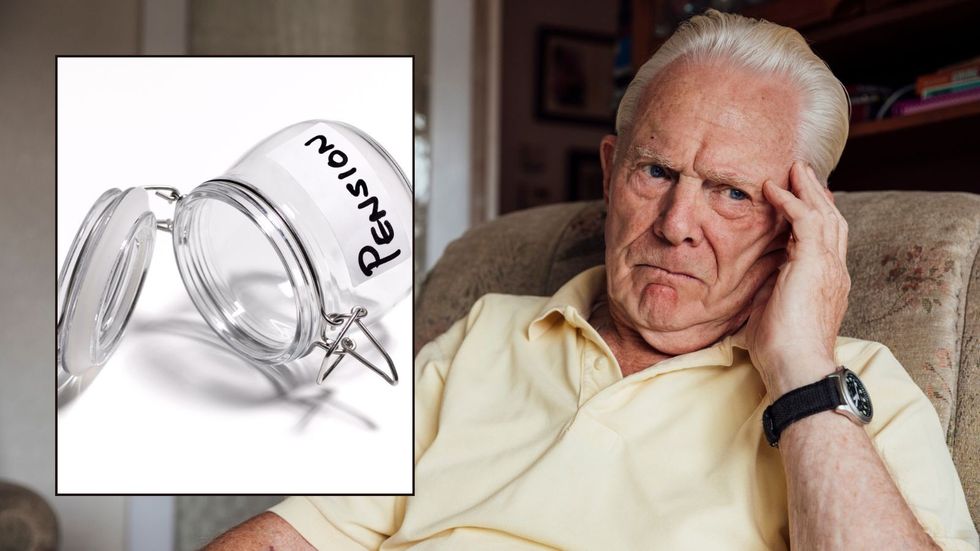

Pensioners are being impacted by the frozen payment policy

|GETTY

Over 400,000 state pensioners living overseas face this predicament, with nearly half residing in Australia.

A pensioner who relocated to Australia ten years ago on the full basic state pension of £113.10 weekly continues to receive that same amount, worth £5,881 annually.

To maintain their 2014 purchasing power in Australia, they would now require £151.54 per week - a shortfall of £38.44 weekly or nearly £2,000 yearly.

Those same retirees would be receiving £176.45 weekly if they had remained in Britain, where the triple lock ensures pensions rise by the highest of inflation, earnings growth or 2.5 per cent annually.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

British expats are at risk of a state pension shortfall

| GETTYThe situation proves particularly severe in South Africa, where approximately 25,000 UK state pension recipients have witnessed dramatic erosion of their payments' value.

Those who emigrated there a decade ago would require £195.87 weekly to match their 2014 purchasing power - £83 more than their current frozen payment, equating to £4,300 annually lost to inflation.

Countries including Thailand, New Zealand and the Philippines face similar challenges.

Only expatriates in nations with reciprocal agreements receive annual increases, including those in the US, EU, European Economic Area, Iceland, Liechtenstein, Norway and Switzerland.

LATEST DEVELOPMENTS:

Anne Puckridge is among the estimated 500,000 pensioners living with 'frozen' state pensions | PA

Anne Puckridge is among the estimated 500,000 pensioners living with 'frozen' state pensions | PAJohn Duguid, Chair of the End Frozen Pensions campaign, said: "This latest analysis highlights not only the severe financial pressure that the frozen pensions policy places on many British pensioners living overseas, but also how that impact deepens over time."

He added: "The majority of those affected live in countries with a similar or even higher cost of living than the UK, and mostly in Commonwealth nations with close political and cultural ties to Britain.

"It is indefensible that pensioners who paid in over a lifetime are forced into poverty purely because of where they live."

A Government spokesperson said: "We understand people move abroad for many reasons, and we provide clear information on how this can impact their finances in retirement with the policy on the uprating of the UK State Pension for recipients living overseas a longstanding one."

More From GB News