Millions of Britons letting inflation erode their hard-earned savings

Savers are being reminded to take advantage of high interest rate accounts before its too late

Don't Miss

Most Read

Around 43 million Britons are keeping their money in either low or no-interest rate accounts to the “mercy of inflation”, experts have warned.

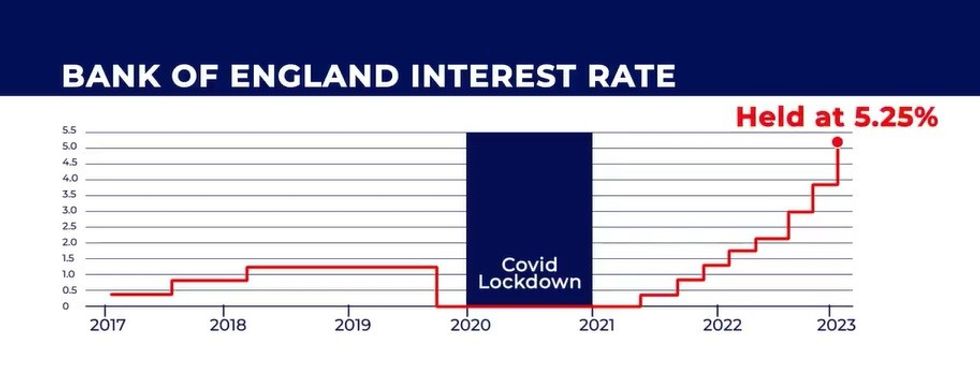

In recent years, savers have benefited from the Bank of England’s decision to raise the base rate with better returns being offered on more competitive products from banks and building societies.

However, new analysis suggests that people are still choosing to leave their cash in current accounts which pay little to no interest.

This is despite inflation continuing to be an issue for households with savings returns being decimated by the relatively high Consumer Price Index (CPI) rate.

Research conducted by InvestEngine found that eight in ten Britons, equating to around 43 million people, keep at least some of their savings in a current account with many not paying any interest.

Some 14 per cent of people surveyed by the investment platform said they have at least some of their savings in cash “at home”.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings interest rates are being eroded by inflation, experts warn

|GETTY

On top of this, 12 per cent of Britons shared that they keep the entirety of their savings in either a current account, in cash at home or a combination of both.

As it stands, the average Briton’s savings pot comes to £11,185 which suggests as much as £71.3billion is trapped in current accounts and not earning interest.

Many of those asked said they avoid investing because they find saving or investing cash too complicated or inaccessible.

Around 32 per cent of those polled mistakenly believe that investing is “only for the wealthy” with 35 per cent unsure of where to start.

Only 19 per cent of people hold a stocks and shares ISA, with 38 per cent having a cash ISA, with the vast majority of people in the UK not knowing how to use them for their full potential.

Notably, only 17 per cent of ISA holders make a regular monthly despot into their tax-free account, with only 15 per cent reaching their full tax-free allowance.

Furthermore, just 15 per cent of those polled are confident they will hit their full tax-free ISA allowance by the end of this year.

Andrew Prosser, the head of Investments at InvestEngine, highlighted the “barriers” potential savers face who are wanting to bolster their finances.

He explained: “Despite many understanding the benefits that long-term investing can bring, millions are still choosing to keep their savings in low or no interest accounts, or even at home where it will make no interest and be left to the full mercy of inflation.

“Our research clearly shows there are several barriers stopping people from getting into investing.

LATEST DEVELOPMENTS:

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWS

Interest rates have increased over the past couple of years after 14 consecutive base rate hikes | GB NEWS“For example, our data shows a certain level of misunderstanding that investing is only for the rich while many say they want low cost, low risk investments with regular payments set up so that they don’t have to think about it too much.

“Stocks and shares ISAs are a great way for individuals of all income brackets to invest and generate returns in a tax-efficient manner.”

With investing, capital is at risk and people may get back less than they put in.