State pension means testing update: Britons must have £300k in retirement savings to 'match' DWP payment

Shadow Work & Pensions Secretary Helen Whately speaks to GB News Breakfast |

GB NEWS

Analysis of the the state pension is breaking down how much the DWP payment would 'cost' if the benefit was means tested

Don't Miss

Most Read

Britons would need to have close to £300,000 in retirement savings to match the amount offered by the state pension, according to new analysis from Fidelity International.

The benefit, which is administered by the Department for Work and Pensions (DWP), has came under scrutiny in recent months due to rising costs with some analysts calling for payments to be means tested.

if implemented, this would see eligibility for the retirement payment linked to income and savings which would see millions of older households lose access to the support.

New research reveals that workers would need to accumulate between £210,311 and £299,325 in their pension pots to generate an income matching the current full state pension of £230.25 per week if means testing became a reality.

Workers will need to have nearly £300,000 in retirement savings to 'match' the DWP payment

|GETTY

The calculations from Fidelity International show that purchasing an annuity to replicate the retirement benefit's income would require £210,311 in pension savings, based on current market rates.

Alternatively, those opting for income drawdown would need a larger sum of £299,325 to achieve the same weekly income. Ed Monk, an associate director at Fidelity International, explained the mechanics behind these figures.

He said: "An annuity lets you exchange money saved inside your pension for a guaranteed income. The rates on annuities fluctuate but right now the rate paid to a healthy 65-year-old is around 5.7 per cent."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

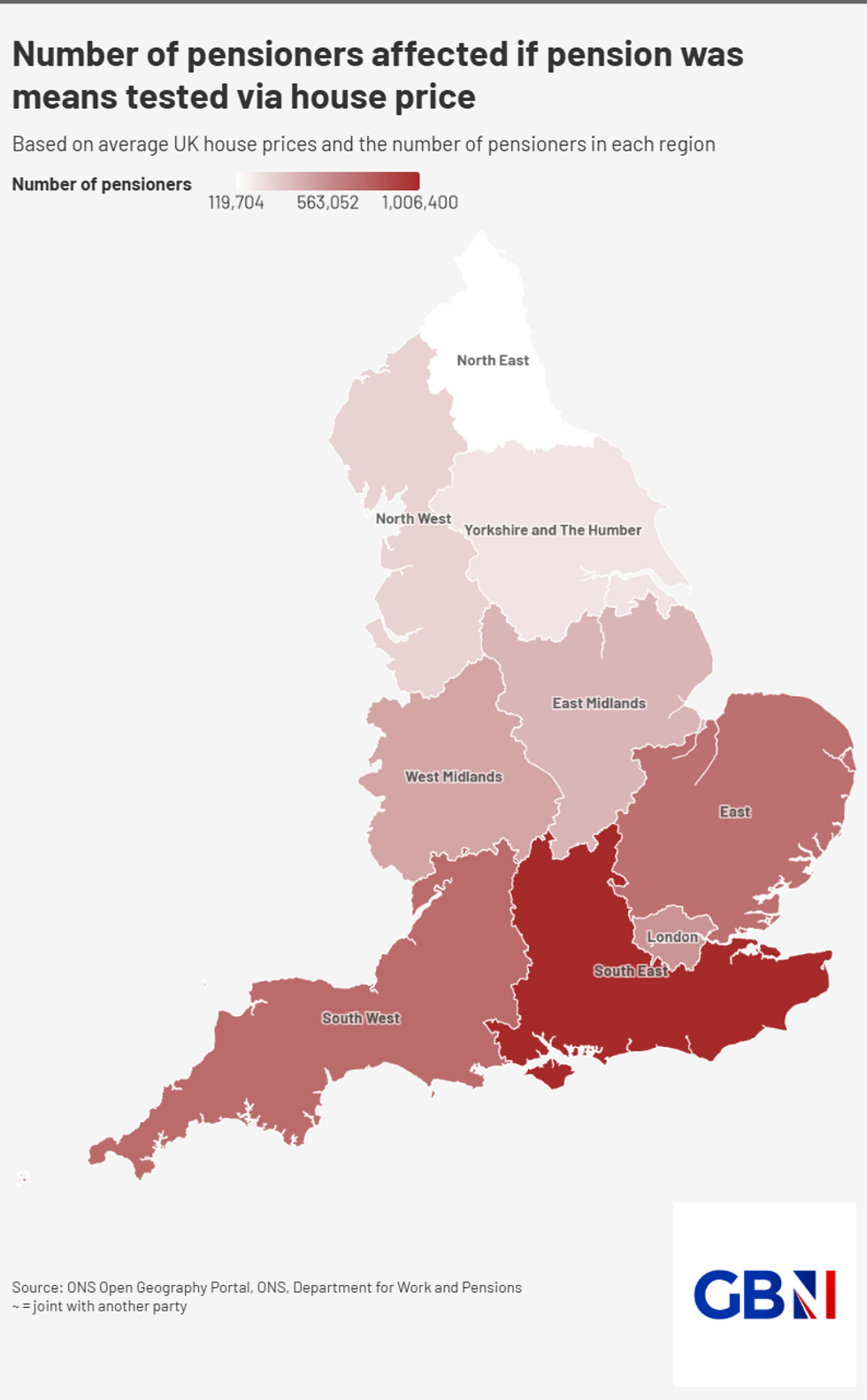

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNIt should be noted that this rate includes annual increases of three per cent to protect against inflation. For those preferring flexibility, retirement experts note that income drawdown offers an alternative approach.

"A rule of thumb is that you can withdraw around four per cent a year from a drawdown pot and still have a good chance that your savings last for 30 years," Monk said.

However, analysts highlight that drawdown lacks the lifetime income guarantee that annuities provide.

The monthly savings required to build such a pension pot are considerable, particularly for younger workers.

A 30-year-old would need to set aside approximately £234 monthly to accumulate the £299,325 needed for drawdown by their projected state pension age of 68.

This calculation assumes five per cent investment growth after fees, though Monk cautioned that "investment returns are not consistent, and the value of your money can fall."

LATEST DEVELOPMENTS:

The DWP is responsible for administering the state pension

| GETTY"Saving those sorts of sums is no mean feat - but the job is made easier the earlier you start," Monk noted, emphasising the advantage of beginning pension contributions early in one's career.

Monk warned that "the state pension in the future is very likely to be significantly more than it is today in cash terms, so to truly match it with your pension would require you save significantly more",

He suggested a practical approach to address this issue: "One way to achieve that is by escalating your contributions. In our example, a 30-year-old may begin by saving £225 a month but could increase this in line with their wages as their career progresses."

Fidelity's associate director cited that this strategy allows workers to gradually build their pension savings as their earning capacity grows over time.

More From GB News