Pensioners could be slapped with £15k stealth tax raid to pay for 'comfortable retirement'

Shadow Work & Pensions Secretary Helen Whately speaks to GB News Breakfast |

GB NEWS

Fiscal drag continues to be an issue for pensioners as older Britons find themselves at risk of being pulled into higher tax brackets

Don't Miss

Most Read

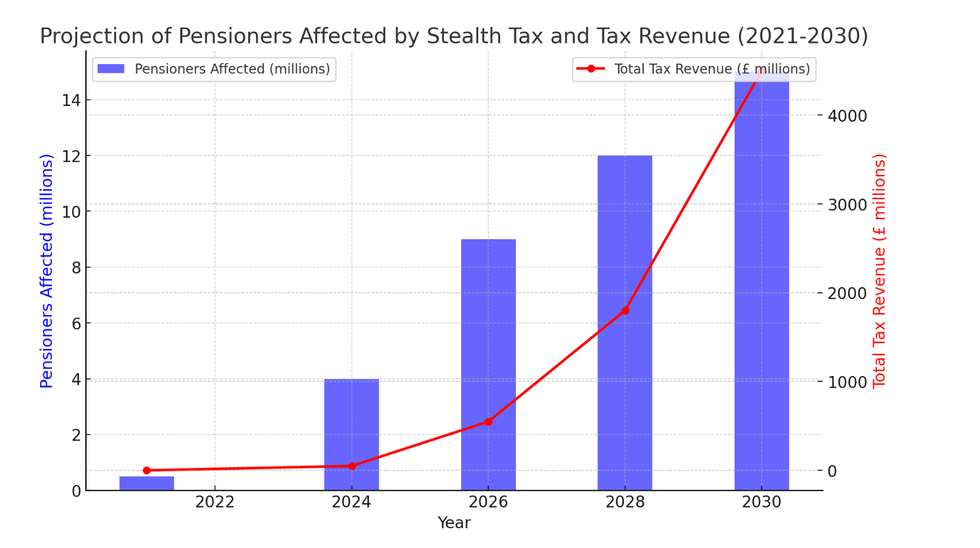

New analysis reveals that pensioners could face a £14,960 increase in the amount needed for a comfortable retirement by 2030 if Labour extends the current income tax threshold freeze beyond 2028.

The freeze on tax thresholds, which has been in place since 2021 and is set to continue until 2028, creates fiscal drag as inflation pushes incomes higher whilst tax-free allowances remain static.

Prime Minister Keir Starmer and Chancellor Rachel Reeves have declined to rule out extending the freeze past 2028, as the Government seeks to address what it describes as a £22billion fiscal "black hole".

According to trade body Pensions UK, a single pensioner currently requires £43,900 in disposable income to maintain a comfortable retirement, which includes luxuries such as regular beauty treatments, theatre visits and annual two-week European holidays.

Pensioners are risk of having to pay a stealth tax to reach the desired "comfortable retirement" savings goal

|GETTY

This represents a significant increase from 2019-20, when £33,000 of expenditure was sufficient for the same lifestyle.

The analysis shows that if disposable income requirements continue rising at six per cent annually and tax thresholds remain frozen, pensioners would need £58,860 by 2030.

If this were to happen, older Britons would require a gross income of £77,153, as more retirement income becomes subject to taxation through the fiscal drag effect.

Financial analysts have raised concerns about the impact on the poorest retirees, with some potentially facing tax bills for the first time.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT Baroness Altmann, a former pensions minister, warned: "Taxing these pensioners for perhaps a few pennies will be an administrative nightmare and cause distress and upset."

She highlighted that state pensions could breach the £12,570 tax-free personal allowance if the the freeze to tax thresholds is allowed to continue.

Alan Barral, financial planner at Quilter Cheviot, said: "Frozen income tax thresholds may feel like a technical detail, but they have real consequences for retirees whose standard of living is being squeezed."

He warned that more retirement income would be taxed, "effectively reducing spending power year after year".

LATEST DEVELOPMENTS:

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PAA Government spokesman responded: "We are committed to helping our pensioners live their lives with dignity and respect, which is why in April the basic and new state pension increased by 4.1 per cent."

The spokesman added that pensioners would receive an income boost of up to £470 in 2025-26.

"Our commitment to the triple lock means millions will see their pension rise by up to £1,900 this parliament," the Government stated.

However, the response did not address whether the income tax threshold freeze would be extended beyond 2028, despite pressure from economists who suggest tax rises are likely in the autumn Budget.

More From GB News