State pension triple lock to boost incomes by £657 a year but DWP urged to consider means testing 'solution'

State pension age rise ‘almost inevitable’: Ann Widdecombe issues warning as Denmark raises the bar |

GB NEWS

The state pension triple lock is under scrutiny due to rising costs

Don't Miss

Most Read

State pension payments for older Britons born after 1951 could see their payments rise by £657 annually if current projections hold. Analysts are urging the Department for Work and Pensions (DWP) to consider means testing as a potential "solution" to this hiked cost.

The retirement benefit is set to cost the UK Government an estimated £145.6billion over the 2025/26 financial year, according to recent reports. The triple lock system, which guarantees annual rate increases based on the highest of three measures, could deliver a 5.5 per cent rise linked to earnings growth.

This would bring the full new state pension to £12,630.80 per year, or £242.90 per week. The potential increase comes as the Office for Budget Responsibility (OBR) recently reported that state pension triple lock costs could balloon to £15.5 billion per annum by 2030.

It represents a figure three times higher than initial estimates made when the triple lock was introduced in 2011.Financial experts have issued warnings about the long-term viability of the current system.

State pension payments will rise by hundreds of pounds but could means testing hurt future rate hikes?

|GETTY

Claire Trott, the head of advice at investment firm St James's Place, stated: "The long-term affordability of the triple lock has been questioned for some time and understandably so."

She explained that with increased life expectancy and more frequent higher rises than originally anticipated, costs have exceeded expectations.

"Yet despite the fiscal pressure, it remains a politically sensitive promise," Trott added. Alternative reform proposals have been suggested to address the mounting costs.

Trott outlined potential options: "There are other options such as freezing the state pension and increasing access to Pension Credit which might be a more pragmatic route - it's already in place and better targeted to those who need help most."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

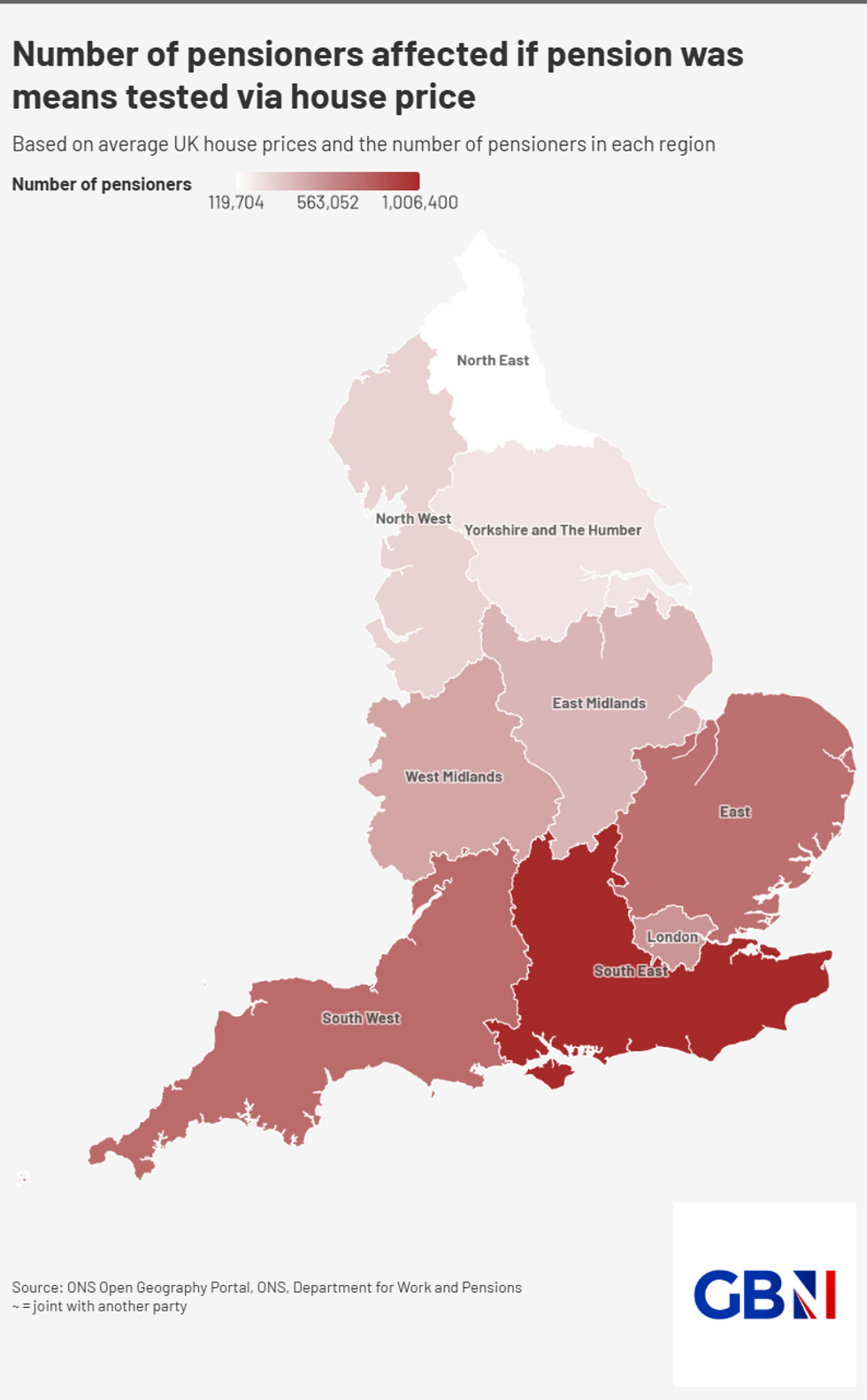

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNThe complexity of implementing means-testing has been highlighted as a significant barrier to reform. Trott noted: "Means testing is often raised as a solution, but in practice it's unlikely to be pursued, given the cost and complexity of implementation outweighing the savings."

Another option under consideration involves adjusting the state pension age.

"Raising the state pension age has been controversial in the past, but it's arguably the most viable and publicly palatable option in the longer term, as people continue to live and work for longer," Trott remarked.

The state pension age is already scheduled to rise from 66 to 67 starting next year, with the increase due to be completed by 2028. A further rise from 67 to 68 is set to be implemented between 2044 and 2046.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves may have to may difficult decisions regarding the state pension | GB News

Chancellor Rachel Reeves may have to may difficult decisions regarding the state pension | GB NewsLabour has pledged to maintain the triple lock throughout this Parliament, ensuring state pensioners receive a 4.1 per cent increase in April aligned with the policy.

Despite this commitment, some experts anticipate future changes once the current administration concludes.

Tomm Adams, a partner at tax advisory firm Blick Rothenberg, stated: "We will likely see the triple lock pension end when the current Parliament does, as the cost of providing it to the UK's aging population is increasing and Government debt is rising."

Professor Joe Nellis from MHA warned that demographic and economic shifts have made the policy difficult to uphold. He noted that any attempt to undo it would "move the Government into treacherous waters."

More From GB News