State pension row erupts as Hunt accuses Labour of ‘scaremongering’ about retirement payments

The Shadow Chancellor has accused Jeremy Hunt of jeopardising the future of the state pension following last week’s National Insurance announcement

Don't Miss

Most Read

Chancellor Jeremy Hunt is accusing the Labour Party of “scaremongering” about the future of the state pension.

He accused Rachel Reeves of not knowing how the retirement benefit works during a row on social media.

Posting on social media, Hunt took Labour’s Shadow Chancellor to task after she warned cuts to National Insurance would lead to less funding for the state pension and the NHS.

Earlier this week, Reeves argued contributions from the levy go towards paying for the benefit and the country’s health service.

She questioned whether recently announced tax cuts would be paid for by reductions in state pension pay outs.

Last week, Hunt confirmed that the rate of National Insurance for workers and the self-employed would be slashed to eight per cent and six per cent, respectively.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

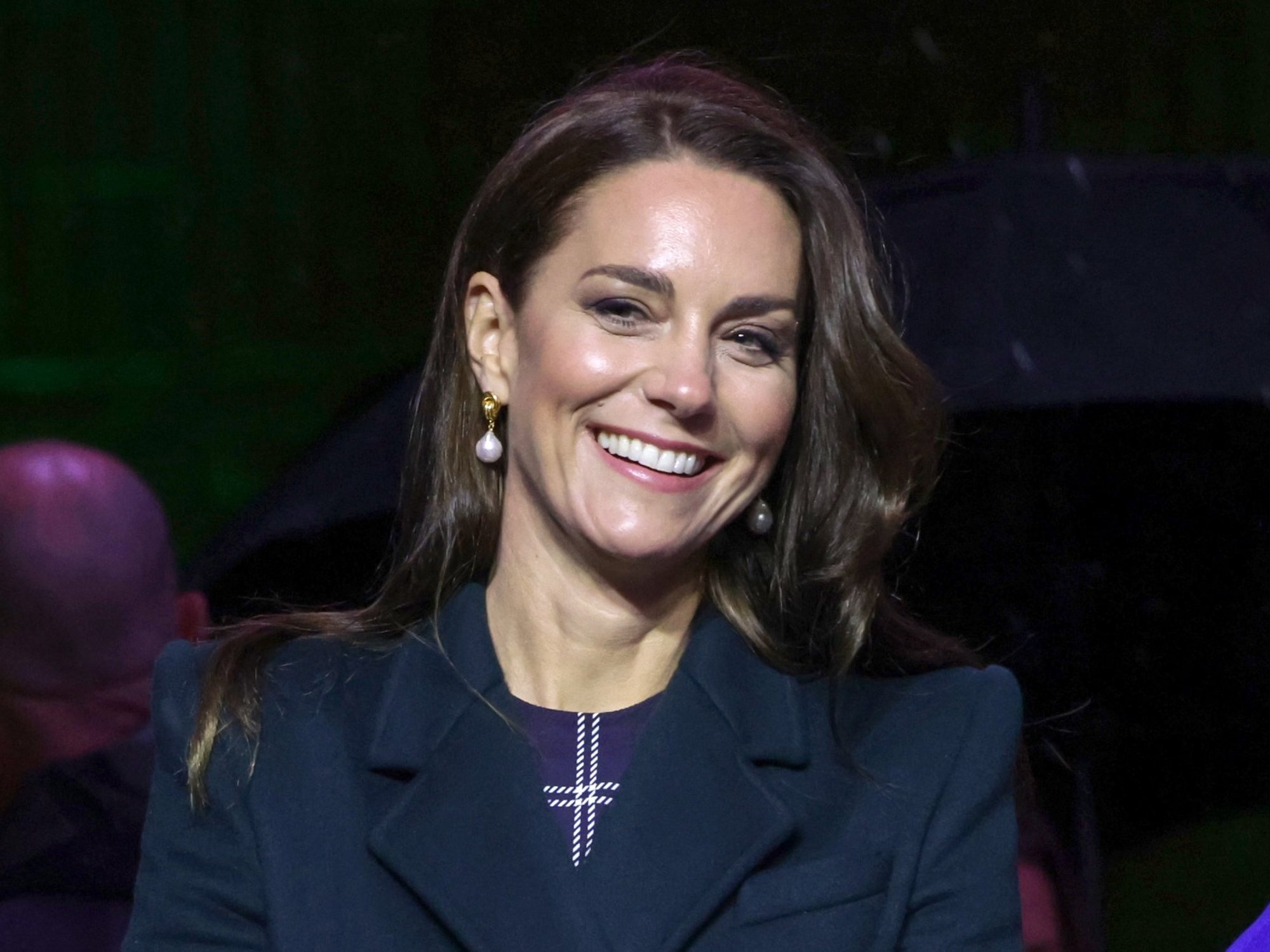

The Chancellor slammed his counterpart over comments regarding state pension funding

|GETTTY

Replying to the Labour politician’s comment, the Chancellor stated: “This is just scaremongering.

“The value of National Insurance contributions receipts do not determine the NHS budget or the value of pensions. Those decisions are taken entirely separately.”

Reeves’ post received a community note, which is used to fact check claims on X, which highlighted that it was a “common misconception” that National Insurance contributions are solely ring-fenced for state pension and NHS funding.

However, it should be noted that the state pension is paid for through varies taxes, including National Insurance.

There is no National Insurance fund that is used to pay for only retirement payments and the health service.

According to healthcare charity The King’s Fund, the NHS gets 18 per cent of its yearly budget from contributions.

A worker on the average salary is expected to save around £900 from this year’s cuts to National Insurance, Hunt claimed in his Budget.

Furthermore, state pension payments will exceed £11,000 for the first time in April thanks to the triple lock remaining in place.

LATEST DEVELOPMENTS:

Pensioners are worried about the future of their retirement | GETTY

Pensioners are worried about the future of their retirement | GETTYHowever, experts have “raised concerns” over the future of state pension funding after Hunt’s decision to cut National Insurance twice in a

Steven Cameron, Aegon’s pension director, explained: “The cut will mean less National Insurance receipts even though the state pension is increasing by 8.5 per cent in April, more than double the current rate of inflation.

“Our ageing population, combined with the current triple lock mechanism, means the costs of state pensions are rising sharply.

“Reducing National Insurance contributions, their primary source of funding, adds to the challenge, potentially requiring alternative state pension funding sources from general taxation in future.”