State pension funding future in doubt after National Insurance cut: ‘Where will the money come from?

National Insurance is due to be cut once again which has led to questions over how the state pension will be paid for

Don't Miss

Most Read

The future of state pension funding is in doubt following recently announced cuts to National Insurance.

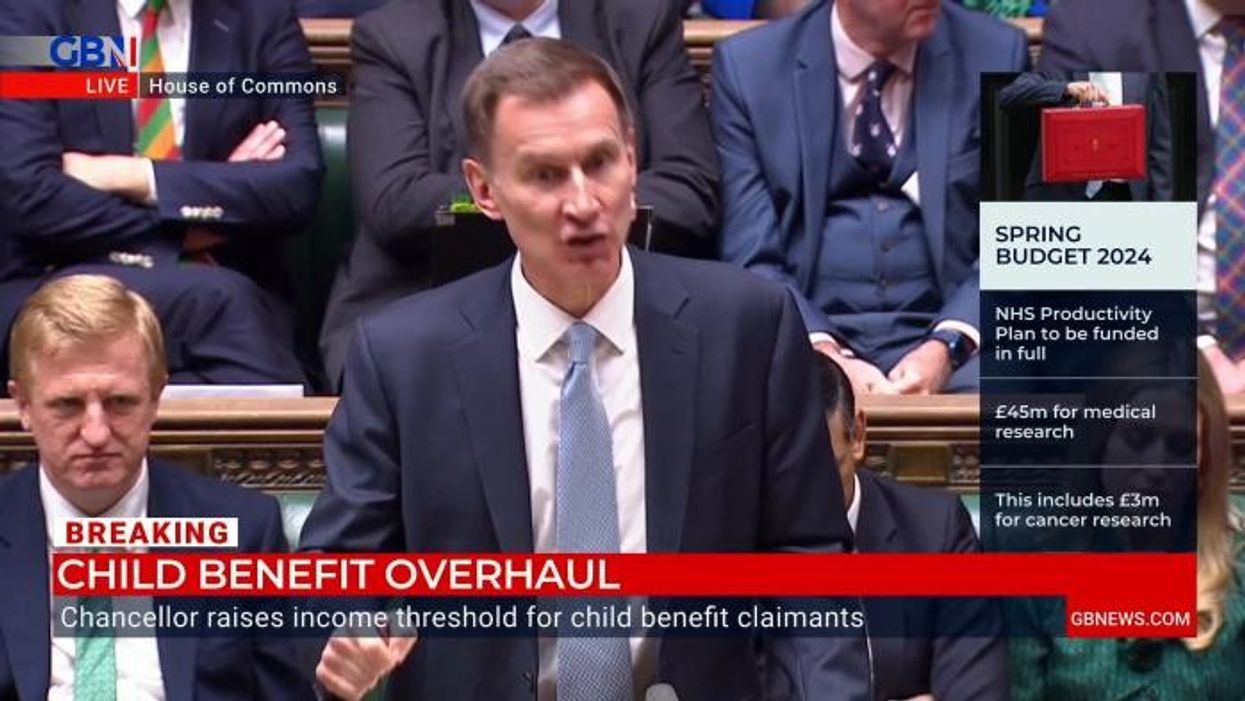

During the Spring Budget, Chancellor Jeremy Hunt confirmed the levy’s rate would be slashed to eight per cent for workers and six per cent for the self-employed.

Combined with the National Insurance cut implemented in January, a worker on the average salary is expected to save £900.

However, concerns have been raised over how the state pension will be paid for with experts questioning “where the money will come from”.

Britons need to have 35 years of National Insurance contributions under their belt to get their full benefit retirement, including the full new state pension.

While the levy does not fund the state pension fully, payments are partially financed from contributions and general taxation.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The state pension's funding model is being questioned following a series of tax cuts

|GETTY

As such, consecutive tax cuts have many worried what the state pension will look like in the years to come if a funding gap widens.

Steven Cameron, the pensions director at Aegon, called for “long-term clarity” to address the anxieties people have over funding.

He said: “While Government decisions on setting of National Insurance contribution rates may now be taken separately from increases to the state pension, there are still official reports on the position of the ‘NI fund’, showing NI contributions received against payments made year on year.

“The Treasury does have provisions to make special one-off payments from general taxation to prop up the fund.

“So even if National Insurance contributions are not specifically earmarked, with NI already substantially cut and the potential for it to be scrapped, we need longer term clarity from whoever is in power on where the money for state pensions will come from.”

Earlier this week, Hunt accused Shadow Chancellor Rachel Reeves of “scaremongering” after she echoed a similar question.

On social media Reeves asked whether the recently announced National Insurance cuts would be paid for by reductions in state pension pay outs.

In response, Hunt said: “The value of National Insurance contributions receipts do not determine the NHS budget or the value of pensions. Those decisions are taken entirely separately.”

LATEST DEVELOPMENTS:

Jeremy Hunt outlined the cuts to National Insurance in his Spring Budget

| PAThese concerns are compounded by the ongoing questions over the affordability of the triple lock, which is used to determine the annual payment rate hikes for the benefit.

State pensions are either raised by the rate of inflation, average earnings or 2.5 per cent; whichever is highest.

With inflation and wages having been relatively high in recent years, this has resulted in older Britons being awarded a sizable pay out from the Department for Work and Pensions (DWP).

Earlier this week, the Labour Party warned that the state pension could be at risk as a result of the Conservative Party's tax plan.