Savers could slash debt repayment costs by nearly £8,000 with high interest rate accounts

Interest rate increases have impacted both savers and borrowers but people could pay off any debts quicker thanks to high interest accounts

Don't Miss

Most Read

Households could save up to nearly £8,000 in debt repayments thanks to high interest savings accounts, according to a savings expert.

Britons are being encouraged to consider taking advantage of the recent increases to savings interest rates before banks and building societies reduce them.

Furthermore, savers are being reminded of how they can use said accounts to their advantage to tackle any debt they may have.

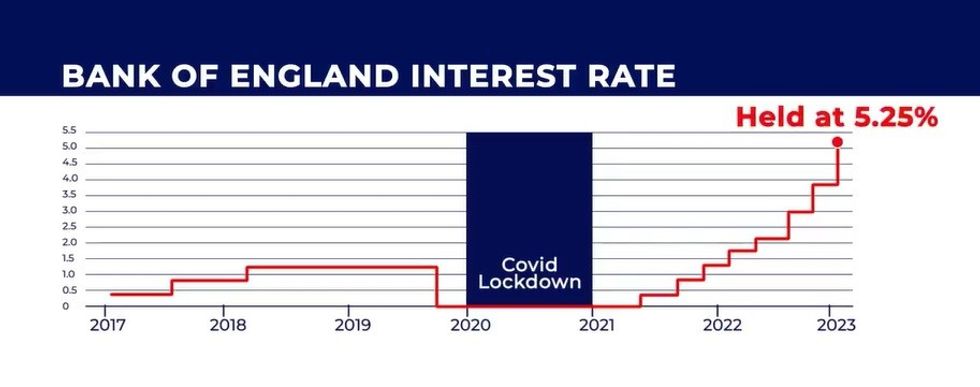

The Bank of England has raised the country’s base rate 14 consecutive times since December 2021 to 5.25 per cent to ease inflation.

Experts are sharing the best ways people can reduce their debt repayments

|GETTY

While this has been beneficial for savers, borrowers have been saddled with expensive repayments which take time to pay off.

Speaking to GB News, co-founder and co-CEO of Loqbox Tom Eyre suggested households should take into account the benefit of “putting the right money in the right places at the right time” because it could make your money go further.

The savings expert broke down how someone with a credit card balance worth £5,000 with a 24.9 per cent interest rate could pay off their debt with lower repayment costs and in less time.

According to Mr Eyre, if the minimum payment to the credit card is £100 a month, this amount would take 12 years and four months to pay off.

Furthermore, the credit card holder would have £9,757 in interest by the time the balance was finally paid.

Putting this money into a competitive savings account would mean the debt would be made more affordable, Mr Eyre said

He explained: “Now, if you'd saved that extra £100 per month instead, in a savings account paying a market leading 5.22 per cent AER, in two years and 11 months you'd have earned £238.04 in interest.

"Saving that money would have seen you earn £238.04 in interest in a savings account. Using it to pay off your highest cost debt would have saved you £7,954 in interest costs and about nine years of repayments.

LATEST DEVELOPMENTS:

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWS“This scenario doesn't even go into the benefit of different debt repayment tactics - merely the importance of considering when it is time to save, when it is time to invest and when it is time to do something else... like repaying debt."

According to The Money Charity, the average credit card debt per household in September 2023 came to £2,409.

Moneyfacts reports that the best notice savings accounts and fixed rate bonds are currently offering upwards of 5.30 per cent.

Recently, Paragon Bank warned that bank customers are missing out on around £6.9billion in savings interest.