Pension disaster as single retirees slapped with £225k retirement savings shortfall: 'Unfair!'

Pensioner lets rip at Labour in furious rant after winter fuel announcement: 'Appalling' |

GB NEWS

British pensioners are already facing an uncertain future with the recent means-testing of the Winter Fuel Payment and questions over the long-term viability of the state pension triple lock

Don't Miss

Most Read

Single retirees face a staggering £225,000 financial disadvantage compared to couples in retirement, according to new analysis from Standard Life.

The research reveals singles must save nearly double what each person in a couple needs to achieve the same standard of living in later life.

This significant gap emerges as couples can pool resources and share expenses, while single pensioners must shoulder all costs alone.

The findings highlight the substantial financial burden of solo retirement, with singles needing to amass considerably more savings to maintain equivalent lifestyles to their coupled counterparts.

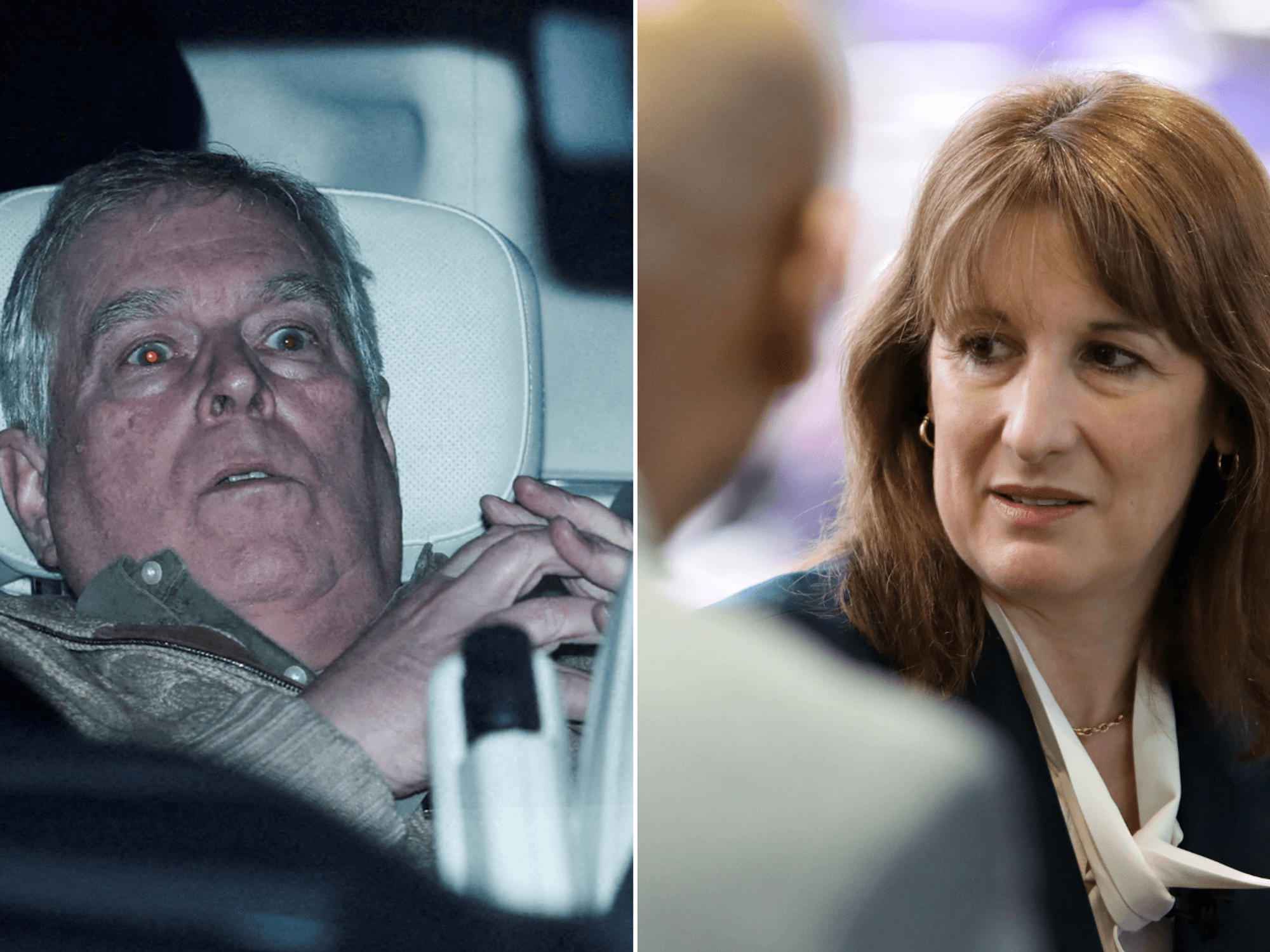

New research is shining a light on the specific struggles impacting certain groups of pensioners

|GETTY

Standard Life's analysis demonstrates how shared living costs create a substantial economic advantage for couples in retirement planning.

For a minimum living standard in retirement, single pensioners need an annual income of £14,400 after tax, according to the Pensions and Lifetime Savings Association.

With a full state pension of £11,973 annually, they require an additional £2,884 per year. This means singles need approximately £54,500 in retirement savings to purchase an RPI-linked annuity providing guaranteed lifetime income.

In stark contrast, pensioner couples need £22,400 annually for the same minimum standard. However, this amount would be fully covered by two state pensions, meaning couples need no additional savings to achieve this basic retirement lifestyle.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Single pensioners are expected to face a significant financial shortfall

| PEXELSThe disparity highlights how shared expenses benefit couples from the outset of retirement. The gap widens significantly for those seeking a moderate retirement lifestyle, which includes a car and an annual two-week foreign holiday.

Single pensioners need an after-tax income of £31,300 yearly, requiring savings of around £439,000 to supplement their state pension.

Couples need a combined income of £43,100 after tax for the same standard of living. This requires joint pension savings of £428,000, or £214,000 each – nearly half what a single person needs.

For a comfortable retirement with three-week foreign holidays and home improvements, singles need approximately £709,000 in savings.

Couples would need the same amount between them, meaning singles must save £311,000 more than each person in a couple.

Mike Ambery, Retirement Savings Director at Standard Life, said: "Whether single by choice or by circumstance, solo living comes with a financial price tag.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves has come under fire for her fiscal policies, especially the changes impacting pensioners

| POOL"While it seems unfair, mortgage, rent, utility bills and holidays costs don't simply halve for those living alone."

He added: "The same applies to pension savings. While couples can combine their resources, single retirees need to build up much more to achieve the same lifestyle in retirement." Ambery also highlighted that relationships don't always last.

"The importance of pension planning extends beyond just those who are single today. Awareness of these figures can help when considering pension sharing in divorce settlements or preparing for a potential single retirement.

"It's important to take control of your future financial happiness whether you're single or in a relationship," he said.

He advised that early preparation can make a substantial difference to retirement outcomes.

"Starting early, making regular contributions, and topping up savings where possible can make a real difference," Ambery noted.