Homeowners urged ‘to switch’ deal as mortgage rates plummet to lowest level since 2022

Mortgage rates have been falling in recent months

Don't Miss

Most Read

Homeowners are urged to consider “switching their mortgage if they can” after a fall in mortgage rates.

Following the Bank of England’s decision to freeze rates earlier this month, those on a standard variable rate (SVR) mortgage are being told to shop around for the best deal.

Rachel Springall, a finance expert at Moneyfacts, warned homeowners that the central bank is unlikely to slash the base rate over the next couple of months which will affect SVR customers.

She explained: “Borrowers who are sitting on their SVR should be incentivised to switch their mortgage if they can, as it’s unlikely they will see their repayments drop for the foreseeable.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Homeowners are being encouraged 'to switch' mortgage deals to save money

|GETTY

“Indeed, the average two- and five-year fixed rates are much lower than the average SVR. Seeking advice from an independent broker is wise to work out if an individual could save a decent sum on their monthly repayments by changing their mortgage deal.”

Mortgage rates on fixed rate deals have plummeted to their lowest level since 2022, according to the latest figures.

The average interest rates for two-year and five-year fixed mortgages fell for the sixth consecutive month, Moneyfacts reports.

Between the start of January and February 2021, the overall average two-and-five fixes dropped to 5.56 per cent and 5.18 per cent, respectively.

As it stands, the average two-year fixed rate is sitting 0.38 per cent higher than the average five-year counterpart.

The average Standard Variable Rate (SVR) also fell over the period, albeit slight, by 0.01 per cent to 8.17 per cent.

Notably, the average two-year tracker variable mortgage continued to sit at 6.15 per cent between January and February.

Despite this trend of interest rate cuts and holds, overall product choice dropped month-on-month for the first time since July 2023 to 5,787 options.

LATEST DEVELOPMENTS:

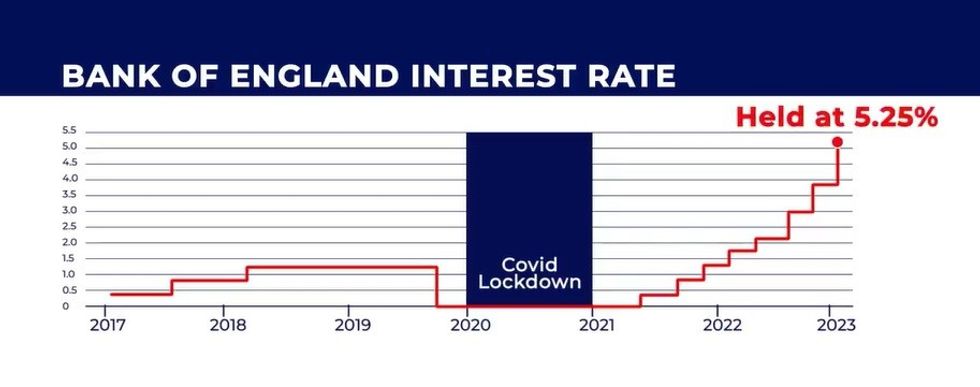

The Bank of England has held the base rate at 5.25 per cent since August 2023 | GB NEWS

The Bank of England has held the base rate at 5.25 per cent since August 2023 | GB NEWSHowever, the availability of the mortgage deals at the 95 per cent loan-to-value tier has risen to its highest level since September 2022.

Rachel Springall, a finance expert at Moneyfacts, reminded homeowners coming to an end of their fixed rate to take action in light of these rate reductions.

She explained: “Those borrowers who have waited patiently in recent months to re-finance, or indeed are preparing for when their mortgage deal expires, would be wise to review rates, as lenders are closely monitoring the volatile swap rate market, which tends to influence fixed rate pricing.

“There have been big expectations for fixed rates to fall further, and whether now is the right time to refinance will come down to an individual’s circumstances.”

The Bank of England’s Monetary Policy Committee (MPC) voted to hold the country’s base rate at 5.25 per cent again earlier this month, as the central bank strives to bring inflation down to its desired target.

The Bank of England’s Monetary Policy Committee (MPC) will next meet to discuss interest rates on March 21.