Mortgage payments to rise by £240 a month in 'devastating blow' for 1.1 million families

British public react to interest rates being kept at 5.25 per cent

|GB NEWS

Homeowners have been saddled with soaring interest rates in recent years which have pushed mortgage repayments up

Don't Miss

Most Read

Latest

More than one million households will see their mortgage repayments rise by £240 a month later this year in a “devastating blow” to families, according to new research.

Analysis commissioned by the Liberal Democrats is warning of the cost which will likely hit homeowners later this year ahead of the Bank of England’s decision whether to cut interest rates from 5.25 per cent today.

Some 1.1 million fixed term mortgage deals are set to come to an end between February and October, the analysis into Financial Conduct Authority (FCA) data found.

Of this group, around 700,000 fixed rate mortgages are set to expire between May and the end of October 2024.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgage repayments have skyrocketed for households

|GETTY

This will add further pressure to Prime Minster Rishi Sunak as he attempts to woo voters ahead of the General Election which he is rumoured to delay until November.

Based on the House of Commons Library research, a typical homeowner whose deal is coming to an end will witness their mortgage interest payments go up by £240 a month, a 39 per cent rise.

Around 120,000 homeowners will see their mortgage deals come to an end every month between now and November, which comes to more than 4,000 daily.

Other political parties have taken the Conservatives to task over the financial burden that has been placed on mortgage holders under their watch.

Yesterday, Sir Keir Starmer accused Mr Sunak of “laughing” at an Iceland worker who is struggling to make his repayments.

The Labour Party leader shared the story of Phil from Warrington in the House of Commons and said the Prime Minister “just doesn't get how hard it is for millions of people across the country like Phil”.

In response, Rishi Sunak confirmed that there was help in place for people coming out of fixed rate mortgage deals.

On the rise in mortgage rates, Liberal Democrat Treasury Spokesperson Sarah Olney MP said: “Every day thousands more homeowners are being hit with an astronomical rise to their monthly mortgage bills. This is a devastating blow to family finances in the middle of a cost of living crisis.

LATEST DEVELOPMENTS:

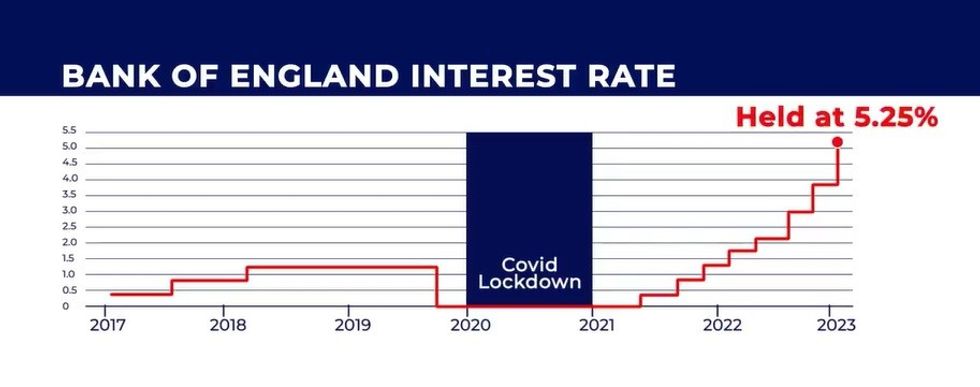

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWS“It is scandalous that families are being left to pick up the tab for Liz Truss crashing the economy. Rishi Sunak needs to help out those at risk of losing their homes over the Conservative Party’s economic vandalism.

“We need a General Election now to end this Conservative chaos. The sooner we put this Conservative government out of its misery the better for the economy, the country and the money in people’s pockets.”

Later today, the Bank of England’s Monetary Policy Committee (MPC) will announce whether the base rate will be cut.

While inflation has eased in recent months, the Consumer Price Index (CPI) rate jumped to four per cent in the 12 months to December 2023. As such, analysts are betting on the central bank to keep interest rates at 5.25 per cent for the foreseeable future.