Inheritance tax loophole announced in Budget could see thousands avoid 40% charge

Rachel Reeves defends inheritance tax rise

|GB News

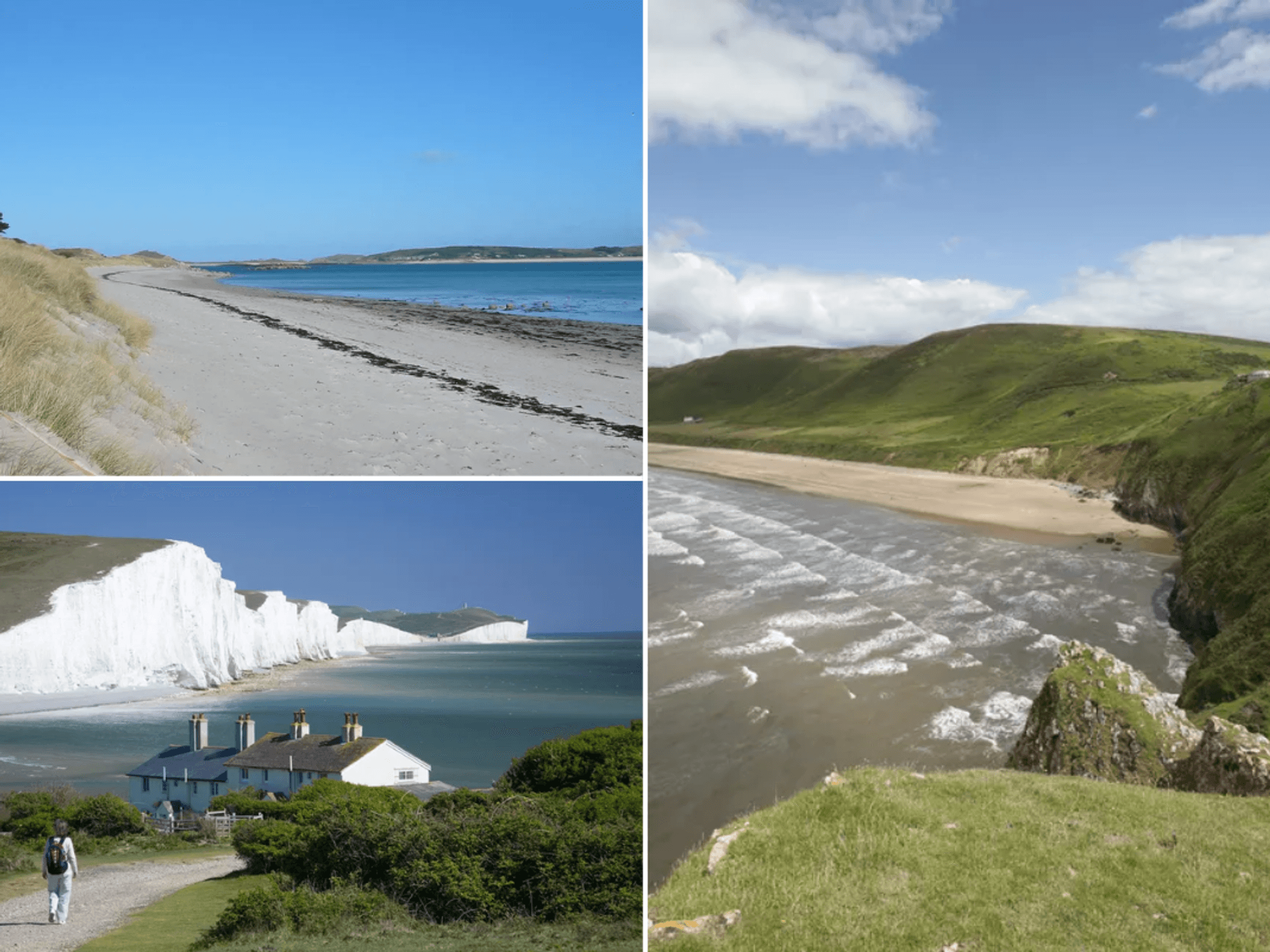

The Budget has left millions of UK residents questioning whether to make the move to retire abroad for tax advantages

Don't Miss

Most Read

Wealthy Britons retiring overseas could escape the 40 per cent inheritance tax thanks to a significant loophole created by Labour's new Budget.

The change means those who spend their retirement abroad will not have to pay inheritance tax on their foreign assets, as long as they live outside the UK for at least 10 years.

Present rules require anyone with a British 'domicile' to pay inheritance tax on their worldwide wealth, even if they spend their retirement and die in a foreign country. The new system, coming into force in April 2025, will replace domicile with residency status.

Tens of thousands of British expatriates already living abroad will immediately benefit from the changes when they take effect.

The new rules mark a significant shift from the current system, where domicile is based on where an individual considers their permanent home to be.

Under existing regulations, changing a UK-domiciled status by acquiring a 'domicile of choice' in another country is a complicated process.

Tens of thousands of British expatriates already living abroad will immediately benefit from the changes when they take effect

| GETTYAlexandra Britton-Davis, partner at accountancy firm Saffery, suggested it could influence retirement location choices between "the south of England or somewhere warmer where they don't have IHT."

Notable examples of those who could benefit include Virgin founder Richard Branson, who has lived on Necker Island in the British Virgin Islands for nearly 20 years.

However, experts have warned the changes could trigger an exodus of wealthy individuals from the UK.

Maxwell Marlow, of the Adam Smith Institute, cautioned: "The abolition of the non-dom regime will drive away highly mobile wealth creators and so their tax contribution will decrease and they will invest less in our economy."

The Office for Budget Responsibility predicts 12 per cent of non-doms who are ineligible for the new regime will leave the country – up from 10 per cent under Jeremy Hunt's previous plan.

Rachel Reeves changed her LinkedIn profile | GB News

Rachel Reeves changed her LinkedIn profile | GB News An HM Treasury spokesperson defended the changes and said: "Replacing the outdated non-dom tax regime with a new internationally competitive new residence-based system addresses unfairness in our tax system, attracts the best talent and investment to the UK."

The spokesperson added that the changes would ensure "everyone who is a long-term resident in the UK pays their taxes here."

The Treasury highlighted that the package of changes to the regime announced in the Autumn Budget is forecast to raise £12.7billion over the next five years.

This revenue will help fill a £22bn fiscal hole and support the rebuilding of public services.