Tax refunds for work expenses - HMRC

GBNEWS

Millions will be pushed into higher brackets as a result of thresholds being kept at the same level for decades

Don't Miss

Most Read

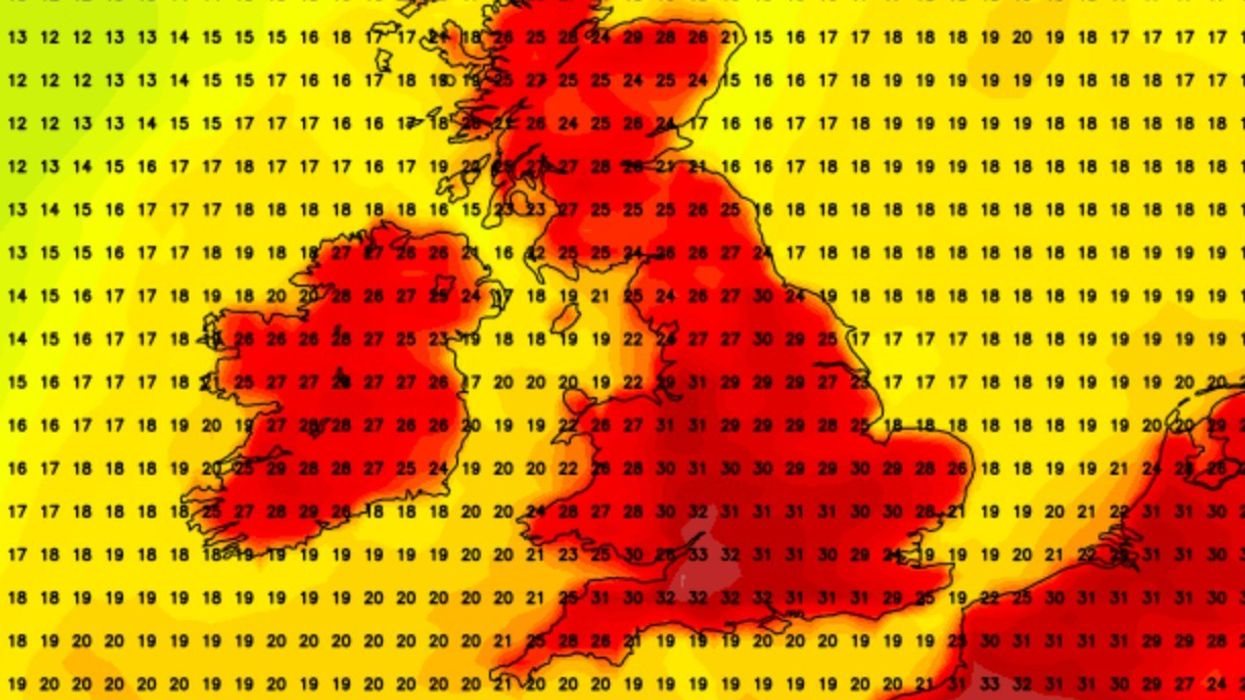

An additional 3.5 million taxpayers will be dragged into the 40 per cent tax bracket by 2029 as a result of frozen thresholds, according to the Office for Budget Responsibility.

A further 0.6 million will be brought into the additional-rate band of 45 per cent by 2028-29.

The changes to personal tax thresholds, which were frozen in 2022 and are set to expire in 2028-29, are expected to bring 4.2 million additional taxpayers into the income tax bracket altogether.

Millions of taxpayers are being pushed into higher brackets as thresholds have been kept at the same level for decades, creating what is known as fiscal drag.

Rachel Springall, finance expert at Moneyfacts, said: "The OBR has released its latest fiscal risks and sustainability report today. The fiscal drag is prevalent, and these latest statistics should be a stark warning for consumers.

"Savers are going to be in dismay of the fiscal drag, as any basic-rate taxpayer who moves up to the higher-rate tax bracket will see their personal savings allowance (PSA) halved, from £1,000 worth of savings interest tax-free each year to just £500."

In some cases, key tax allowances have been frozen since the early 1980s, meaning they have failed to keep pace with inflation for more than 40 years. The result is a growing stealth tax burden on everything from income to investments and inheritance.

Other thresholds have been reduced in recent years rather than simply froze

GETTYOne example of a tax threshold being kept high for decades is the inheritance tax gifting allowance, which dictates how much you can give away each tax year without it being added to the value of your estate.

It has been stuck at £3,000 since 1981, when Margaret Thatcher was the prime minister. Adjusted for inflation, it should now be worth £11,529 - nearly four times higher than its current level.

Other thresholds have been reduced in recent years rather than simply frozen. The capital gains tax exemption rose to £12,300 in 2020 but was slashed to £3,000 in April 2023, back to its 1981 level.

Similarly, the dividend allowance has fallen dramatically from £5,000 in 2016 to just £500 today. Had it tracked inflation, it would now be £6,876 - almost 14 times more, the investment service interactive investor found.

The effect is becoming more widespread as wage growth continues and inflation remains above target, currently sitting at 3.4 per cent in the UK. The higher-rate income tax threshold has been held at £50,270 since 2021.

If it had risen with inflation, it would now stand at £62,059, dragging thousands more earners into the 40 per cent tax band. Even the personal allowance, the amount people can earn tax-free, has been frozen at £12,570 and will remain unchanged until at least 2028.

It would now be worth £15,517 had it kept pace with prices. Springall added: "Savers need to take advantage of their ISA allowance and protect their hard-earned cash from tax."

The Government's policy of freezing thresholds is coming under increased scrutiny ahead of the Autumn Budget. Rachel Reeves has so far ruled out raising headline tax rates, but continuing the freeze could quietly deliver billions more to the exchequer.

Extending the deep freeze on tax thresholds beyond 2028 is a way for the Government to raise billions of pounds without technically breaking its manifesto promise not to raise taxes on working people.

The OBR has released its latest fiscal risks and sustainability report, with the fiscal drag prevalent throughout the tax system.

Craig Rickman, personal finance expert at ii, said fiscal drag is "a sneaky tactic" to raise the tax burden over time, as it freezes tax thresholds so that people pay more of their income as wages rise with inflation.

He said: "While it’s not as obvious as raising tax rates directly, it could have a bigger impact over long periods, particularly when you see the length of time that some of these rates have been frozen."