‘I fell into debt after my salary plummeted overnight… but now I’m a homeowner'

Britons are struggling to navigate their debt issues due the recent hike to interest rates but some are revealing how they have been able to get on top of their finances

Don't Miss

Most Read

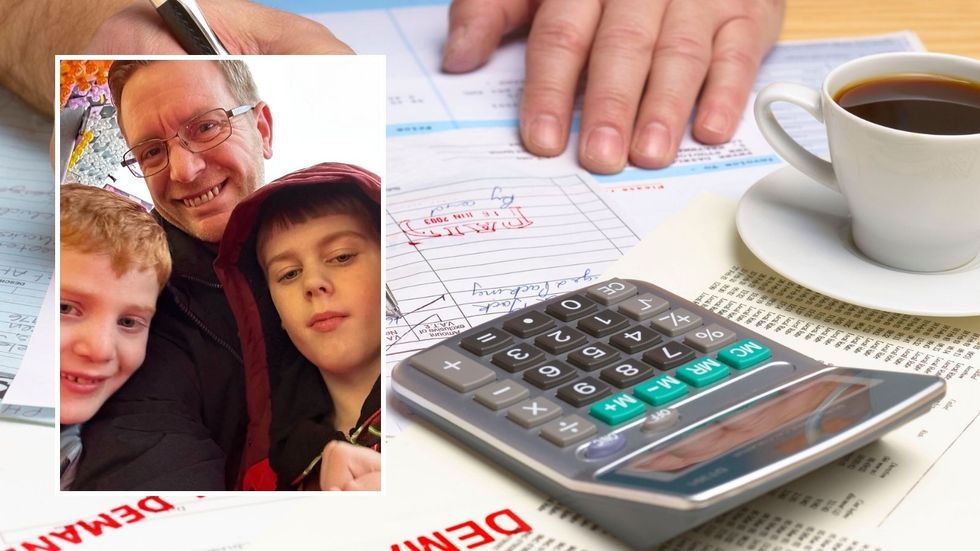

A father of two fell into £6,000 of debt after his salary fell “overnight” during the Covid pandemic.

Derrick Gough, 45, from Swindon, has since managed to repay the debt and get onto the property ladder, and spoke to GB News about the ongoing struggle millions face in navigating high interest rates, low credits scores and pulling themselves out of debt.

Prior to the pandemic, the dad-of-two was moving house and had to borrow to pay for the cost of settling in.

Mr Gough said: “Me and my ex split up in December of 2019. I have two autistic boys, and I made a decision when I moved into my new place four weeks before lockdown, to start afresh.

“Unfurnished place, three bed house. I had to get everything for it. That way they had something at home where they felt normal, stable.

“I maxed out my credit card, took out a PayPal loan and got a very thorough washing machine/combi dryer on buy now, pay later.”

Do you have a debt story you’d like to share? Get in touch by emailing money@gbnews.uk.

Derrick is one of the millions who have struggled with debt issues following the pandemic

|GETTY/LOQBOX

At the time, the 45-year-old’s basic wage was covering all his bills and utilities, which he knew could pay everything with. As well at this, he constantly hit the criteria for his work’s bonus package.

However, Mr Gough’s world turned upside down when the coronavirus lockdown was announced in 2020.

His income was slashed due to the ramifications of the pandemic and he was saddled with credit debt he was unable to pay.

His credit score took a hit which had consequences when he and his fiancé tried to get a mortgage years later.

“I had a significant reduction in wages. I was left with about £100 disposable income a month,” Mr Gough added. “To begin with, I almost buried my head for a bit because I couldn't afford my bills.

“I called my creditors. I'm lucky enough that I kept up with all my bills except those credit ones and I said to them, ‘I can't pay you’. It's that simple.

“I didn't think about my credit score too much, because credit scores aren't things people look into until they need to.

“I was definitely one of those people, and I've learned some really hard lessons for my benefit now.”

When Mr Gough and his fiancée were preparing to get a mortgage together in 2022, he realised how bad his credit score had got and the state of debt he was in.

He explained: “I was gutted, gobsmacked, hurt, because I had defaults on my account. They're painful.

“Now it's only taken me up until four months ago to have a good credit score and how long it takes to recover that score. When you've got a bad score, credit is a fact of life, unfortunately.”

To get out of debt, Mr Gough took out a high interest card to build up credit but he described the rates as “disgusting”.

LATEST DEVELOPMENTS:

According to Mr Eyre, Derrick's story is indicative of the issues many people face

|LOQBOX

The dad noted that those with lower credit scores are penalised for circumstances out with their control and labelled “high risk”.

He says he was able to pull himself out of debt by taking initiative and researching the best method of doing so with Google “leading him in the right direction”.

Thanks to services such as Loqbox, Mr Gough was able to find out how to log his rent onto his credit score to boost it. He said: “It’s a win win. I do believe there's no quick answer to things. I quite often refer to my credit score as in to how to lose weight.

“A long time ago, I was ten stone heavier than what I was, and it was a five-year slog to repair. My credit score has been a four-year slog. It's very easy to get bad results.”

On Mr Gough’s situation, co-CEO of Loqbox Tom Eyre said: “I think Derek's story is a wonderful one. Credit scores are so hard to rebuild.

“What Derek did is focused on solving his debt issues now. There are a number of online resources you can go to. There are debt advice charities out there that offer and guidance for free.

“Something really interesting about the charities is a relatively small percentage of the people who phone them for advice and guidance end up going into some sort of formal debt solution.

“Actually, it's about reassurance. It's about understanding. It's about help with budgeting. It's about help with understanding the options and income and stuff that they're out there.”