Deliveroo agrees £2.9bn sale to US rival DoorDash

Deliveroo boss has agreed to sell his stake and will stay on to help with the transition

Don't Miss

Most Read

US delivery giant DoorDash is buying Deliveroo in a £2.9bn takeover that will see the British firm leave the London Stock Exchange.

The deal values Deliveroo shares at 180p each, which is 44 per cent more than they were worth before talks started.

Deliveroo's board has backed the £2.9 billion offer and the sale is expected to go through later this year if shareholders and regulators give it the green light.

San Francisco-based DoorDash, already the largest food delivery platform in the US, is offering 180p per share in cash to acquire the London-listed company.

The deal will create a global player operating in more than 40 countries and handling around $90 billion (£67.7 billion) in orders annually.

The firms said: "The combination with Deliveroo will strengthen DoorDash’s position as a leading global platform in local commerce, enabling the combined entity to better serve businesses, consumers and couriers."

Deliveroo hands over reins to DoorDash in £2.9 billion deal

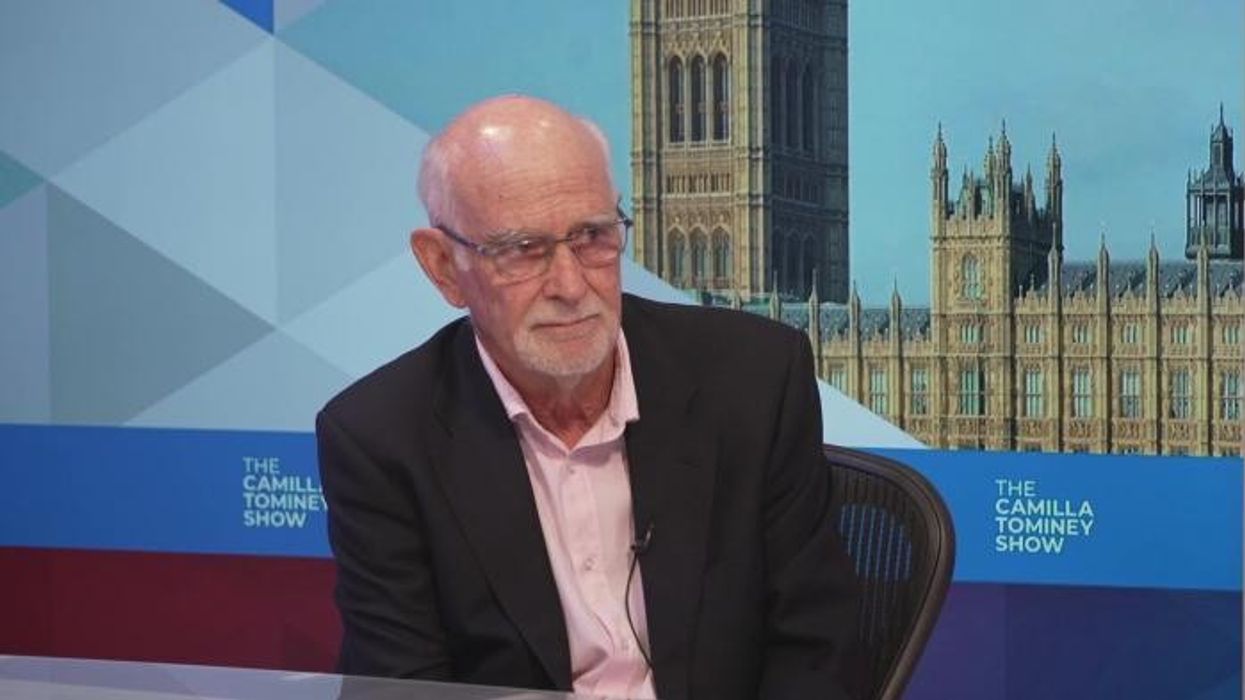

| PAWill Shu, Founder and CEO, who started the business in 2013, has agreed to sell his stake and will stay on to help with the transition.

Deliveroo staff could pocket around £65 million if the sale to DoorDash goes ahead. Current and former employees are believed to hold roughly 36 million shares in the company, which DoorDash has offered to buy at 180p each.

Shu stands to gain even more. Based on his six per cent stake, he could receive over £170 million. On top of that, he holds around 15 million restricted stock units, which could add tens of millions more to his payout depending on how the deal is structured.

Deliveroo floated on the stock market in 2021 but has had a tough ride since. Its shares have mostly stayed below their listing price, and it’s faced stiff competition from Uber Eats and Just Eat.

Still, it recently returned to profit and expanded into grocery and retail delivery. For DoorDash, this is a big move into global markets at a time when the food delivery industry is trying to stay profitable after the pandemic boom cooled off.

If approved, the deal is expected to close by the end of 2025

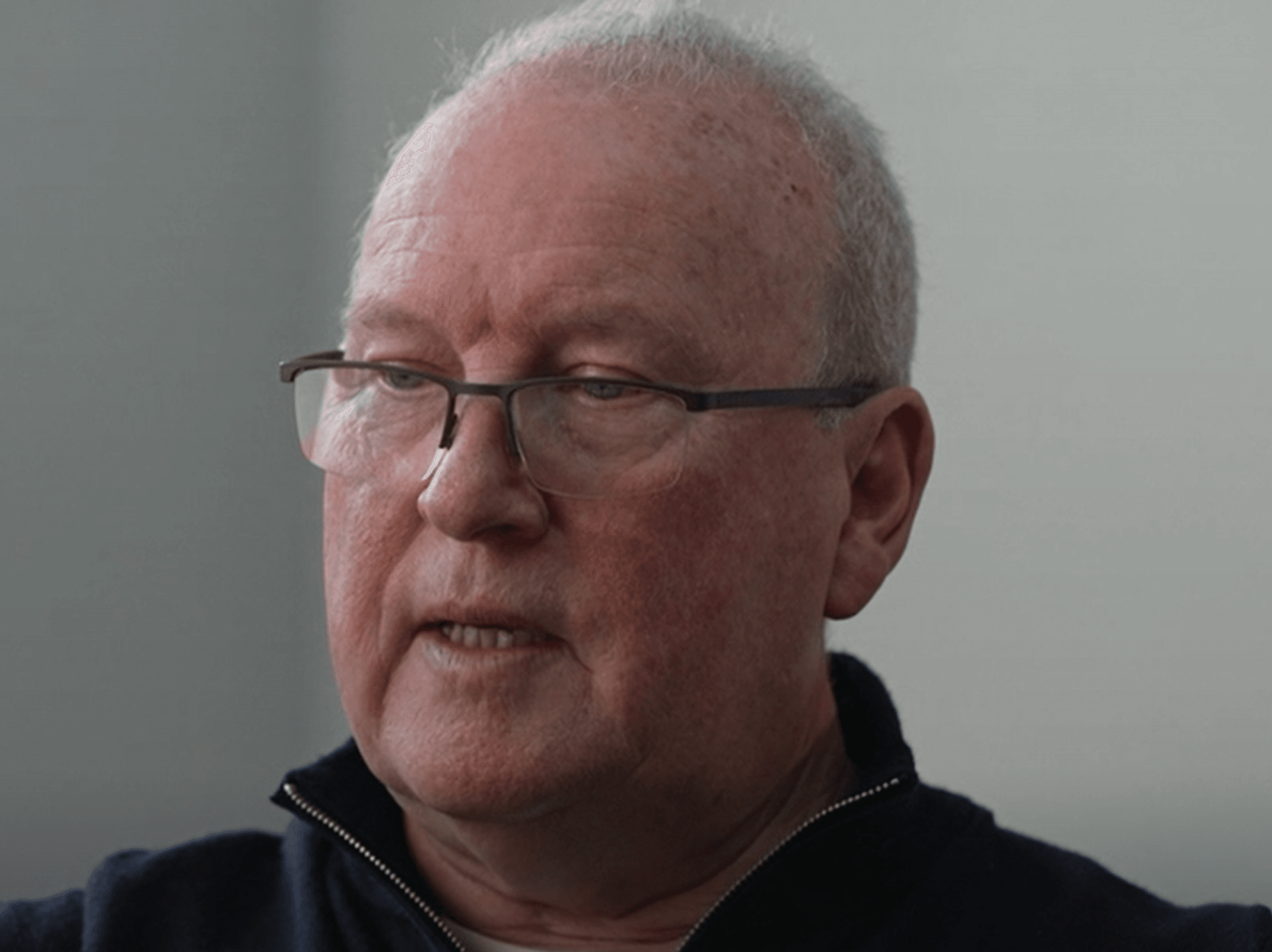

| GETTYThe company says the takeover will improve services for customers, businesses and delivery riders by combining each platform’s strengths. If approved, the deal is expected to complete by the end of 2025.

For DoorDash, the acquisition is a chance to expand globally. While Deliveroo operates in nine countries including the UK, France and Italy, DoorDash has a stronger presence in markets like the US, Canada and Australia.

With little geographic overlap, the two firms see the merger as a way to grow without stepping on each other's toes — allowing them to scale up efficiently across new regions.

Deliveroo shares have mostly stayed below their listing price, and it’s faced stiff competition from Uber Eats and Just Eat

| GETTYThe acquisition will be carried out through a court-approved process under UK company law and is expected to be completed by the end of 2025, provided regulators and shareholders give it the green light.

This is one of the latest examples of a UK tech company being snapped up by a foreign buyer, and it raises fresh questions about the long-term appeal of listing in London.

For Deliveroo customers, no immediate changes are expected, but over time the app may start to look more like DoorDash’s, especially when it comes to features and partnerships.