Car tax changes to hammer millions of drivers within months in 'further headache' for Britons

The former Chancellor said that a fairer system of vehicle taxation was needed

Don't Miss

Most Read

Electric vehicle owners are set to be hit by expensive costs over the coming year with major new car tax changes set to launch.

New research has found that 54 per cent of electric vehicle drivers purchased their car to save money and reduce their overall running and motoring costs.

Just over a quarter of motorists said they purchased their vehicle because of local charges, and 17 per cent bought theirs because of an incentive like a Government grant.

A further 42 per cent were unaware that any changes would be made to key incentives coming to an end in 2025, including Vehicle Excise Duty (VED).

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

EV owners will face car tax charges starting in April 2025

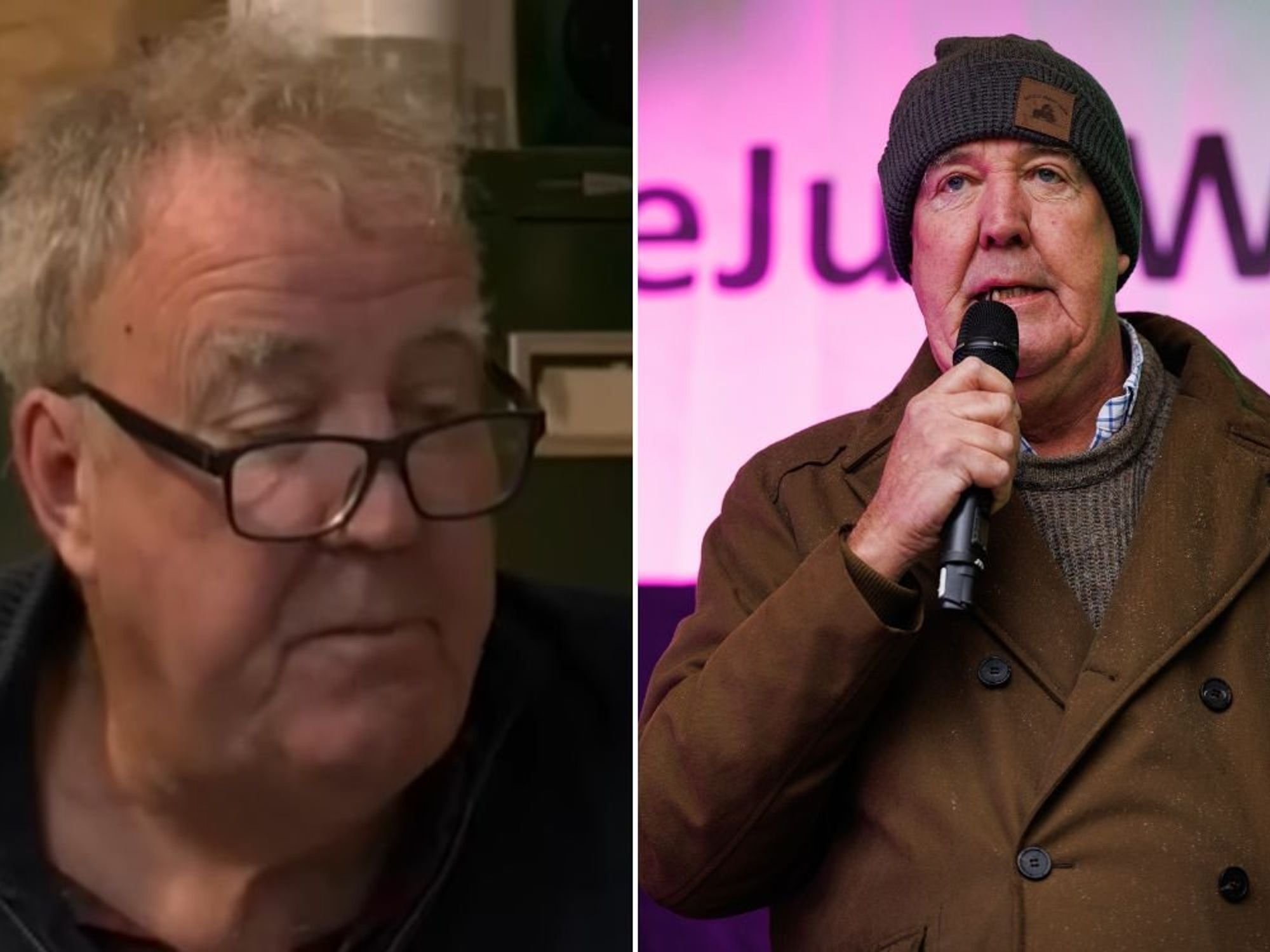

| GETTYFrom April 2025, electric vehicles will be forced to pay car tax following former Chancellor Jeremy Hunt's goal to create a fairer system of taxation for all motorists.

EV owners will be required to pay the lowest amount of car tax starting in the new financial year, with further announcements expected in the October or March Budgets.

Currently, vehicles that are registered on or after April 1, 2017, will need to pay £10 if they release between one and 50g of CO2 per kilometre.

From the second tax payment onwards, the vehicles will also have to pay the standard rate, which is £190 for vehicles registered between April 1, 2017, and March 31, 2025.

These car tax bands will soon apply to electric cars and other zero emission vehicles, although the Government warns that these prices are still likely to change, likely in line with inflation.

They will also be required to pay the Expensive Car Supplement, which is attributed to any vehicle that has a list price of more than £40,000 and will apply to those registered on or after April 1, 2025.

Data also found that one-third of EV owners were not aware of any changes to car tax, with 33 per cent of those claiming that they would not have purchased the vehicle if they were aware of the charges.

Around one in four said they were not previously aware of any changes to the Expensive Car Supplement. More than 25 per cent of those said they would not have switched if they had prior knowledge.

Lisa Watson, director of sales at Close Brothers Motor Finance, said: "Changes to electric vehicle exemptions set to come into force in 2025 makes for negative reading for both current and prospective owners."

She highlighted how the Zero Emission Vehicle mandate - which requires 22 per cent of new cars manufactured this year to be electric - was "proving a challenge".

Watson continued, saying: "The removal of available incentives could further dampen demand, which could cause further headaches for manufacturers.

"Many will feel the impacts of the changes; for example, the average price of a new EV is significantly higher than the Expensive Car Supplement Threshold.

LATEST DEVELOPMENTS:

EVs with a list price of more than £40,000 will face the Expensive Car Supplement

| PA"The cost-of-living crisis, coupled with the fact that a majority of EV owners purchased their car to reduce costs, means the upcoming changes leave less reason for motorists to consider making the switch."

There have been calls from experts and drivers for the Government to make further interventions to ensure drivers are not left behind when looking to invest in more sustainable forms of transport.