Virgin Money launches 'competitive' savings account with 6.5% interest rate in boon for savers

Savers urged to be careful of tax on savings interest |

GB NEWS

The Bank of England may be slashing interest rates but certain banks are still offering competitive savings accounts

Don't Miss

Most Read

Latest

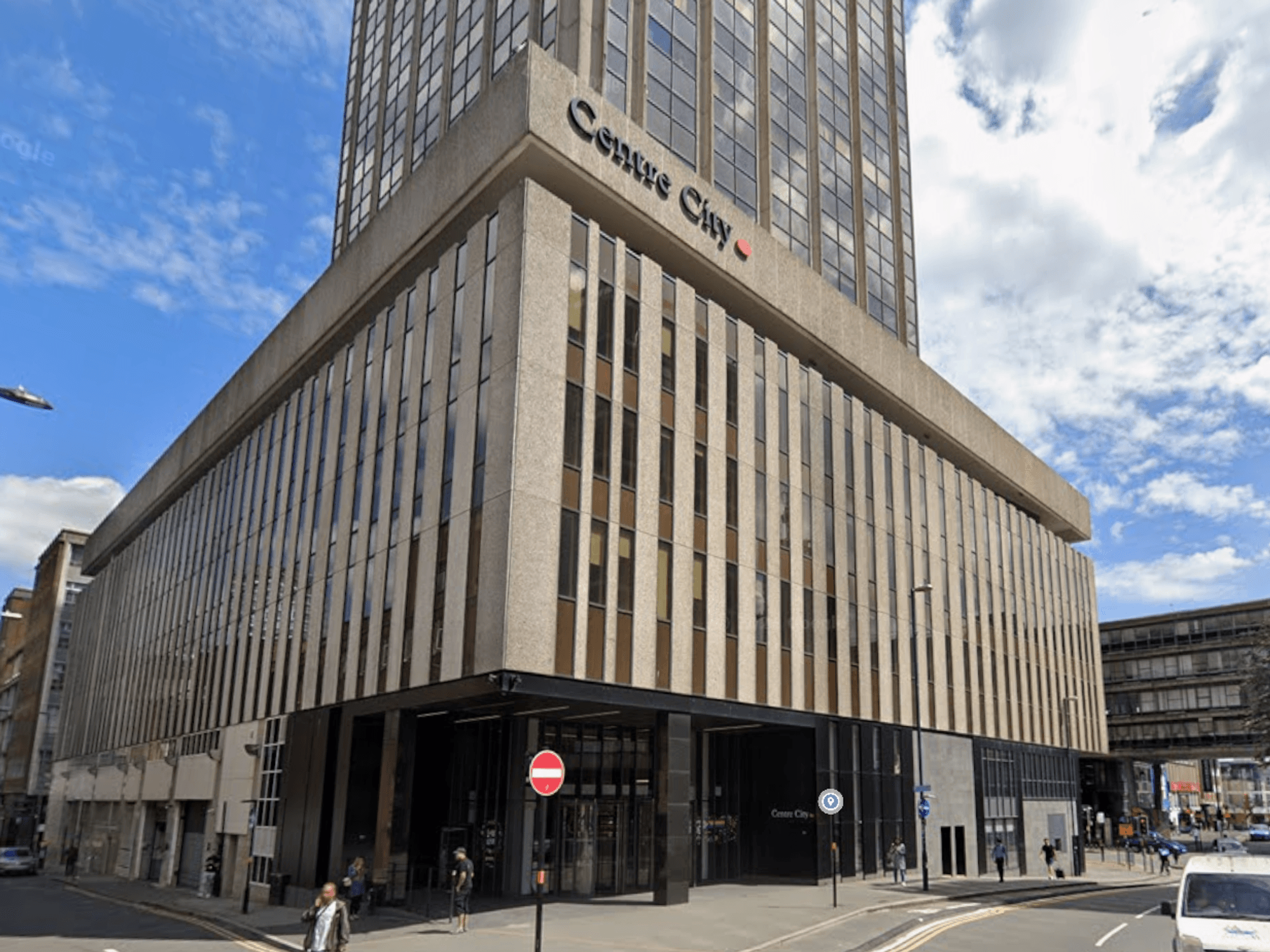

Virgin Money has launched a new Regular Saver Exclusive Issue 2, offering customers a fixed rate of 6.50 per cent until May 29, 2026.

The account is available to existing personal current account customers and new customers who open an eligible account with the bank.

According to the bank, the product aims to help customers establish regular savings habits by encouraging them to save small amounts consistently.

The competitive interest rate comes at a time when savers are looking to maximise returns on their money in the wake of recent decisions from the Bank of England.

Virgin Money is offering a savings account with a competitive interest rate

|PA / GETTY

The Regular Saver Exclusive Issue 2 allows customers to deposit up to £250 every calendar month throughout the product term.

There is no minimum monthly deposit requirement attached to the account, and customers are not obligated to make payments every month.

However, if a customer skips a month or deposits less than the maximum amount, they cannot make up for it in subsequent months.

The latest account from Virgin Money offers flexibility for those with short-term savings goals or who may need access to their money.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Andrew Carter, the head of personal banking at Virgin Money, outlined why new and existing customers should consider the bank's latest offering.

Carter explained: "Our new Regular Saver Exclusive is designed for people who want to build good savings habits by growing their savings little and often all while benefiting from a competitive fixed interest rate.

"It's a simple, flexible way for customers to boost their balance while staying in control of their budgets."

The account is positioned as an attractive option for those with surplus cash each month who want to establish consistent saving patterns.

The Office for Budget Responsibility (OBR) forecasts inflation could peak at 3.7 per cent later this year before declining once again.

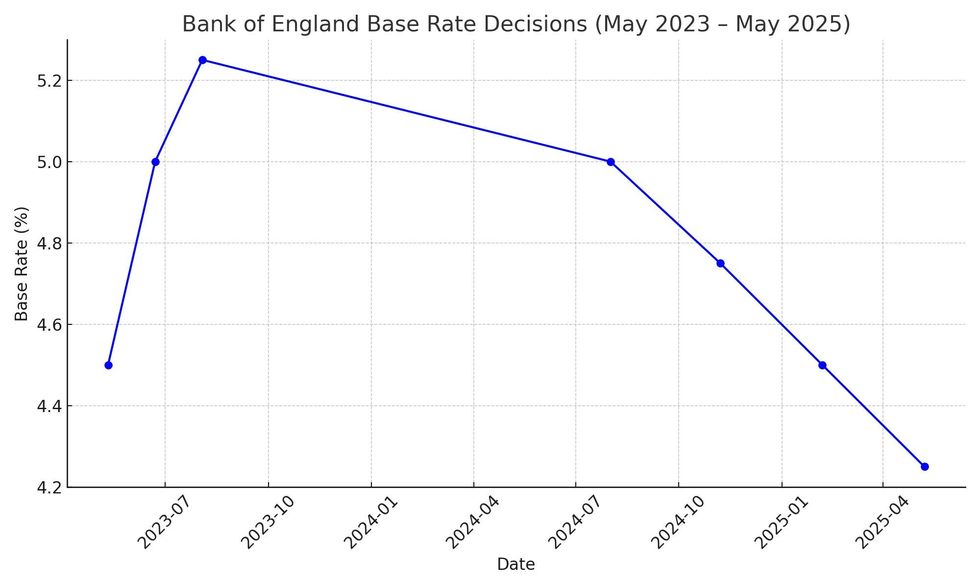

Despite these inflationary pressures, the Bank of England has prioritise economic support with a series interest rate cuts, slashing the base rate to 4.25 per cent yesterday (May 8).

LATEST DEVELOPMENTS:

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT Kevin Mountford, the co-founder of Raisin UK, notes: "A 25 basis point cut would be welcome news for borrowers and could help businesses offset the recent rise in National Insurance costs.

"For savers, however, a falling base rate typically spells bad news. That said, the UK savings market remains highly competitive.

"While we can expect the most attractive offers to start edging down, there are still solid rates available, with one-year fixed accounts hovering around 4.5 per cent. If you’ve been holding out, now is the time to act.”

As such, analysts cite that Virgin Money's fixed 6.50 per cent rate particularly attractive in a potentially declining interest rate environment.