Bank of England cuts interest rates to 4.25%: What does it mean for your pension, savings and mortgage?

Interest rates cut: Recession warning as top economist says Bank of England move falls short - ‘I would have welcomed more’ |

GB NEWS

The base rate cut will impact savings and mortgage deals offered by banks and building societies

Don't Miss

Most Read

The Bank of England has made another dramatic change to UK interest rats but what does this mean for your pensions, savings and mortgage?

Earlier today, the central bank's Monetary Policy Committee (MPC) voted with a slim majority of five-to-four to slash the base rate from 4.5 per cent to

The base rate sets the cost of borrowing in the UK, impacting how much people will pay towards paying off any debt and mortgages.

Due to a period of high inflation following the Covid-19 pandemic, the Bank has raised interest rates in a blow to borrowers but is now taking action to reverse its decision-making.

What does the Bank of England's latest decision mean for you?

| GETTYWhat does the Bank of England rate cut mean for savings?

Savers are expected to take a hit with the central bank's move to bring the base rate down to 4.25 per cent as banks and building societies are less likely to offer competitive savings account deals.

Analysts are warning the 40 million Britons who hold some form of savings product to prepare for "diminishing returns" in the months ahead.

Andrew Harrison-Chinn, the CMO of DragonPass, said: "With interests rates cut by 25 base points and several more reductions predicted this year, it's clear that banks can no longer rely on savings rates alone as a primary driver for customer loyalty.

"Nearly 40 million Brits holding savings accounts will see diminishing returns on their funds, meaning retail banks must now shift their focus to experience-led value, rewarding customers not just for saving or spending, but for staying."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons have been saddled with hiked mortgage costs | GETTY

Britons have been saddled with hiked mortgage costs | GETTY What does the Bank of England rate cut mean for mortgages?

Those planning to remortgage or get on the property ladder in the near future are likely to benefit from the MPC's base rate vote.

Lenders, including Nationwide Building Society, are already slashing rates linked to mortgage products in the wake of the decision.

Some 937,433 homeowners are coming off two-year fixed rate mortgages in 2025, according to Compare the Market, with an average interest rate of 5.06 per cent.

Jonathan Handford, the managing director at national estate agent group Fine & Country, shared: "For homeowners and buyers, this is welcome news.

"Mortgage rates had already started to come down in anticipation, and today’s decision could lead to even better deals, especially on fixed-rate products. That’s good news for first-time buyers and anyone looking to move, at a time when affordability is still a major hurdle.

"The cut also comes during what’s usually a busy time for the housing market. With spring activity already picking up, lower borrowing costs could give the market an extra push, helping more people take the leap."

LATEST DEVELOPMENTS:

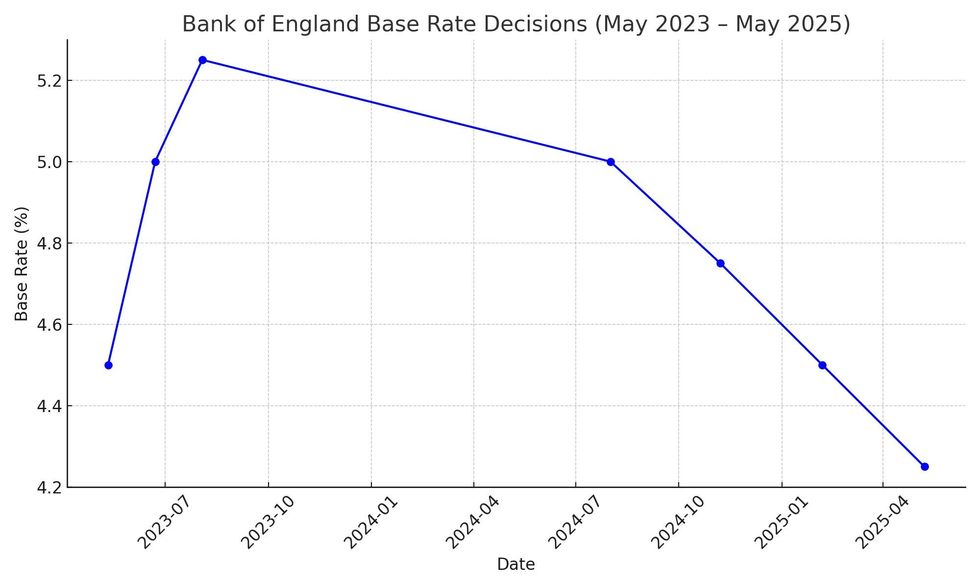

Full list of base rate changes from the Bank of England over the last two years

|CHAT GPT

What does the Bank of England interest rate cut mean for pensions?

Pension savers are being urged to be vigilant in navigating a volatile market despite the Bank's rate reduction, as inflation continues to be a concern for the MPC.

Lily Megson, the policy director for My Pension Expert, explained: "Factoring in continued economic challenges, the market could yet remain unpredictable. It’s key that savers stay proactive, not passive.

“This is a good opportunity for savers to revisit their financial strategy, check whether your savings are still delivering value, and seek independent financial advice if unsure.

"Staying engaged and informed will be the best defence against market noise and short-term disruption when putting together a long-term financial plan."