ISA alert: Provider launches 'enticing' 8.5 per cent interest rate deal - but it's only for a limited time

The boosted rate is only available for a limited time - with a key deadline fast approaching for new and eligible customer

Don't Miss

Most Read

Latest

As savings rates begin to shift again, one investment platform has thrown down a bold challenge to the rest of the market.

A new deal has landed, offering a rate far above the current Bank of England base rate but with strings attached.

Investing and trading platform IG is offering a temporary interest rate of 8.5 per cent AER (annual equivalent rate) on cash balances held in certain investment accounts.

That’s exactly twice the Bank of England’s base rate, which was cut this week from 4.5 to 4.25 per cent.

The boosted rate is available to anyone who opens a stocks and shares ISA, SIPP (self-invested personal pension), or a general investment account (GIA) and makes an initial investment before May 31.

Once that first investment is made, any extra cash deposited into the account, but left uninvested, will earn 8.5 per cent interest until August 31.

Britons use ISAs to save any earned interest from the tax man | GETTY

Britons use ISAs to save any earned interest from the tax man | GETTY The offer is also open to existing IG customers who haven’t yet placed their first trade, provided they do so by the same May deadline.

The high rate only applies to uninvested cash balances up to £100,000 and is conditional on the investor keeping their position open until the end of August. After that, the rate will revert to IG’s standard 4.25 per cent.

Michael Healy, UK managing director at IG, said: "Many investors are sitting on the sidelines right now as they wait for market clarity – this offer gives them a place to park their money and still earn a serious return."

While the headline rate is eye-catching, financial experts have urged savers to read the fine print before diving in.

LATEST DEVELOPMENTS:

financial experts have urged savers to read the fine print before diving in.

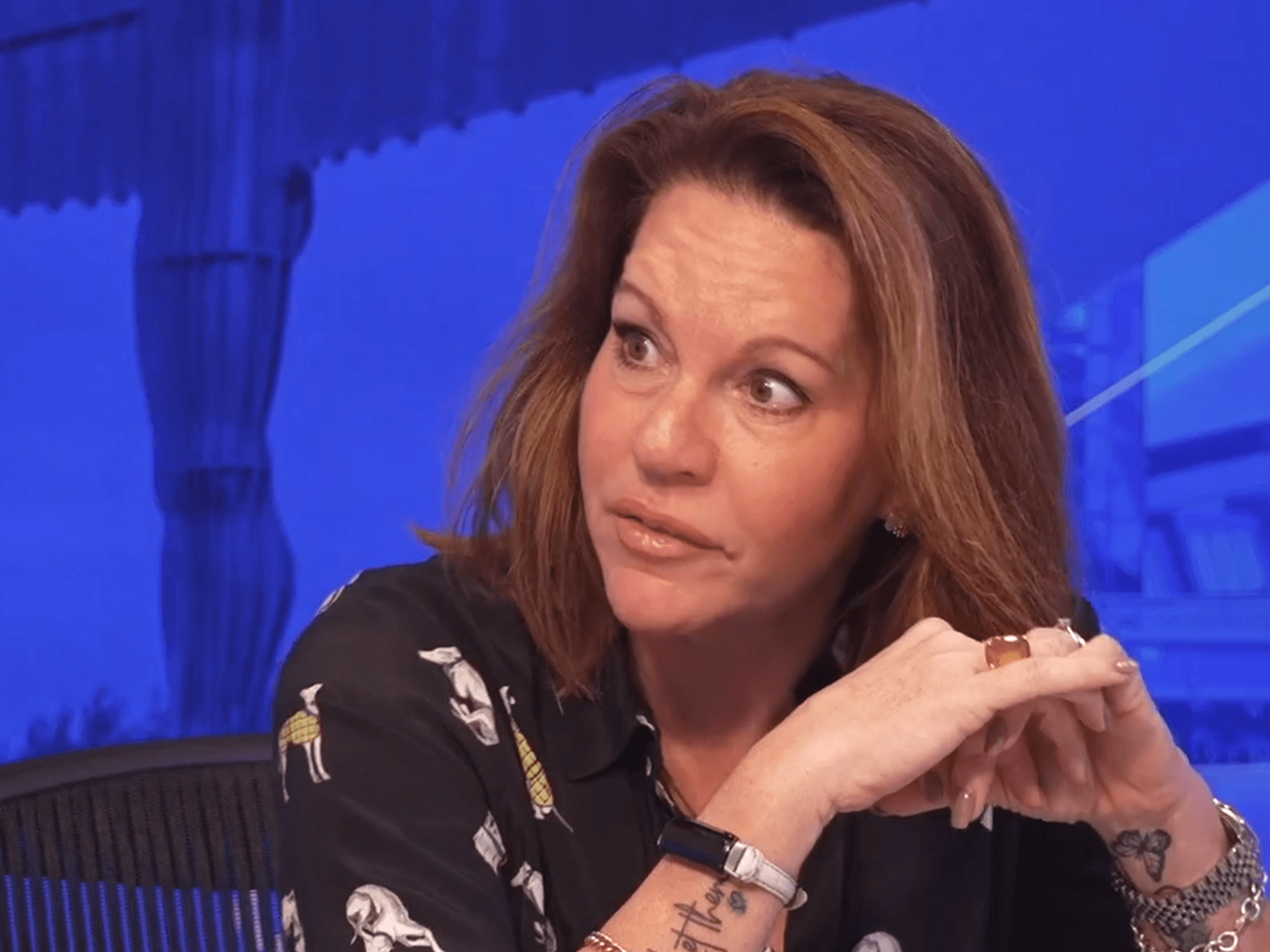

| GETTYRachel Springall, finance expert at Moneyfactscompare.co.uk, said: "The high interest rate looks enticing, and it is positive to see appetite to draw in savers who are looking to make their money work harder for them. However, it is essential savers carefully check the terms and conditions of the account before they invest."

She added: "Savers need to understand that the interest rate is applied to money sitting in a specific type of account, which should entice investors who are waiting for the market storm to calm.

"Offering a high interest rate is a great way to entice the more risk-averse saver, and it gives them an opportunity to consider the longer-term benefits of investing in the stock market once they feel comfortable to do so.

"In the meantime, they can earn an attractive rate on their hard-earned cash, but they need to make sure they review it once the offer expires. Investing puts any capital at risk, so this option will not be suitable for every saver."

Savers are losing money to low interest accounts | GETTY

Savers are losing money to low interest accounts | GETTYIG does not offer a traditional cash savings account, so the rate applies solely to uninvested cash held in investment accounts. The move comes as volatility in the markets continues, partly driven by global political tensions and uncertainty over US tariffs.

In a separate development, West Brom Building Society has increased the rate on its Four Access Saver account from 4.40 to 4.65 per cent AER (variable).

The rate applies to both new and existing customers holding issue one or two of the account. Applications can be made online, and savers can make up to four withdrawals per year.

Sophie Dwyer, product manager at West Brom, said: "As a mutual, our customers are at the heart of everything we do."