Rachel Reeves could rake in £8.8bn from 'double tax hit' on savers, Coventry Building Society warns

Savers urged to be careful of tax on savings interest |

GB NEWS

The building society is breaking down the consequences of certain tax polcies for savings account customers

Don't Miss

Most Read

Latest

Coventry Building Society has warned that the Treasury could receive a multi-billion-pound windfall from frozen income tax thresholds and potential cuts to ISA allowances, with UK taxpayers set to pay an additional £8.8billion next year alone.

The building society's analysis of Office for Budget Responsibility (OBR) figures reveals the significant cost to savers as more people are pushed into higher tax brackets by fiscal drag.

The tax warning comes amid speculation that Chancellor Rachel Reeves may announce changes to the annual cash ISA limit, which currently stands at £20,000.

Reports is understood to have been considering lowering the limit to as low as £4,000 or £5,000, forcing savers to either invest in riskier products or face increased tax bills on their cash savings.

Coventry Building Society has issued a warning about tax on savings

| COVENTRY BUILDING SOCIETYThe changes would particularly affect the 500,000 people expected to move from basic to higher-rate tax next year, who would see their Personal Savings Allowance cut from £1,000 to £500.

Jeremy Cox, the head of Strategy at Coventry Building Society, said: "Savers are facing a double hit. First, frozen tax thresholds are quietly dragging millions into higher tax brackets.

"Now, the potential cut to the cash ISA limit risks punishing those who simply do the right thing by putting money aside."

"For many - especially the half a million people expected to move into higher-rate tax next year - the blow will be even harder. With their Personal Savings Allowance slashed in half, they'll either pay more tax on their savings or be pushed toward riskier investments they may not fully understand."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

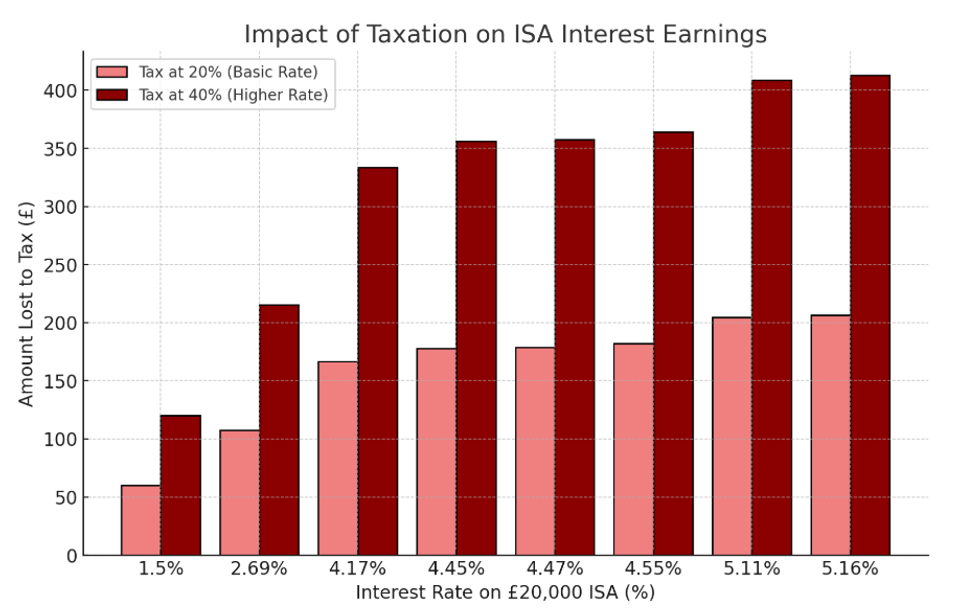

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBN

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBNCox warned that interest earned outside an ISA counts towards total income, meaning even modest savings can push people into a higher tax bracket without them realising.

"The Treasury may gain billions from these changes, but it's responsible savers who'll end up footing the bill through higher taxes on their hard-earned money," he said.

The savings exepert provided an example of how savers could inadvertently be pushed into higher tax brackets: "A basic-rate taxpayer earning £50,000 who receives £1,000 in interest from non-ISA savings would tip over into the higher-rate bracket.

"This shift halves their Personal Savings Allowance, meaning the remaining £500 of interest is taxed at 40 per cent, costing them £200."

He noted that while ISAs offer the best solution to shelter savings from tax, a reduced cash ISA limit would make this protection harder to access.

However, reports suggest that the Chancellor is putting her ISA reform plans on hold, with no immediate changes expected to be announced at next week's Mansion House speech.

LATEST DEVELOPMENTS:

Rachel Reeves will announce reforms in next week's Mansion House address | GB News

Rachel Reeves will announce reforms in next week's Mansion House address | GB NewsIt is understood that Reeves will instead focus on new plans to provide consumers with the information and support they need to invest.

The Government is expected to continue talking to industry members about options for reform, with a Treasury spokesperson saying: "Our ambition is to ensure people's hard-earned savings are delivering the best returns and driving more investment into the UK economy."

The decision to pause the reforms has been welcomed by the savings industry, with building societies reporting a jump in cash ISA applications last week as speculation about the changes intensified.

Harriet Guevara, Chief Savings Officer at Nottingham Building Society, said: "If reports that the Chancellor will not announce a cut to the annual Cash ISA allowance in her Mansion House speech next week are true, this is positive news for savers and for lenders."

More From GB News