State pension age review defended by Rachel Reeves as 'ageing population places burden on taxpayer'

GB NEWS

The state pension is set to rise to 67 from next year

Don't Miss

Most Read

Chancellor Rachel Reeves has defended a comprehensive examination of the state pension age to guarantee the system remains financially viable as people live longer. The review will deliver its findings in March 2029.

Reeves explained: "As life expectancy increases it is right to look at the state pension age to ensure that the state pension is sustainable and affordable for generations to come."

The Department for Work and Pensions (DWP) revealed the review on Monday. Dr Suzy Morrissey will lead an independent assessment examining relevant factors, whilst the Government Actuary's Department analyses the most recent life expectancy data.

Currently, the Government must conduct regular assessments of the state pension age as a statutory requirement. People currently become eligible for state pension at 66, with this threshold set to increase to 67 before 2028.

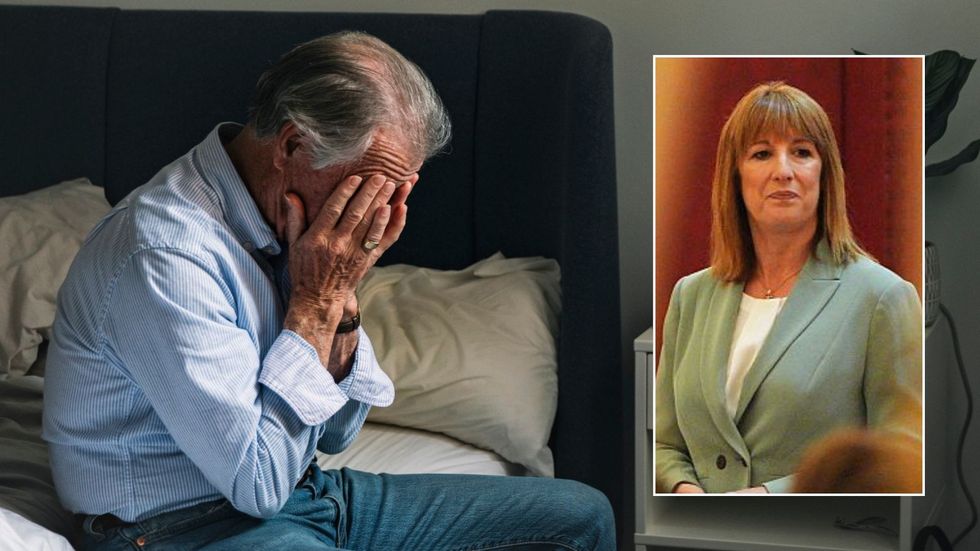

A review has been launched into the state pension age

|GETTY

As well as this, Chancellor confirmed that experienced specialists have been appointed to examine all available evidence. She stated: "We have just commissioned a review of pensions adequacy, so whether people are saving enough for retirement, and also the state pension age."

Reeves emphasised that evaluating the state pension age was "right" given rising life expectancy trends, ensuring the system's long-term viability for future generations.

The Centre for Ageing Better has responded positively to the Government's announcement whilst issuing stark warnings about potential consequences. The charity highlighted that when the state pension age last increased, poverty rates amongst 65-year-olds doubled.

Elaine Smith, the interim deputy director for Work at the Centre for Ageing Better, said: "The last time the state pension age rose, nearly 100,000 more 65-year-olds were pushed into poverty while waiting to collect their state pension, with poverty rates for this age group doubling in the wake of the rise."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are concerned about the rise in the state pension age | GETTY

Britons are concerned about the rise in the state pension age | GETTYThe organisation stressed that any reforms must be approached with extreme caution to avoid repeating past mistakes. The Centre for Ageing Better advocates for a comprehensive examination of benefit eligibility for people in their sixties, rather than focusing solely on pension age adjustments.

In its support of a state pension age review, the charity emphasised that traditional retirement patterns have fundamentally shifted.

Smith explained: "Any reform or review of pensions in this country must recognise that the traditional retirement cliff-edge, where people moved directly from full-time work to no work, is no longer the case for the majority. Government policy needs to catch up with this fundamental change."

Notably, the organisation proposes reconsidering whether reaching state pension age should automatically determine pension collection and working-age benefit ineligibility, given today's varied retirement circumstances

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “There will be many factors that need to be assessed during this review of the state pension age.

“One of the most important will be healthy life expectancy which according to the latest data hovers in the early 60s.

LATEST DEVELOPMENTS:

Pensioners have enjoyed a sizable payment boost from the Winter Fuel Payment

| GETTTY"This means the reality is that many people will face real difficulties in continuing to work until their mid-to-late 60s and could face a sizeable income gap while they wait to receive their state pension."

Rachel Vahey, head of public policy at AJ Bell, said: "An ageing population places an increasing burden on taxpayers, with state pension costs rising and fewer working-age taxpayers to cover the cost.

“Future governments will hope that an improved economy and growing tax receipts will help alleviate some of the pressure.

"But that can’t be guaranteed and there needs to a be a credible plan for maintaining affordability."