State pension triple lock future in doubt as Labour called to review 'sustainability' of future payments

GB NEWS

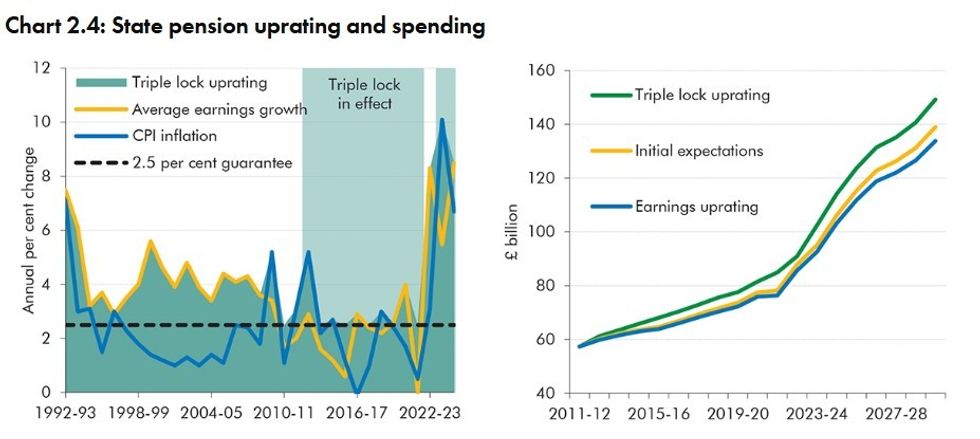

Under the triple lock, state pension payment rates rise every year in line with either the rate of inflation, average wages or 2.5 per cent; whichever is the highest

Don't Miss

Most Read

Labour has confirmed the state pension is being placed under the review as future pensioners face being £800 a year worse-off by 2050, however the triple lock will not be scrutinised.

Analysts are urging ministers to review the "unsustainable" triple lock as part of its Pensions Commission, which the Office for Budget Responsibility (OBR) recent highlighted as being a considerable expense on the taxpayer.

Professor Joe Nellis, an economic adviser at accountancy firm MHA, said: "The OBR’s report highlighted the increasing cost of the triple lock on pensions as the population ages.

"Despite the political unpopularity that a Government already reeling from a backtrack on the Winter Fuel Allowance can barely afford, they must review the long-term sustainability of the policy.

Labour is being urged to review the state pension triple lock

|GETTY

"Whether this comes at the Autumn Budget this year remains to be seen. Cuts to unprotected Government departments will happen but can only raise so much, and the likelihood of any meaningful cuts to the ever-growing welfare state has declined following the rebellion in the Labour Party against the recent Welfare Bill."

The Government has brought back the Pensions Commission after nearly two decades to tackle a mounting retirement savings emergency, with Work and Pensions Secretary Liz Kendall making clear that reviewing the triple lock guarantee falls outside its remit.

This commission, dormant since 2006, will focus on addressing the alarming trend of working-age people failing to save adequately for their later years. Financial specialists have calculated that individuals planning to retire in 2050 face receiving approximately £800 annually less than those currently drawing pensions.

Kendall stated: "The triple lock is out of scope of the commission. We've got a very clear commitment to that for the entirety of this Parliament." The commission's recommendations on improving retirement income are anticipated in 2027.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How much is the state pension triple lock?

|ONS

Kendall revealed that a statutory assessment of state pension age adjustments would commence immediately alongside the commission's work. During her launch address, she warned: "Unless we act, tomorrow's pensioners will be poorer than today's, because people who are saving aren't saving enough for their retirement."

The commission has been tasked with examining the relationship between state and private pensions through to mid-century. Kendall explained: "And what we're asking the commission to do is genuinely look medium to longer term, the middle of this century, and how the state pension and second pensions work together."

Recent analysis from the Office for Budget Responsibility (OBR) indicated the triple lock has exceeded initial cost projections threefold, raising questions about its long-term viability. Department for Work and Pensions (DWO) figures reveal that 45 per cent of working-age individuals contribute nothing towards their pensions.

The crisis particularly impacts specific demographics, with approximately three million self-employed workers saving nothing for retirement. Just one quarter of private sector workers on low incomes are making pension contributions, with Pakistani and Bangladeshi communities showing identical participation rates.

Gender disparities present another significant challenge. Women approaching retirement can anticipate receiving barely half the pension income available to their male counterparts.

Despite automatic enrolment's success in raising workplace pension participation from 55 per cent in 2012 to 88 per cent among eligible employees, DWP analysis indicates 15 million people remain inadequately prepared for retirement.

The commission will explore reducing the age and income requirements for automatic enrolment participation, alongside investigating "sidecar" savings accounts that offer easier access to funds.

Addressing concerns about increased costs for smaller firms, Kendall acknowledged the challenges whilst emphasising the broader implications. She said: "I want our small businesses to be successful, but it is also the case if we don't act, the amount of pensioner poverty we face will cost everybody if we don't act."

LATEST DEVELOPMENTS:

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR The Work and Pensions Secretary admitted she was "under no illusions about how difficult this will be". The original pensions commission's recommendation for automatic workplace enrolment has transformed participation rates amongst eligible workers.

Reform UK leader Nigel Farage has acknowledged that Britain's retirement age must increase as lifespans extend. Speaking at a Westminster press conference, he stated: "We're going to have to face the reality that if people are living longer and longer, then inevitably retirement age is going to have to rise."

Pensions expert Steven Cameron from Aegon highlighted that the state pension age review has been instructed to assume the triple lock remains permanent. He cautioned that this assumption could prove misleading, noting that maintaining the guarantee might necessitate accelerating increases to the retirement age.

Cameron warned that whilst current pensioners might welcome triple lock protection, younger workers could face extended waits before accessing their state pensions as a consequence of sustaining the policy.