State pension age increase to 68 could be ‘sped up’ to pay for triple lock

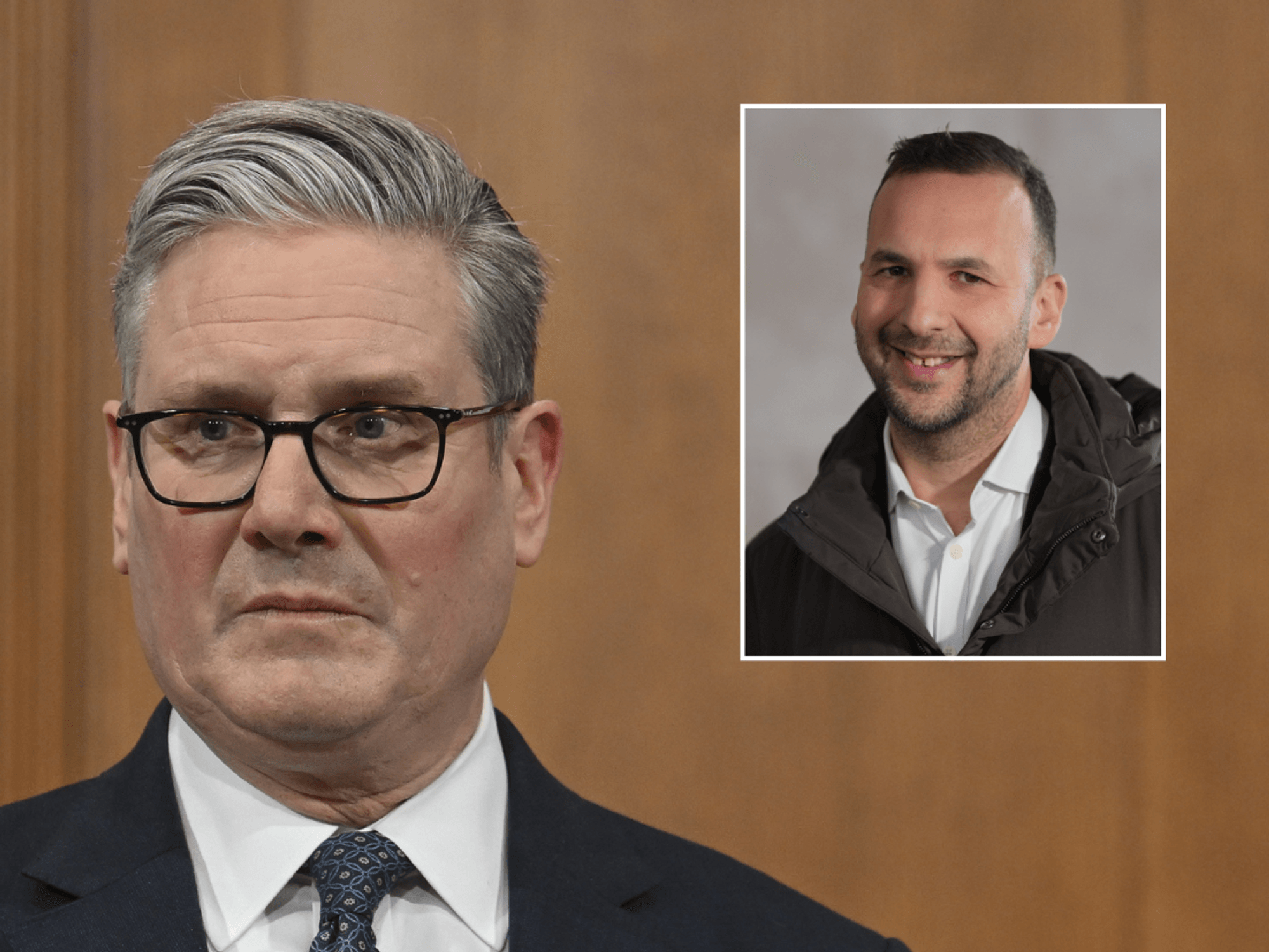

Liam Halligan discusses the state pension age

|GB NEWS

The triple lock guarantees the state pension rises every year but former MPs are pushing for the retirement age to be raised to keep this pledge going forward

Don't Miss

Most Read

The state pension age increase to 68 could be “sped up” to generate revenue to pay for the triple lock, a former government minister has warned.

Former Conservative MP Lord Willetts said there was “precedent and evidence” which suggests the retirement benefit’s age threshold could be raised sooner than previously expected.

He told i that the Government is set to raise the state pension age to 67 by the next Parliament but noted a “further increase could be sped up”.

This comes amid growing concerns over the long-term viability of funding for the state pension going forward.

Yesterday, Prime Minister Rishi Sunak confirmed that the triple lock would remain in place throughout the next Parliament if the Tories win the next General Election.

According to economists, this would cost the taxpayer as much as £49billion at a time when the country’s tax burden is the highest it has been since World War II.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The state pension age could be raised sooner than expected

|GETTY

Since 2010, the Government has promised to raise state pension payment rates every year through the triple lock, although it was temporarily replaced with a double lock in 2022/23.

The triple lock is a pledge to uprate the state pension by the highest out of the rate of inflation, average earnings or 2.5 per cent.

Britons currently aged between 47 and 48 will be expecting to retire in 2044 at 68 under the status quo.

However, this group could have to wait longer for their retirement entitlement if these changes come into effect.

Currently, the Government is planning to hike the state pension age from 66 to 67 between 2026 and 2028.

It has also scheduled a further review within two years of the next Parliament to review recommendations for an earlier increase to 68.

Last March, an independent review of the state pension age by Baroness Lucy Neville-Rolfe recommended an increase to 68 between 2041 and 2043.

As a result, state pension expenditure would be capped at six per cent of the UK’s gross domestic product (GDP).

A consequence of this would be a further hike to the retirement benefit age to 69 between 2046 and 2048.

Lord Willets explained: “The argument was, if we speed up the increase in the pension age, there will be fewer pensioners, and we’ll be able to pay them a higher pension.

LATEST DEVELOPMENTS:

Lord Willetts warned the changes will need to be made to protect the triple lock

|GETTY

“That was the trade-off on which the triple lock rested when it was first introduced, and it is a reminder that somehow or other these pledges have to be paid for, even with unpalatable measures like that which have come back and proved to be very controversial.”

Issues surrounding the retirement age have came to the forefront of the national conversation in recent years. Last week, the Parliamentary and Health Service Ombudsman (PHSO) recommended that women affected by historic changes to the state pension age changes be awarded compensation.

The Department for Work and Pensions (DWP) was found guilty of “maladministration” over its handling of informing women born in the 1950s of how they would be impacted by the equalization of the retirement age between the sexes.

In the ombudsman’s report, a level four amount of compensation was proposed which could result in payouts of close to £3,000. Analysts estimate a compensation settlement for WASPI women could cost between £3.5billion and £10.5billion.