Savers urged to ‘shop around’ for best deal as interest rates ‘highest they’ve been for last 15 years’

Interest rates on savings accounts have been improving over the last year but experts are speculating they might not last for that much longer

Don't Miss

Most Read

Britons are being urged to take advantage of savings interest rates on offer as they are currently “higher than they’ve been for the last 15 years”.

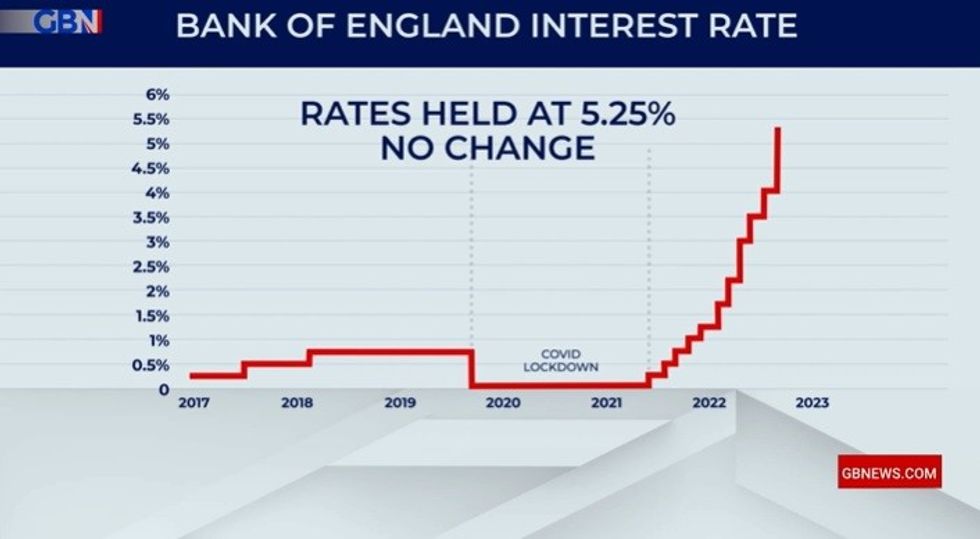

Interest rates have been on the rise over the past year as the Bank of England has pushed the base rate up to mitigate the impact of inflation on the economy.

While this has been detrimental to borrowers, savers have been able benefit with competitive account rates on the market.

Earlier this week, CPI inflation eased to 3.9 percent which had led many analysts to believe that the era of sky-high interest rates could be coming to an end.

Savings interest rates continue to be high

|GETTY

Rajan Lakhani, a personal finance expert at smart money app Plum, told GB News he thinks now is the time for bank customers to “shop around” for the deal that suits them the best.

He explained: “Interest rates are currently higher than they’ve been for the last 15 years. If you do have savings, it’s important to make sure they aren’t languishing in a current account earning little to no interest.

“Unfortunately, many high street banks have been slow to pass on the increase in the base rate to savings accounts, so it may well be that you need to shop around to find a better deal.

“The good news is that there are some great deals out there on savings – take a look at fintechs and smaller banks or building societies, who often offer their customers the highest rates on the market.”

According to Moneyfactscompare, the average gross rate for an easy access savings account is sitting at 3.18 percent as of December 2023.

Some easy access account offerings from Metro Bank and Ulster Bank are currently on 5.20 percent or more.

One of the “market-leading” savings products on offer is Nationwide Building Society’s eight percent Flex Regular Saver.

Similarly, Santander’s Edge Saver is offering customers a high savings interest rate of seven percent.

LATEST DEVELOPMENTS:

The Bank of England Base Rate has increased 14 consecutive times | GB NEWS

The Bank of England Base Rate has increased 14 consecutive times | GB NEWSAccording to Mr Lakhani, many banks and building societies are offering interest rates which are higher than the current rate of inflation, including Plum’s 4.21 percent AER on savings.

The expert added: “You might want to also consider exploring low-risk investments such as money market funds, where the rate offered tends to more closely follow the base rate compared to traditional savings accounts.”

The Bank of England’s Monetary Policy Committee (MPC) will next consider any changes to interest rates on February 1, 2024.