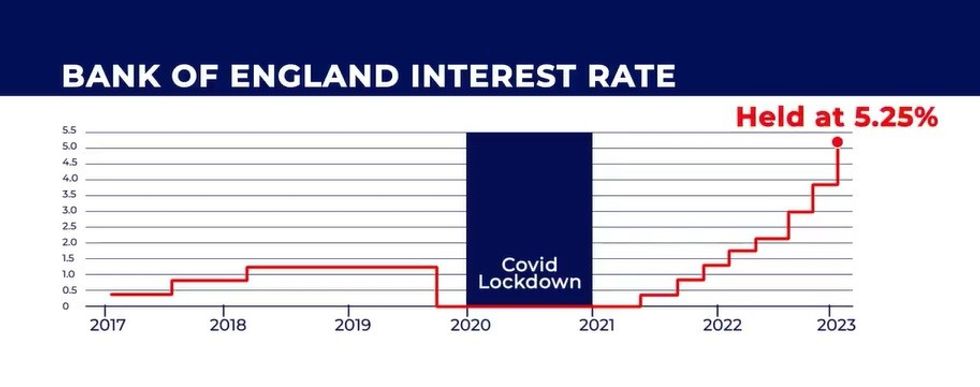

Bank of England holds interest rates at 15-year high - two years after first of 14 consecutive hikes

The Bank of England base rate is at a record high following 14 consecutive interest rate hikes within the past two years

- The Bank of England has held the base rate at 5.25 per cent

- The central bank increased interest rates 14 times in a row between December 2021 and August 2023

- Base rate reaction: What the Bank of England decision means for savings

Don't Miss

Most Read

Latest

The Bank of England's Monetary Policy Committee (MPC) has voted to hold the base rate at the 15-year high of 5.25 per cent.

Rate-setters hiked the bank rate 14 consecutive times in less than two years, but have been maintaining it at the current level in recent months, which it reached in August this year.

The Bank of England Governor Andrew Bailey stressed there is “still some way to go” in policymakers’ efforts to get inflation down.

Six members of the nine-strong MPC voted in favour of holding the base rate at 5.25 per cent, while three called for an increase to 5.5 per cent.

The bank of England base rate has been held at 5.25 per cent

|GB NEWS

The Bank of England increased interest rates in an attempt to ease inflation, which reached a peak of 11 per cent in 2022.

Inflation hit its lowest level in two years, according to statistics published by the Office for National Statistics, last month.

The data showed the Consumer Prices Index (CPI) rose by 4.6 per cent in the 12 months to October 2023, down from 6.7 per cent in September.

The ONS will publish the CPI inflation data for the year to November 2023 on Wednesday morning.

While the rate of inflation has dropped, it's still significantly higher than the Bank of England's target of two per cent.

The next Bank Rate decision is due on February 1, 2024.

What does Bank of England decision mean for mortgage rates?

Steve Seal, CEO, Bluestone Mortgages, said the decision to leave rates untouched would be "welcomed by would-be and existing borrowers, who have felt the brunt of 14 rate rises one less than two years".

He added: "While this decision could indicate that rate rises have reached their peak, affordability remains a key concern as the cost of living crisis continues to squeeze the nation’s finances.

“For those worried about how they can climb onto or up the property ladder amid this challenging environment, rest assured that there is help at hand.

"Whether that be opting for a product transfer, asking for a payment holiday or being signposted to specialist support, the earlier they engage, the sooner they will receive the tailored support to help make their homeownership dream a reality.”

Karen Noye, mortgage expert at Quilter, explained the "picture is mixed" for people with mortgages.

She said: "Borrowers on variable-rate mortgages gain a reprieve from immediate payment increases, which could encourage spending and economic activity.

"However, those looking to remortgage or secure new mortgages may still face relatively high rates and stringent lending criteria.

"Lenders however are likely to remain competitive, which could lead to more favourable rates for borrowers over time."

LATEST DEVELOPMENTS:

Kevin Pratt, business expert at Forbes Advisor, said that with the bank rate held at 5.25 per cent for the coming months, attention will now shift to the inflation figure due next week.

He said: "With the economy flatlining in terms of GDP, we can only hope the headline rate falls further from 4.6 per cent towards the long-term target of two per cent.

"In other words, we need to see hard evidence that the pain inflicted by 14 successive Bank Rate increases up to August is finally being justified.

"The coming days are the most important of the year for many businesses, especially those in the hospitality and retail sectors, and firms simply cannot afford to have a bad Christmas.

The Bank of England's Monetary Policy Committee met today to decide whether to change the base rate

|PA

"If customers are deterred from spending because they see little prospect of Bank Rate falling in the near term and the cost of living crisis coming to an end, then festive cheer will be in short supply."

Almost five million UK homeowners are set to be affected by higher mortgage payments over the next three years, the central bank said.

Around 500,000 households could face a monthly hike of more than £500 by the end of 2024.

What does the Bank of England decision mean for savings?

With the base rate held at the same level, savers are being urged against delaying taking out fixed term savings deals offering high interest rates.

Myron Jobson, senior personal finance analyst at interactive investor, said: “Those who have been waiting to nab a top savings deal might want to get a move on as the very best deals may not be around for much longer.

“As things are moving so quickly there’s a risk that, by delaying taking out a savings deal now – especially a fixed-term deal - you could miss out on a higher rate in the next week.

“One solution is to adopt the ‘laddering’ or ‘staircase’ savings strategy which involves gradually increasing the amount you save overtime.

“This involves savers putting their cash in fixed rate accounts over the long term with different maturities, thus bridging the waiting period for higher interest rates.”

Mr Jobson also addressed those who may be interested in investing money. With investing, capital is at risk.

“Those who can afford to put money away for at least five years or more should consider investing for the potential of long-term inflation-beating returns that far outstrip savings rates.

WATCH NOW: Britons share Christmas spending plans after Base Rate decision

“While past performance is not indicative of future results, saver can take courage in the fact that history shows that even a ‘middle of the pack’ fund is likely to outperform returns from cash savings interest over the long term - so, you don’t need to be an expert stock picker to benefit. The key is to give your money ample time in the market – at least five years - to smooth out the effects stock market ups and downs.”

Victor Trokoudes, founder and CEO of smart money app Plum, was more optimistic about higher savings rates, stating he thinks it appears higher interest rates will remain for the "foreseeable future".

He said this would be "good news for savers" who can lock in a higher interest rate than seen in recent years.

Mr Trokoudes said: "If your bank is not offering a rate close to the base rate, shop around to find a decent one. Some savings rates on easy-access accounts are beating the inflation rate currently, which we’ve not really seen on conventional savings over the past decade and a half.

"It’s important to not miss out on this if you have money stashed away."