Bank of England needs to see ‘clearer decline’ in wage growth before interest rate cuts says rate setter

The Bank of England's Monetary Policy Committee (MPC) voted to hold the base rate at 5.25 per cent last week

Don't Miss

Most Read

The Bank of England needs to see clearer evidence that wage growth in the UK is slowing before considering cutting interest rates, a policymaker has said.

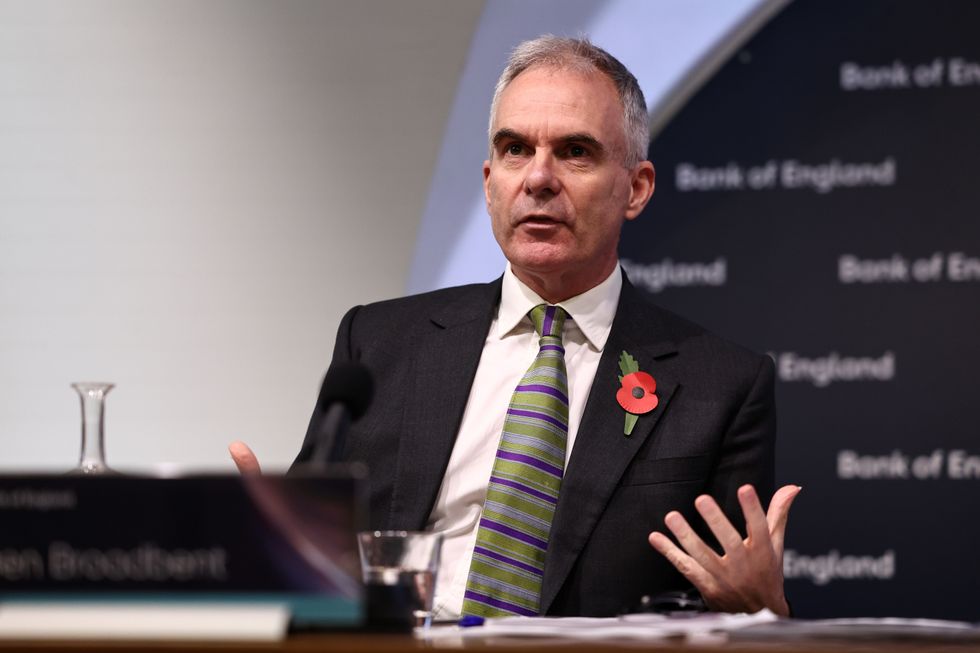

Ben Broadbent, a member of the Bank’s nine-member Monetary Policy Committee (MPC) which sets UK interest rates, said there is still a lot of uncertainty around how the economy is performing.

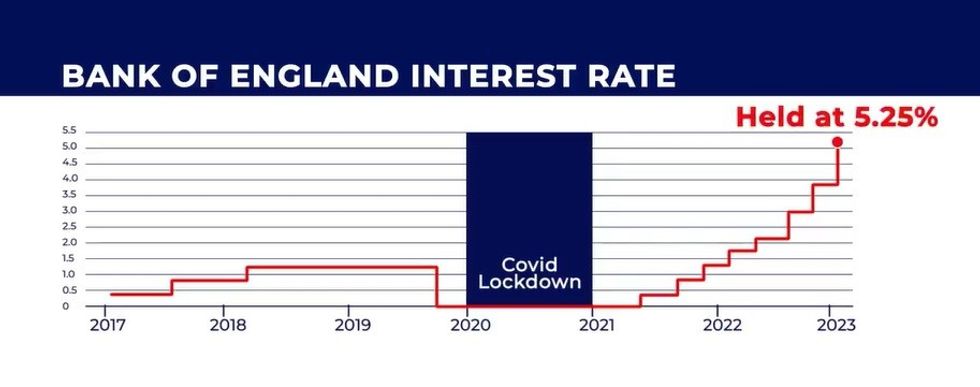

There has been speculation interest rates could have peaked in recent months, as the Bank of England's MPC has continued to hold rates following 14 increases in a row to try to ease inflation.

Financial commentators have turned to predicting when the base rate could be cut, but policymakers have signalled there is still some way to go.

Bank of England MPC member Ben Broadbent said there is still a lot of uncertainty about how the UK economy is performing

|PA

During a speech at the London Business School, Mr Broadbent said the MPC needs more certainty over the accuracy of current wage growth data.

He said: “Given the volatility in the official estimates, and the disparity among the various indicators we have, it will probably require a more protracted and clearer decline in these series before the MPC can safely conclude that things are on a firmly downward trend."

The rate of average wage growth for workers in Britain is an important indicator for policymakers of whether there is pressure on inflation.

The central bank upped the base rate from 0.1 per cent in December 2021 before hiking it consecutively until it hit a 15-year high of 5.25 per cent in August 2023.

The Bank of England's governor Andrew Bailey previously said firms should avoid raising staff wages above the rate of inflation, as it helps lock higher prices into the economy.

Mr Broadbent said: “We know that firms were accepting significant increases in wages early this year in order to help compensate employees for the steep rises in the cost of living.”

The MPC member said pay rises being given disproportionately to existing employees, rather than new members of staff, could explain why wage growth this year hasn't been in line with forecasts.

He added: “But the slightly muddy picture of the recent past, coupled with the general volatility of the data, means the MPC would probably want to see more evidence, across several indicators, before concluding things are on a clear downward trend.”

Mr Bailey recently emphasised he thought it was "too early" to think about cutting interest rates.

LATEST DEVELOPMENTS:

The Bank of England's MPC voted to hold the base rate at 5.25 per cent last week

|GB NEWS

The Bank of England chief said they need to see more evidence that inflation is under control.

Inflation has been showing signs of easing in recent months, with the most recent data from the Office for National Statistics (ONS) showing Consumer Price Index (CPI) rose by 4.6 per cent in the year to October 2023.

Inflation hit a recent peak of 11.1 per cent in October 2022.

The Bank of England's target for inflation is two per cent.

The ONS will publish the next CPI release this Wednesday, on December 20.