UK inflation falls again in bigger than expected drop to 3.9 per cent - lowest rate in more than two years

The UK rate of inflation recently peaked at 11.1 per cent in 2022

|GETTY

The UK rate of inflation has fallen, new official figures published today show

Don't Miss

Most Read

The rate of price rises in the UK has eased, meaning inflation has fallen to the lowest rate in more than two years.

The Consumer Prices Index (CPI) rose by 3.9 per cent in the 12 months to November 2023.

It’s down from 4.6 per cent in the previous month. Most economists had predicted inflation would fall to 4.3 per cent in November.

CPI inflation peaked at 11.1 per cent in the year to October 2022.

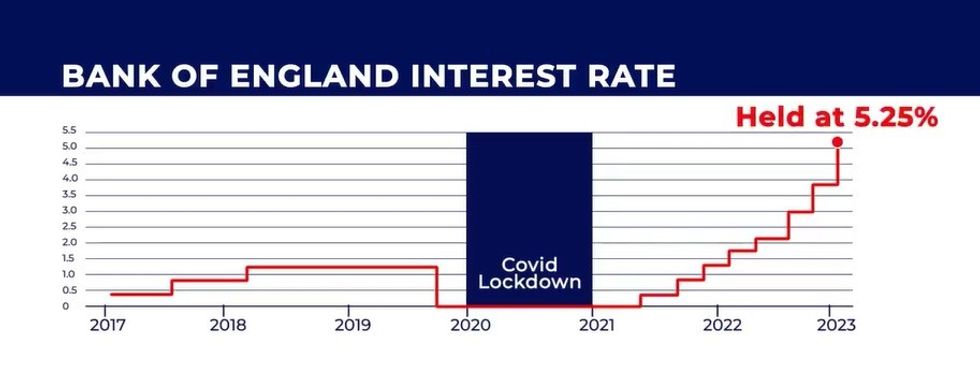

The Bank of England has held the base rate at 5.25 per cent

|PA

The CPI inflation rate is the lowest since autumn 2021.

Speaking to GB News today, former advisor to the Bank of England and Treasury Roger Gewolb said there were "slight but significant falls" in inflation, which are "going in the right direction".

He added: "In plain language, everything is still getting more expensive, but doing so more slowly."

Mr Gewolb said the UK mainly has non-consumer-driven inflation, which is called "cost-push".

Last month, Rishi Sunak heralded the data as showing his Government had “halved inflation meeting the first of the five priorities” he had set out at the beginning of the year.

While inflation has been easing since its peak in October last year, it’s still far from the Bank of England target of two per cent.

The Bank of England increased the base rate 14 consecutive times to try to ease inflation, finally pausing the hikes when policymakers voted to hold interest rates at 5.25 per cent in September this year.

The Bank of England’s Monetary Policy Committee (MPC) has held the base rate at this level, a 15-year high, since then.

What does the inflation figure mean for mortgages?

Amanda Aumonier, director of mortgage operations at Better.co.uk said while a decrease in inflation typically prompts the Bank of England to consider cutting interest rates, it seems that isn't likely any time soon.

She added: "Current indications suggest that Bank of England Governor Andrew Bailey will keep the base rate at 5.25 per cent for at least the first six months of the upcoming year, which means mortgage interest rates are likely to stabilise for the time being.

“For those planning to buy their first home next year and contemplating waiting for interest rates to fall, don’t hold out for the perfect moment - consult with a mortgage broker to understand your realistic affordability and make informed decisions without compromising on your dream home."

Borrowers whose fixed rate deal is due to end within the next six months are being warned its "vital" they talk to a mortgage broker as soon as possible.

Ms Aumonier said: “Even though mortgage rates have fallen from six per cent-plus to four per cent-plus this year, it’s still going to be a shock for thousands of homeowners who are coming to the end of their ultra-low fixed-rate deals.

"Don’t bury your head in the sand about the fact your mortgage repayments will shoot up - it’s important to budget for what’s to come and get your head around the drop in your disposable income.”

LATEST DEVELOPMENTS:

The Bank of England base rate has been held at 5.25 per cent

|GB NEWS

What does the inflation figure mean for savings?

With the Bank of England having signalled a pause in interest rate hikes and inflation falling, savers are being urged to act.

Founder and CEO of My Community Finance, Tobias Gruber, said: “With inflation on the decline and the Bank of England signalling a pause in interest rate hikes for the foreseeable future, savers must seize the opportunity now before the best deals vanish.

“If your savings have stagnated in the same account for years, there's a high likelihood that you're missing out on potentially higher returns.

"The new year presents an ideal time to reassess your finances and spend time exploring what your money could be earning elsewhere. The landscape is changing, and the very best deals that are on offer today may not be available again for several years to come."

Mr Gruber suggested savers should "stay open-minded" and "consider diversifying" their savings portfolio by exploring accounts with lesser-known providers.

He added: “Credit unions and challenger banks in particular have emerged as top performers this year, offering some of the most competitive rates.

"Embrace innovative ways of saving - a small effort today could yield significant rewards in the long run.”