Best savings accounts this week include interest rate of seven per cent

As interest rates remain frozen at 5.25 percent, savers are urged to get the best rate possible on their savings

|GETTY

With the top savings accounts now paying more than inflation, there's a chance for savers to really make their money work hard for them

Don't Miss

Most Read

Latest

As interest rates remain frozen at 5.25 percent, savers have been urged to get the best rate possible on their savings.

Experts at moneyfactscompare have revealed the best savings accounts for the week beginning March 15 which are offering customers an “excellent” and “competitive” interest rate.

With the central bank expected to cut rates later this year, Britons are looking to lock down the best deals before its too late.

Those looking for the best savings accounts can earn up to 5.2 per cent on an easy-access account with unlimited withdrawals or earn up to 5.18 per cent if they are prepared to fix for a year.

The cahoot Sunny Day Saver is offering savers 5.20 per cent AEsA

|GETTY

Top savings accounts:

- The best easy-access savings account is 5.2 per cent AER with Cahoot Bank

- The best one-year fixed deal is 5.18 per cent AER with Beehive Money

- The best regular saver is seven per cent AER with The Co-Op Bank

- The best one-year fixed Cash ISA is 4.18 per cent with Punjab National Bank

Sunny Day Saver is offering savers 5.2 per cent AER on balances up to £3000 in easy access savings.

Britons can get this top interest rate for one year on balances between £1 and £3,000.

There is no interest paid on balances over £3,000. The maximum amount allowed is £2 million.

Second place on the easy access table is Ulster Bank’s Loyalty Saver. Savers can also get 5.2 per cent on savings but the minimum deposit is £5,000.

The Virgin Money Defined Access E-Saver has a lower buy-in at £1, but only offers savers 5.01 per cent.

Beehive Money currently offers the best one-year fixed rate at 5.18 per cent.

People can open the account with a minimum deposit of £500 and continue to add to your savings while the issue remains open.

As with most fixed bonds, people won’t be able to access their money until the end of the term.

Hodge Bank comes in second, offering savers 5.16 percent with a minimum deposit of £1,000 on the one-year fixed bond saver.

The market-leading two-year bond continues to come from iFAST Global Bank’s Fixed Term Deposit at 5.1 per cent AER.

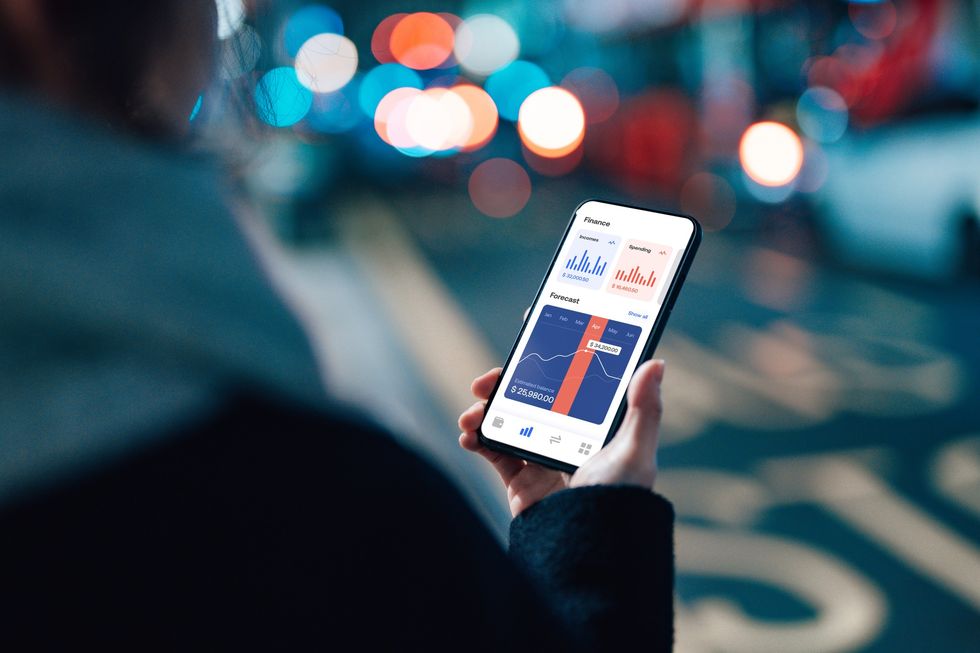

This account, which people can open and manage online and via mobile app, pays interest on maturity and doesn’t specify a minimum deposit.

Atom Bank’s three-year Fixed Saver now tops the three-year fixed bond chart at 4.7 per cent AER.

Savers can get double the inflation rate with the leading regular saver account.

LATEST DEVELOPMENTS:

The Co-Operative Bank is offering seven percent on their regular saver. Customers can open the account with just £1, and the maximum deposit each month is £250.

The notice period is 12 months on the account.

The top paying Cash ISA is with Punjab National Bank. Savers can get 4.8 per cent, with a minimum deposit of £1,000.

Otger top savings accounts:

- The best four-year fixed account is 4.55 per cent AER with Al Rayan Bank.

- The best two-year fixed Cash ISA is 4.65 per cent AER with State Bank of India.

- The best variable Cash ISA is 5.17 per cent AER/5.06 per cent gross with Plum

- The best notice account is 5.25 per cent AER wit Hinckley & Rugby BS