'I'm a property expert and I'm worried about the housing market - is our golden age over?'

House prices are rising, but buyers, sellers, and builders are all running out of steam. Property guru Jonathan Rolande explains why 'stagflation' could be just around the corner

Don't Miss

Most Read

Latest

The kids are still in school, the weather's finally decent, and those long evenings should have families out looking at potential new homes until late.

Instead, we're witnessing a housing market that is - I'm sorry to say - as flat as a pancake.

Halifax's latest figures tell at least part of the story: house prices stayed level in June, with annual growth limping along at just 2.5 per cent.

For context, Gold is up 27 per cent; the FTSE, nine per cent; and even a pint of milk has increased by 13 per cent in the same period.

An unwelcome report from Rathbones Wealth Management this week declared that the 'golden age of house price growth is over' - thanks for that.

Don't get me wrong, I'm not nostalgic for runaway price inflation. That benefits nobody except those who've already done well on the property ladder.

But what we're seeing now is potentially very worrying - the early symptoms of 'stagflation' creeping into the housing market.

In other words, prices are still rising, but demand is weak, buyers are overcautious, sellers are losing interest, and builders are too nervous to start new projects.

'What we're seeing now is potentially very worrying'

|GETTY IMAGES

When you look, the warning signs are staring us in the face daily.

Fewer properties are coming up for sale as homeowners hold back, waiting for better times.

Houses are taking longer to sell. More sales are falling through at the last minute.

Buyers are plagued by uncertainty about jobs, mortgages, repair costs, and the economy.

LATEST DEVELOPMENTS:

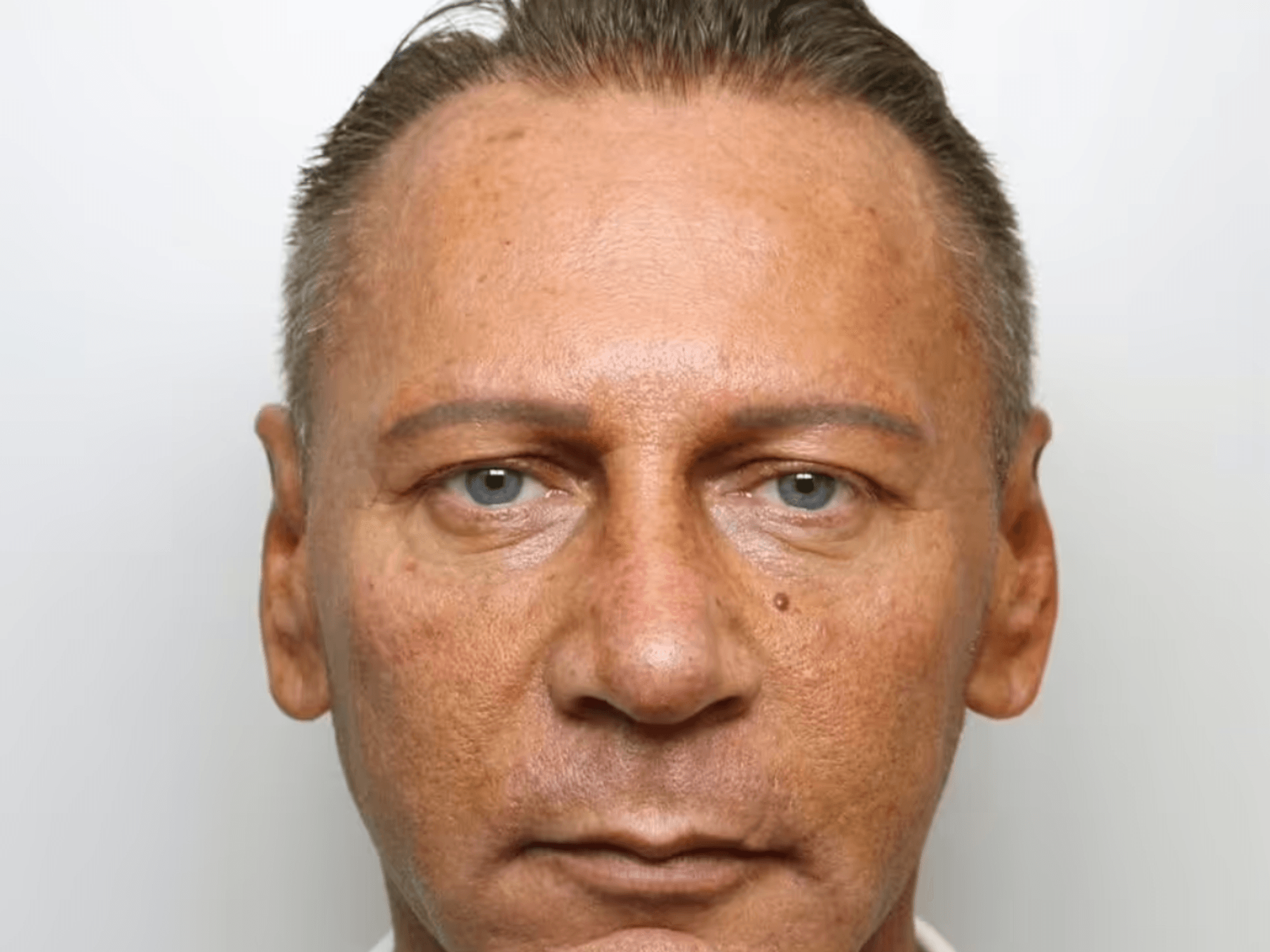

Jonathan Rolande shares his expertise | Jonathan Rolande

Jonathan Rolande shares his expertise | Jonathan RolandeIt's a stand-off right now between those wanting to sell and those wanting to buy, with estate agents working flat out in the middle, trying to convince increasingly reluctant parties to do a deal.

Of course, the ridiculous length of time it now takes to get a property from 'sold subject to contract' to an actual exchange makes everything worse.

We're talking three to four months - and that's from when you've already found a buyer. In that time, enthusiasm fades. Problems crop up. Doubt sets in...

If this continues, it could mean the housing shortage will worsen, not improve as we've been promised.

Young people may find themselves even further from homeownership, while existing homeowners become prisoners in properties that not enough people want to buy. We've already seen this with many flats.

Halifax talks about 'resilience' and points to 'returning' first-time buyers, but honestly, are we really seeing that? The estate agents I speak to daily tell me a different story.

But the crisis edging ever closer can still be averted. The housing market desperately needs interest rates to come down. Rapidly.

It may be summer, but those are storm clouds on the horizon, and they are getting closer…

Jonathan Rolande is the founder of House Buy Fast, and the spokesman for the National Association Of Property Buyers. For more information visit www.jonathanrolande.co.uk.