Santander raises mortgage rates and withdraws deals for first-time homebuyers after inflation rise

High street lenders, including Santander, have cut mortgage interest rates in recent months

Don't Miss

Most Read

Latest

Santander has announced it will raise mortgage rates just days after the lender slashed interest rates on its products. As of today, the bank will increase rates by up to 0.20 percentage points on certain fixed rate products, making it the first major bank or building society to do so in 2024.

This bucks the recent trend of high street lenders reducing interest rates on mortgage products in recent months. Experts are citing the impact of inflation and the recent “dreadful” retail sales for December as to why the bank had made this move.

The bank is raising mortgage rates mere days after cutting them last week

|PA IMAGES

Notably, Santander is withdrawing exclusive mortgage deals for first-time homebuyers in a blow for those trying to get on the property ladder.

- As a result, Santander has made the following changes to its mortgage deals:

- Selected standard residential fixed rates increasing by between 0.05 per cent and 0.20 per cent for purchase and remortgage clients.

- All residential First Time Buyer exclusive fixed rates with £500 cashback are being withdrawn.

- Residential 90 per cent LTV three year fixed rate at 5.18 per cent with no product fee for purchase clients is also being withdrawn.

Speaking to Newspage, Rohit Kohli, director at The Mortgage Stop, warned that the housing market will “see some ups and downs” in months ahead.

He explained: “Inflation rose unexpectedly, if only marginally last week, giving lenders pause for thought but a day or two later the retail sales data for December was published and was dreadful, which will highlight the fragility of the economy to the Bank of England.

“The one positive to take out of it all is that lenders are fighting to lend money after a poor 2023 but how long it lasts is anyone’s guess.”

For the 12 months to December 2023, the Consumer Price index (CPI) rate of inflation jumped to four per cent.

LATEST DEVELOPMENTS:

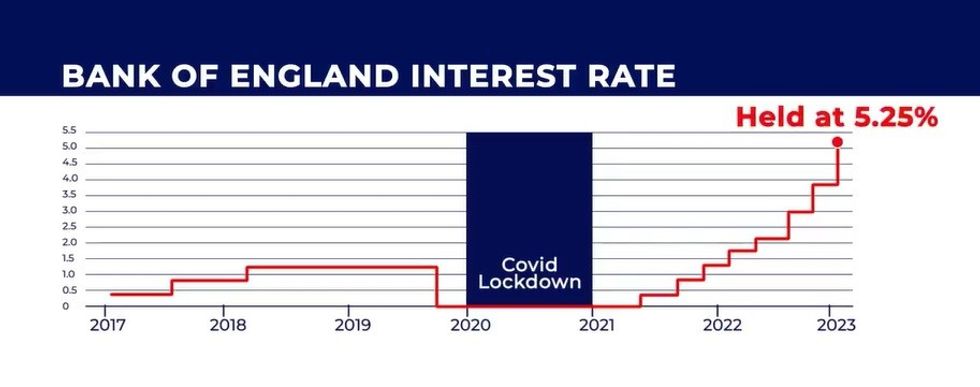

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWSA Santander spokesperson told GB News: "Santander continually reviews its rates based on a number of factors, such as wider market conditions including SWAP rates.

"We offer a range of competitive mortgage deals with five year deals starting from 3.99 per cent and two year deals starting from 4.25 per cent.”

Last week, Santander announced had reduced mortgage rates by up to 0.45 per cent across its line of two-year fixed-rate products.

The Office for National Statistics (ONS) will confirm the CPI inflation rate for the 12 months to January 2024 on February 14, 2024.