Martin Lewis shares vital savings interest rate rule to help homeowners ‘get rid of mortgage’

The British public react to interest rates being kept at 5.25 per cent

|GB NEWS

The host of The Martin Lewis Money Show Live took questions from his audience about mortgage overpayments and savings interest rates on a recent episode

Don't Miss

Most Read

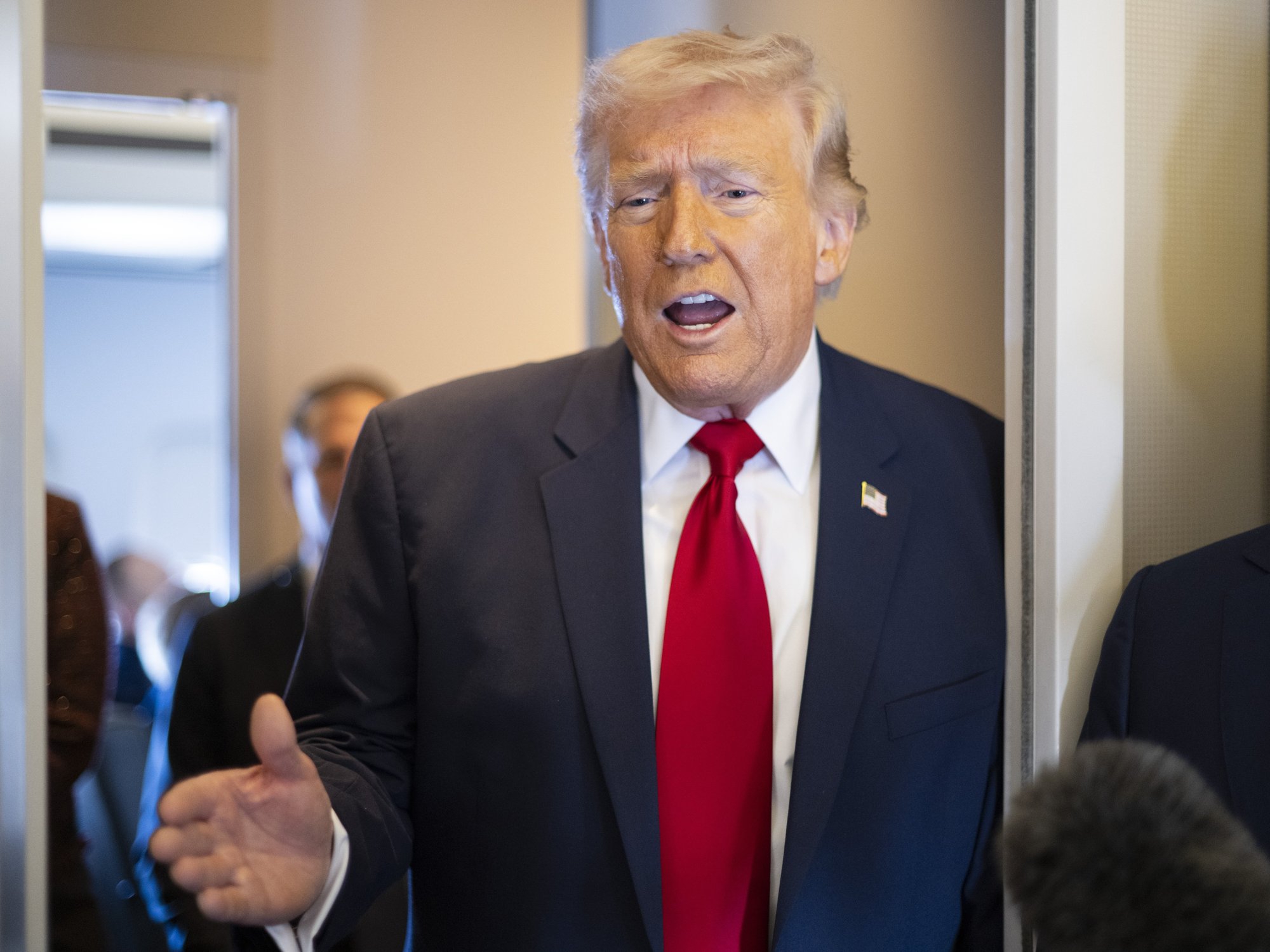

Martin Lewis is urging homeowners to remember this crucial “rule” when it comes to determining whether or not they should overpay their mortgage. The finance journalist broke down the benefits of making overpayments compared to placing extra money in high interest savings accounts.

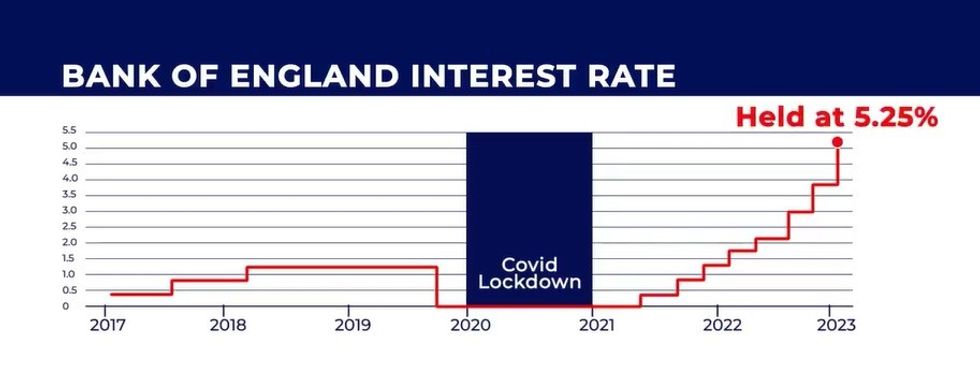

Many households choose to make overpayments on their mortgage to pay off what they have borrowed faster. This has been made more difficult in recent years as mortgage rates have skyrocketed in recent years as lenders have responded to the Bank of England hiking the base rate.

The financial journalist is sharing mortgage tips amid high interest rates

|PA IMAGES

However, some Britons have been able to weather the storm of these hiked repayments and looking to overpay to own their home outright.

Mr Lewis responded to a question from a viewer named Peter who asked whether he should do with an extra £150 a month he has come into.

Pete asked: “Is it better to put it into a savings account for a couple of years or do overpayments. My mortgage rate is 3.7 per cent.”

Mr Lewis said: “Here’s the standard rule: if your mortgage rate is higher than the rate you can get on savings, you are generally better to overpay the mortgage as long as there are no penalties and you keep that cash emergency fund.

“If the savings rate is higher, it’s a little bit more difficult. If they are both the same, the mortgage calculator will show its generally better to overpay the mortgage.

The host of the Martin Lewis Money Show Live clarified that if the savings rate is only a little bit higher than the mortgage rate, it would likely be better to overpay.

However, Mr Lewis said that that if a savings account’s interest rate is a lot higher than the rate of a mortgage product, then it would be better to save.

He added: “Now, you’ve got a 3.7 per cent mortgage. You can get 5.1 per cent in easy access right now.

“I’m pretty certain that means you would be better off on a pure financial calculation. Saving for now, and then, once you come to remortgage and rates are going up, use that money to get rid of your mortgage.”

LATEST DEVELOPMENTS:

The Bank of England base rate has been held at 5.25 per cent | GB NEWS

The Bank of England base rate has been held at 5.25 per cent | GB NEWSThe personal finance journalist told savers to go onto a mortgage calculator to compare the savings that can be made.

Despite this “rule”, Mr Lewis warned that the “gain might not be that great” and it may just be easier to overpay on repayments.

According to the finance expert, overpaying mortgages reduces the capital and if someone has existing repayments, they should not lenders lower them in the future.

Martin Lewis is the Founder and Chair of https://MoneySavingExpert.com .