'10 things you didn't know about your pension...and what you need to know!' Jasmine Birtles reveals all

How to save in this economy |

GB NEWS

Pensions expert Jasmine Birtles is breaking down what Britons need to know about their pensions and how they can bolster their retirement savings

Don't Miss

Most Read

Pensions are always a hot topic in the run-up to Budget announcements. But while they’re a common part of our lives, many people are still unsure about what pensions can offer.

Even for people who are familiar with the ins and outs of pensions might be surprised by these ten facts.

You Can Have Multiple Pensions

There are three types of pension: workplace, state, and private (also called a personal or stakeholder). You can have several workplace and private pensions.

In fact, many people already have several. When they move jobs, if a new employer uses a different pension provider than their previous job, a new fund will be set up. Some people choose to keep them separate while others will transfer in from their old to the new.

Jasmine Birtles is the founder of MoneyMagpie.com. Get their free investing newsletter here.

Jasmine Birtles answers questions from GB News members in the exclusive pensions and retirement Q&A | JASMINE BIRTLES | GETTY

Jasmine Birtles answers questions from GB News members in the exclusive pensions and retirement Q&A | JASMINE BIRTLES | GETTY The state pension is not enough to live on

Many people assume the state pension will offer them a regular income in their retirement years. Certainly it is a handy start to your living income, but for most people it is not enough to live on on its own.

The current full state pension is about £11,500 a year or less than £1,000 a month. According to Retirement Living Standards research, the minimum a person needs is £13,400 for the bare essentials. Ideally, they should have at least £31,700 a year to live comfortably without worry.

Opting Out Loses Free Money

In a time of tight budgets, it’s tempting to opt out of a workplace pension. But this is financially constraining your future. That’s because a workplace pension includes employer contributions and Government tax relief.

So, you’re getting a lot more bang for your buck. You give up your contributions from your pre-tax salary, but then your employer must match your contributions to a certain level.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

As of 2025/6 tax year, employers must pay a minimum of three per cent of your salary, while you must pay a minimum of five per cent. You could pay more by choice, and your employer may pay more too.

Contributing earlier gives you more money long-term

The longer you put money into any investment, including a pension, the longer that money has to grow. Thanks to the power of compound interest, over time your money will grow on its own, even if you stop adding to it each month.

The earlier you save, the less you will need to contribute overall. For example, someone saving £100 from the age of 20 will have made £48,000 in contributions by the age of 60. With an average five per cent interest, their total pension pot would be about £153,000.

But someone starting to save for their pension at the age of 30 would need to contribute £200 a month, costing them £72,000 in contributions for the same final pot. Start saving at 40 and that’s a huge £370 a month (£88,800 in total contributions) for the same.

MEMBERSHIP:

- REVEALED: Embattled Keir Starmer to face voters in 24 hours as pressure mounts on him to resign

- Nigel Farage on collision course with Ed Miliband's climate agenda as new poll reveals surprising results

- Keir Starmer just put the final nail in his party's coffin. But hold off popping the cork - Carole Malone

- EXCLUSIVE: Keir Starmer 'rumbled' before state visit as Donald Trump's team handed embarrassing private letter

- POLL OF THE DAY: Do the courts have too much power in blocking migrant deportations? VOTE NOW

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Of course, the above also doesn’t take into account employer contributions or tax relief. Saving earlier means more into your pension pot from employers and tax relief without any additional sacrifice from your salary.

The Pension Age Changes

Right now, you can take money out of your personal pension from the age of 55. But, this rises to the age of 57 on April 6, 2028. It could also change in the future. The state pension age also changes.

At the moment, you must be at least 66 years old to claim your State Pension, but this will rise to 67 in 2026 and may rise again in the future. It’s important to keep an eye on the pension age changes as they could impact your decision to retire or keep working.

The gender pay gap extends to pensions

While the gender pay gap is closing in most industries, it still exists by a significant amount when it comes to pension pots. This is often because women take time off work for childcare, but the lower salaries they are paid overall also contributes to this gap (including a larger proportion of women being part-time or low income workers eligible for auto-enrolment).

In the year 2019-2020, the average pension amount that women aged 55 had in their opts was worth £94,000, compared to £145,000 for men.

LATEST DEVELOPMENTS:

You can nominate anyone to Be your Pension beneficiary

Your pension fund is part of your estate when you die. This doesn’t include your state pension, only personal pensions. You can nominate any beneficiary you want to receive your pension when you die. It doesn’t have to be a spouse, child, or relative. However, the pension provider can have final say on who receives your pension after your death.

You can take some pension in a divorce

People facing a divorce are often not aware that they can put a claim on their (ex) spouse’s pension. There are reasons why you might want to do this. For example, if you spent several years being a stay-at-home parent to raise children, you had no opportunity to contribute to a pension.

So, you can claim some of your spouse’s pension to make up for those missed years if you divorce. This is a complicated issue and a specialist solicitor is always advised.

Babies Can Have Pensions

There are a few tax-efficient ways to save for your child’s future, such as with a Junior ISA. However, most people aren’t aware that you can set up a pension fund for your child as soon as they are born.

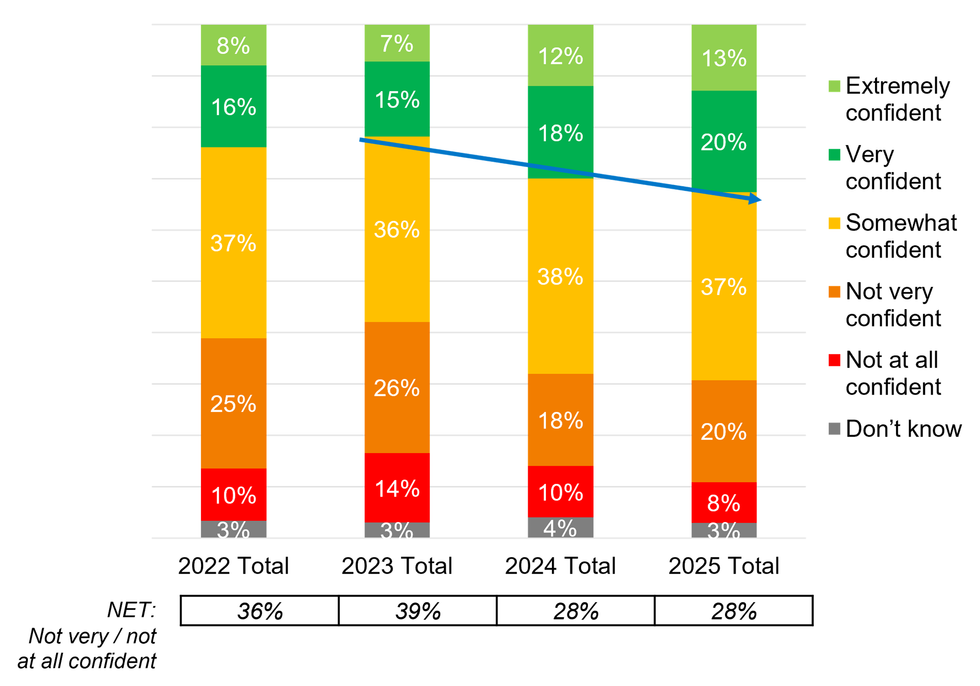

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Just think of the compound interest! It’s a very tax-efficient way of saving for your child’s (very) long-term future, to ensure they are comfortable in retirement long after you’re gone.

You Might Be Able to Get Your Pension Early

It’s a morbid subject, but there are a few cases in which you can access your pension before 55 (or 57 from 2028). The most obvious, saddest, one is if you’re diagnosed with a life-limiting illness. Different providers will have varying policies, but it is usually if you are given a diagnosis with less than 12 months to live. You can often receive the full pension amount tax-free in this instance, unless the total amount is more than the lifetime allowance of £1,073,100.

You may also access your pension early if you are forced into medical retirement early. This means you have a condition which prevents you from working. Speak to your provider if you think you might be eligible.

If you have had your pension since before April 2006, you may also be able to access your pension funds early if the original scheme allowed it. Check with your provider if you’re unsure.

If you are tempted by adverts that promise to help you unlock your pension early, don’t! These are scams that could not only lose your life savings but also put you in hot water with the tax office.

More From GB News