State pension 'wealth test' could hit millions as MPs told to end triple lock on DWP payments

The state pension triple lock is under more scrutiny

Don't Miss

Most Read

Britons could be slapped with a state pension "wealth test" to determine how much they receive from the Department for Work and Pensions (DWP) in lieu of the triple lock under a new proposal.

Last week, retirement industry experts shared suggestions with MPs on the Work and Pensions Committee over what the state pension will look like going forward amid concerns over its long-term sustainability.

A recent report from the Office for Budget Responsibility (OBR) warned the triple lock payment uprate mechanism will cost the Government £10billion more than initially expected by 2030.

Under the triple lock, state pension payment rates increase every year in line with the consumer price index (CPI) rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

State pensioners could be slapped with a 'wealth test'

|GETTY

To address the state pension's future viability, analysts have recommended introducing means-testing for state pensions, having a wealth test for payments or changing the model entirely.

Jonathan Cribb, the deputy director at the Institute for Fiscal Studies (IFS), warned MPs that the existing status quo leads to uncertainty overt retiree incomes and state spending.

He explained: "This creates uncertainty around state pension increases. I'm a critic of the triple lock not because it generates a higher state pension but because you have no idea what level of state pension it's going to be.

"The fact that's it been so impactful over the last 15 years is entirely a function of how volatile macroeconomic growth and inflation have been."

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR However, the economist noted MPs need to ensure state pension payments go up enough to protect retirees from the hiked cost of living, which has been a particular issue in recent years.

Mr Cribb added: "I think it's important to provide pensioners with inflation protection from year to year because they don't have some of the other ways of responding to falls in income that younger groups do."

Chris Curry, director of the Pensions Policy Institute, put forward the idea of a "wealth test" alternative to the triple lock in front of the committee's policymakers.

"You could target additional support to particular groups although as we've found in the past with means testing, that can be difficult if it requires claiming," Mr Curry said.

The Chancellor has confirmed the triple lock will remain in place throughout this Parliament | PA

The Chancellor has confirmed the triple lock will remain in place throughout this Parliament | PA"You don't always reach the people who you want to reach because there tends to be a gap between the people who need it and the people who receive it.

"The other way is to reduce the amount that goes to others, through either a means test or a wealth test. I think both of those have their challenges. There is always a trade off between complexity and simplicity.

"One of the big challenge in all of this is people's perception of fairness. When it comes to the state pension, people have a very specific idea of this is a benefit we have contributed to through National Insurance all our working lives.

"Anything which moves away from the fact that people should get at least some minimum amount is going to be difficult."

LATEST DEVELOPMENTS

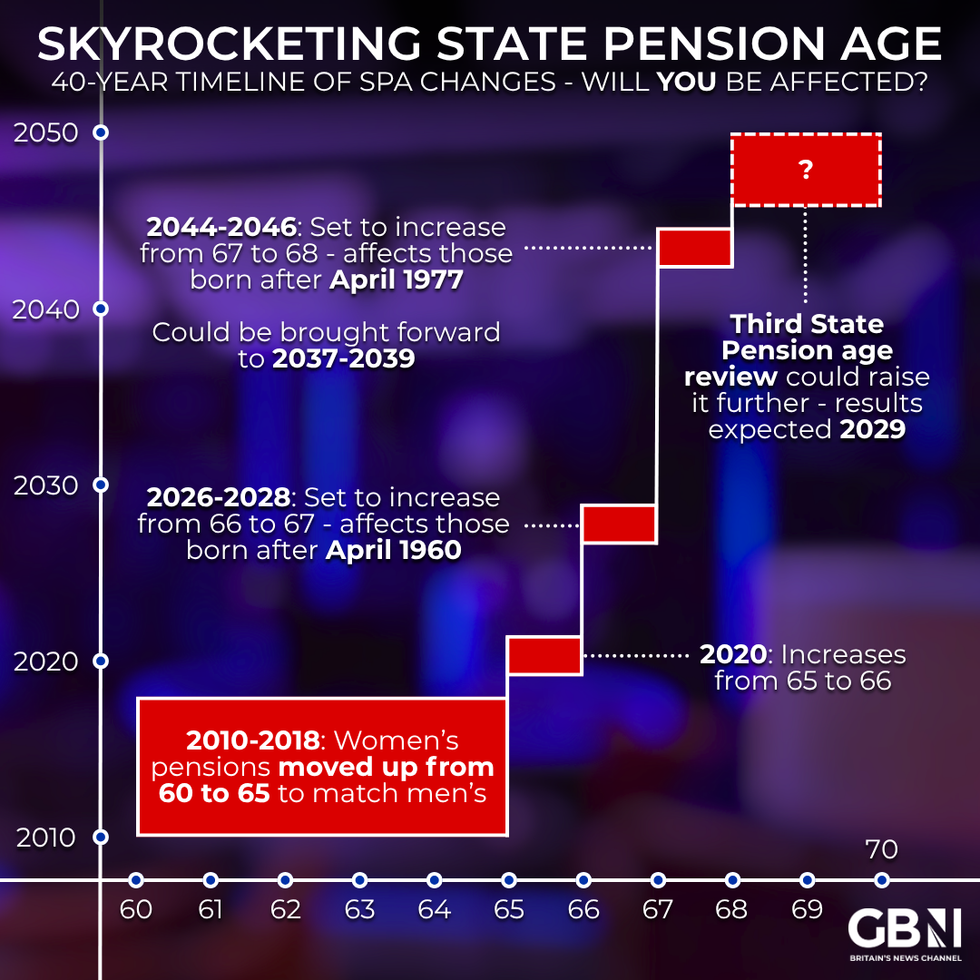

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsChancellor Rachel Reeves pledged to keep the triple lock in place until at least the end of this Parliament during her Budget statement to the House of Commons last month.

She said:

"Whether it's our commitment to the triple lock or to rebuilding our NHS to cut waiting lists, we're supporting pensioners to give them the security in retirement they deserve.

"At the Budget this week I will set out how we will take the fair choices to deliver on the country's priorities to cut NHS waiting lists, cut national debt and cut the cost of living."

State pension payment rates will rise by 4.8 per cent in April 2026 under the the triple lock.

More From GB News