'Brace yourself!' Jasmine Birtles breaks down four tax changes from Rachel Reeves as Budget date CONFIRMED

Andrew Pierce issues grave warning to Keir Starmer after ‘throwing Rachel Reeves under a bus’ |

GB NEWS

The Chancellor is preparing her Budget and money expert Jasmine Birtles is revealing how you can prepare for potential tax hikes

Don't Miss

Most Read

Chancellor Rachel Reeves has confirmed this year's Autumn Budget will fall on November 26, 2025 with economists predicting further tax rises will likely be necessary to balance the books.

Money expert Jasmine Birtles is breaking down the likely HM Revenue and Customs (HMRC) raids coming your way this winter. How much will you be affected?

"If you’re approaching or enjoying retirement, or managing an estate, this year’s Autumn Budget may bring pivotal changes affecting what you owe—and what your loved ones stand to inherit.

"With Chancellor Rachel Reeves under pressure to bridge a growing fiscal gap, taxpayer and those with any property or investments need to prepare. Here are some of the main changes that are rumoured to be announced in the Autumn Budget."

Jasmine Birtles is the founder of MoneyMagpie.com. Get their free investing newsletter here.

Jasmine Birtles answers questions from GB News members in the exclusive pensions and retirement Q&A | JASMINE BIRTLES | GETTY

Jasmine Birtles answers questions from GB News members in the exclusive pensions and retirement Q&A | JASMINE BIRTLES | GETTY Inheritance Tax Reforms: Gifts and Lifetime Caps

Inheritance tax (IHT) reforms are high on the agenda. One of the most talked-about proposals is imposing a lifetime cap on tax-free gifts, replacing—or significantly weakening—the familiar “seven-year rule”.

Gifting today, taxed tomorrow: Under current law, gifts made more than seven years before death escape IHT. Now, that rule may be scrapped or amended—and a new lifetime limit (say, £100,000 or £200,000) could be set.

The stakes are high: IHT receipts hit £8.2billion last year, partly due to frozen thresholds, and the income from this cruel tax is increasing each year.

Reforming gift rules could boost revenue, but at a cost to intergenerational wealth planning. It’s worth speaking to a financial advisor if you are worried about passing on wealth.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are being warned about the looming changes to inheritance tax | GETTY

Britons are being warned about the looming changes to inheritance tax | GETTY Pensions to Fall into the Estate for IHT

Another major shift—first flagged in the 2024 Budget—is coming closer. From April 2027, unused pension pots and death benefits will now be counted in the deceased’s estate for IHT purposes. That means more estates may become liable, and already modest pensions may shrink further

The technical process was under consultation—but the current plan is clear: personal representatives, not pension schemes, will be responsible for reporting and paying the IHT on pensions.

Figures show the average IHT bill rises by about £34,000 where pension assets are included. However, don’t just go and empty out your pension pot.

Many advisors warn against hasty pension withdrawals to avoid IHT, as this could trigger high income tax and deplete retirement income. Best to do it gradually.

MEMBERSHIP:

- Reform to lock horns with fellow insurgent party in just 24 hours as Nigel Farage looks to break 14-year stranglehold

- In 14 words, Keir Starmer and Yvette Cooper just gave tacit approval to open borders - Rakib Ehsan

- REVEALED: The five biggest scandals Reform's Doge unit has uncovered since crowbarring open councils

- Fresh blow for Keir Starmer as SHOCK map shows migrant hotel protests could parachute Nigel Farage into No10

- POLL OF THE DAY: Is free speech under threat in Britain? VOTE NOW

Tax on Rental Income—and a New Approach to Property Tax

If you rent out property—or own a home— potential property tax changes could affect you directly. Rent from buy-to-let property may soon attract National Insurance contributions. Currently untaxed, rental income could see an eight per cent NIC charge, generating around £2billion for the Treasury.

As 94 per cent of rental properties are owned by private individuals this will cause a lot of problems for those trying to live off the rental income.

Stamp duty, long the cornerstone of property sales, may be scrapped in favour of a new annual property tax, or a so-called "mansion tax" on homes valued over £500,000. Such reforms could reshape the property market, especially in high-value areas such as London and the South East.

These measures could also include capital gains tax on main residences above a certain value—a blow to retirees downsizing or relocating.

LATEST DEVELOPMENTS:

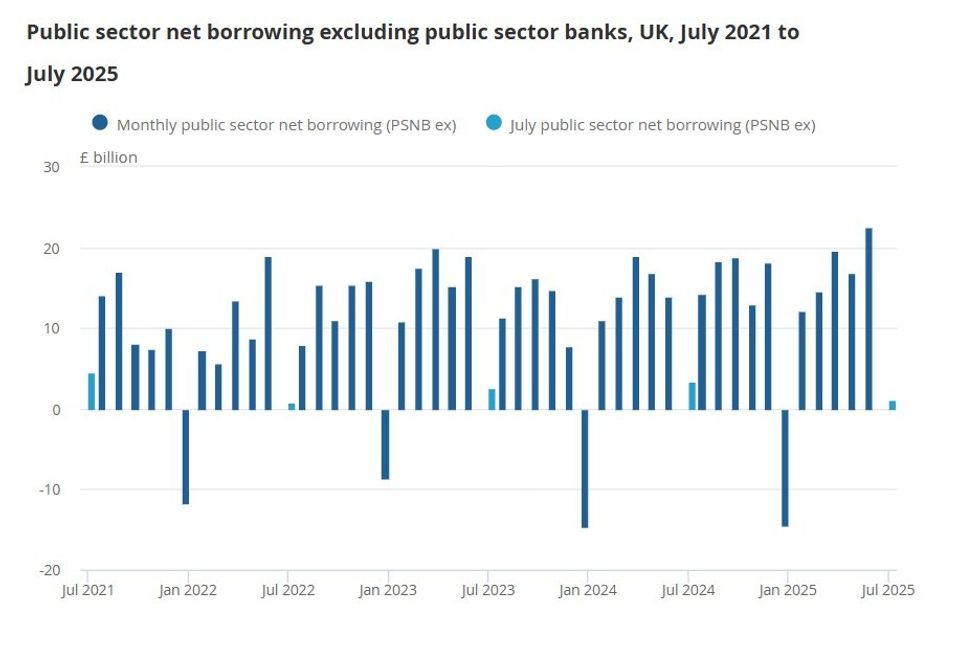

How much did Britain borrow? | ONS

How much did Britain borrow? | ONSBroader Pension Tax Relief Changes

- Beyond IHT, pension taxation may shift in more subtle, long-term ways.

- The government is considering a flat-rate tax relief on pensions, replacing the current income-based system that benefits higher earners

- Another possibility: a small annual levy on pension fund values—say, 0.25 per cent—which could quietly raise funds without direct taxpayer involvement

- Salary sacrifice schemes, often used by employers to help staff save pension-tax efficiently, are also under review. Adjustments here could reduce tax-efficient savings for many retirees in later life

Is there anything you can do about it now?

Here are a few practical steps to consider amid the uncertainty in the lead-up to the Budget.

- Avoid knee-jerk pensions withdrawals: Acting now could trigger unnecessary income tax and reduce essential retirement income.

- Review your estate plans: If gift caps or IHT reforms arrive, strategies relying on the seven-year rule may lose effectiveness. Early planning and advice from probate lawyers or financial advisors is really key here.

- Understand pension tax inclusion: From 2027, pension pots count toward IHT. Discuss ways to mitigate this—like trusts, life insurance, or careful gifting—with independent financial advisors

- Assess property holdings: Landlords should model the impact of an 8% NIC, and homeowners should keep an eye on proposals affecting Stamp Duty or CGT. It may be, for example, that you will need to put off retiring in order to make money to pay the property taxes.

More From GB News